Bain & Co. peers into the past, present and future of Private Equity

The highlights will surprise you

Bain & Co. does a chart-dive on the state of private capital. Random Walk does the highlights:

fundraising still tough, especially outside the top performers

it’s tough, because realized results are . . . still bad

results are bad because sellers who bought too high make unreasonable asks, to very reasonable bids

growing revenue is doable . . . growing profits, is harder

equity is on the sideline, but debt is Johnny-on-the-spot

actually, there is one business that PE still loves to buy at prices the sellers are willing to offer

what’s next? to the Spy Sheikh go the spoils

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. First, sign up for your free trial of AlphaSense, because why wouldn’t you?

A plug for our sponsor, AlphaSense

AlphaSense is actually an amazing one-stop-shop for:

expert calls (especially since it acquired Tegus),

company-filings, and

analyst research;

plus, it’s got a pretty neat generative AI-search tool that I’ve been playing with a lot (which makes searching across the corpus of information much easier than before).

It’s a genuinely fun and very useful platform, and as part of the sponsorship, Random Walk readers have ACCESS TO A FREE TRIAL, which you’d be a fool not to try (just by clicking through the link below):

FREE TRIAL! FREE TRIAL! FREE TRIAL!Give it a shot. It’s a great platform.

Bain & Co. peers into the past, present and future of Private Equity

And what do they see?

Random Walk will give you the abridged version, focusing on the pictures, because that’s what we’re all here for anyway, amiright?

Fundraising is bad (but especially bad outside the top-quartile)

Good news, everyone.

Fundraising is still super-hard, but it’s not just you—it’s pretty much everyone:

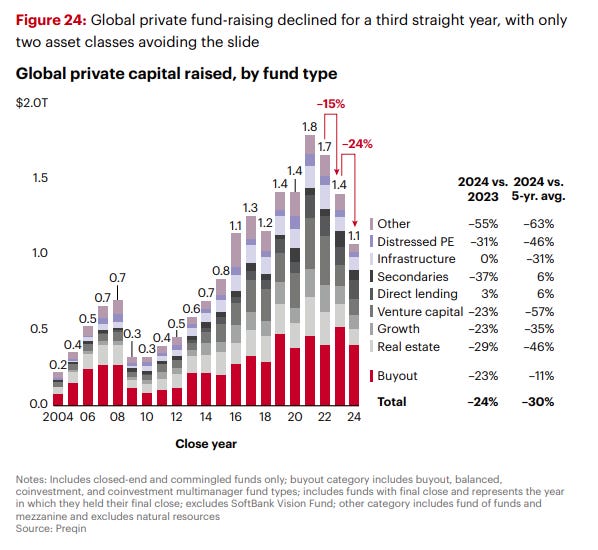

2024 fundraising is ~30% off the 5-year average, with VC and Real Estate hit the hardest, but really no pretty pictures.

Secondaries and direct lending are moderately above water (for reasons discussed below), but 2024 fundraising is at 2016 levels. Given how much has happened between then and now, well, that’s pretty remarkable.

Is there a secret to fundraising?

Not really, because again it’s hard for everyone, but unsurprisingly, it helps if you’ve been able to generate some returns.

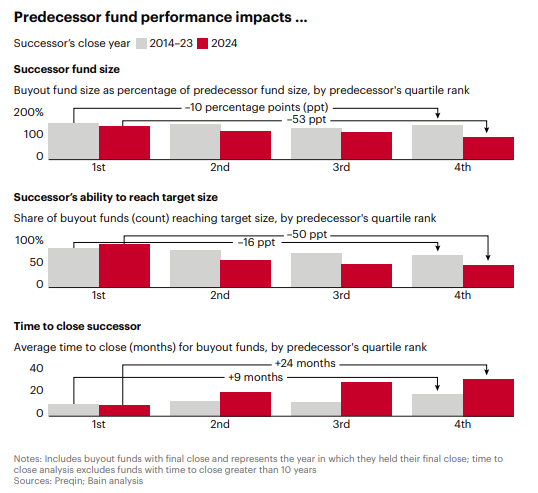

To be clear, while pretty much every kind of manager has struggled to raise bigger funds, hit their targets and timely close (relative to 2014-2023), the dropoff definitely gets worse for funds with weaker performance—and the difference between the best and the worst is much wider than before:

successor funds tend to be smaller, but the gap between the best-worst has gone from 10ppt to 53ppts

ability to hit target sizes is also lower—the bottom three quarters of the distribution is hitting target sizes only about half the time

time-to-close is up to 24 months for the lowest quartile, but it’s ~20 months for everyone but the top quartile

There’s no escaping it. Fundraising was just brutal in 2024.

. . . Because realized returns are bad

Why is/was fundraising so hard?

Well, because realized returns are so bad.

Funds just aren’t generating enough liquidity to LPs, such that they’d be able to re-up, even if they wanted to. Random Walk flagged this phenomenon probably earlier than pretty much anyone, and it remains the case today.

AUM has continue to rise . . .

. . . but distributions have not been able to keep up.

Distributions as a % of NAV is now as low as it’s been:

At just 11%, the amount of money coming back to LPs (relative to the amount still tied up in PE funds) just isn’t high enough to fund new commitments.

And the return profile suggests that more delays are inbound.

The Pandemania vintages are following a distinctly ‘05-’06 style of J-Curve:

Keep reading with a 7-day free trial

Subscribe to Random Walk to keep reading this post and get 7 days of free access to the full post archives.