The marks are still probably too damn high

Some data behind the lack of exit liquidity

visualizing the bid-ask spread for PE buyout funds (and no, it hasn’t always been this way)

valuations are . . . not unreasonable?

it’s not just earnings, it’s fast-growing earnings that you’ll need

venture valuations are harder to believe

the markdown dilemma

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. The marks are still probably too damn high

When it comes to private capital markets, Random Walk has written at-length about its three defining features: No Exits for Private Capital, The Marks are Too Damn High, and (relatedly) Everybody Wants to Lend, but Nobody Wants to Buy.1

The three features are connected, obviously.

There are no exits because the marks are too high (i.e. bid-ask is too wide), so instead of buying companies, investors are lending to them instead.2 Lending functions as a useful interim solution that converts cashflow into yield, without requiring a meeting of the minds on what the company is actually worth. It’s like very expensive dating, when both parties think they can do better, if they just hold-out a bit longer.

At some point, there will be capitulation by someone—either markdowns will come (willingly or otherwise), or, improbably, capital markets return to [ab]normal—although capitulation can also be gradual.

In the meantime, some charts to illustrate the ongoing truthiness of the points, with some interesting wrinkles.

Bid-Ask is too wide

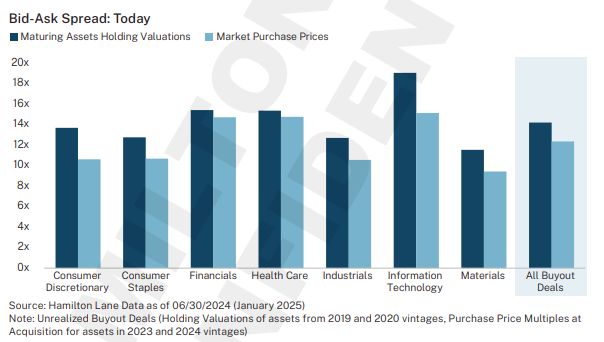

Hamilton Lane (a cap markets advisor to endowments, institutions, etc.) came up with a clever way of measuring the current bid-ask spread in the buyout market.

Using a mix of internal and external data, Hamilton Lane compared the multiples on “maturing assets” (i.e. assets that PE funds still had on their books) with the multiples on recently cleared transactions. In other words, Hamilton Lane compared the multiple that funds used to mark their investments v. actual clearing prices.

Here’s what they found:

Across every category (but especially tech), multiples on unsold companies were higher than the multiples on sold companies.

It’s not perfect (because static multiples do not say anything about growth), but if funds are assigning a higher earnings premium to their assets than what the market is willing to bear (such that it bears anything), that’s pretty solid evidence that the Ask is way too high for the Bid.

I know what you’re thinking. Holding multiples are always going to be higher than clearing multiples.

But, it turns out that they’re not.