Upwardly Mobile are Less Upwardly Mobile

Random Walk at Night: "Help Wanted" at the Nursing Home, but MBAs need not apply

There is no vibecession. There is a sea change that’s just getting started, and it’s probably less fun for the chattering class than they hope, but it’s good for other people, so there’s that.

Everything reads better in your browser or in the app. The footnotes especially, and Random Walk is really leaning into the footnotes. Plus, if you have the app, you can set delivery to “app only” and then my daily barrage will feel less like a barrage. Alternatively, sign up for Weekly Recap only.

If this email was forwarded to you, please click the shiny blue button:Random Walk at Night

Upwardly mobile are less upwardly mobile

MBAs Need Not Apply

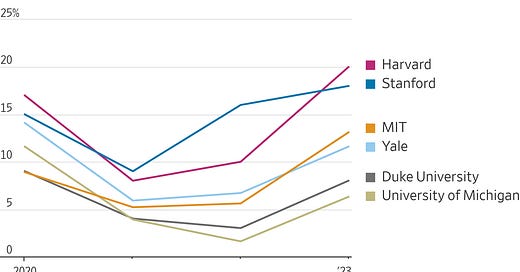

People with fancy MBAs are having a harder time getting a job:

Too bad, so sad, you captains of case studies.

To Random Walk, this observation is perfectly consistent with the gradual deflation of the Everything Bubble, and one of the more proximate effects of higher interest rates (that’s actually materialized).

Quite simply, having less money sloshing around means less demand for credentialed people to move it from here to there—it’s deflationary pressure that pushes from the top down. This isn’t a short-term thing, so much as a correction from the post-GFC ZIRP-era boom time for the managerial class.

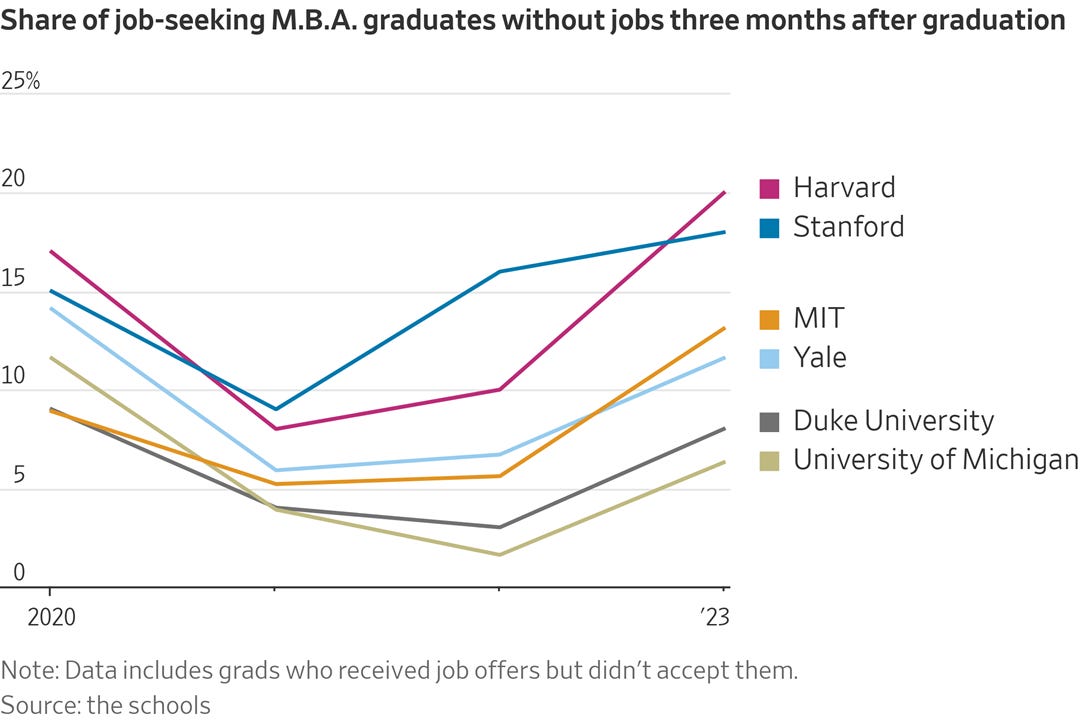

This is still a very underrated chart:

Naturally, after we melted the entire global financial system (if only for a moment), we had lots of organic demand for “management professionals.”

Lol, no.

ZIRP is over, and it means the upwardly mobile are now somewhat less upwardly mobile.1

Now, considering that I’ve been wrong-ish on some of the other proximate effects of higher interest rates, there’s reason to be skeptical of the other inferences I draw (and my model entirely).

I certainly am. Afterall, you may have heard that everything is awesome, inflation is licked, the stock market is ripping, and interest rate cuts are around the corner.

It doesn’t really matter that claims 1-2 are wrong, 4 is a bit of a guessing game, and while 3 has definitely been true, it’s been slightly less true lately, I’ve been wrong enough to wonder whether I’ve got the broader picture right.

So what does the data say?

Keep reading with a 7-day free trial

Subscribe to Random Walk to keep reading this post and get 7 days of free access to the full post archives.