Hard data > Soft data

Sentiment (and prices) sour, but the actual hard data continues apace

a big stock market selloff, and soft data diverges from hard data

pessimism is real, but no one is actually doing anything differently (except people in D.C.—they’re definitely feeling it)

there are reasons why stock prices may fall, but tariffs aren’t high on the list

what correction? valuations are still historically high

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. Hard data > Soft data

Markets continue to shimmy and shake for reasons known only to the various market participants buying and selling.

The headlines (and all the lines beneath the headlines) are screaming Tariff Uncertainty Crisis at the top of their (metaphorical) lungs, the reality is surely more complicated than that.

The harpies are shrieking, but the hard data pays no nevermind

To the extent there’s been a “sudden” economic slowdown, it’s all in the “soft” data (i.e. surveys and sentiment). As far as actual changes in behavior, there’s not a whole lot of it.

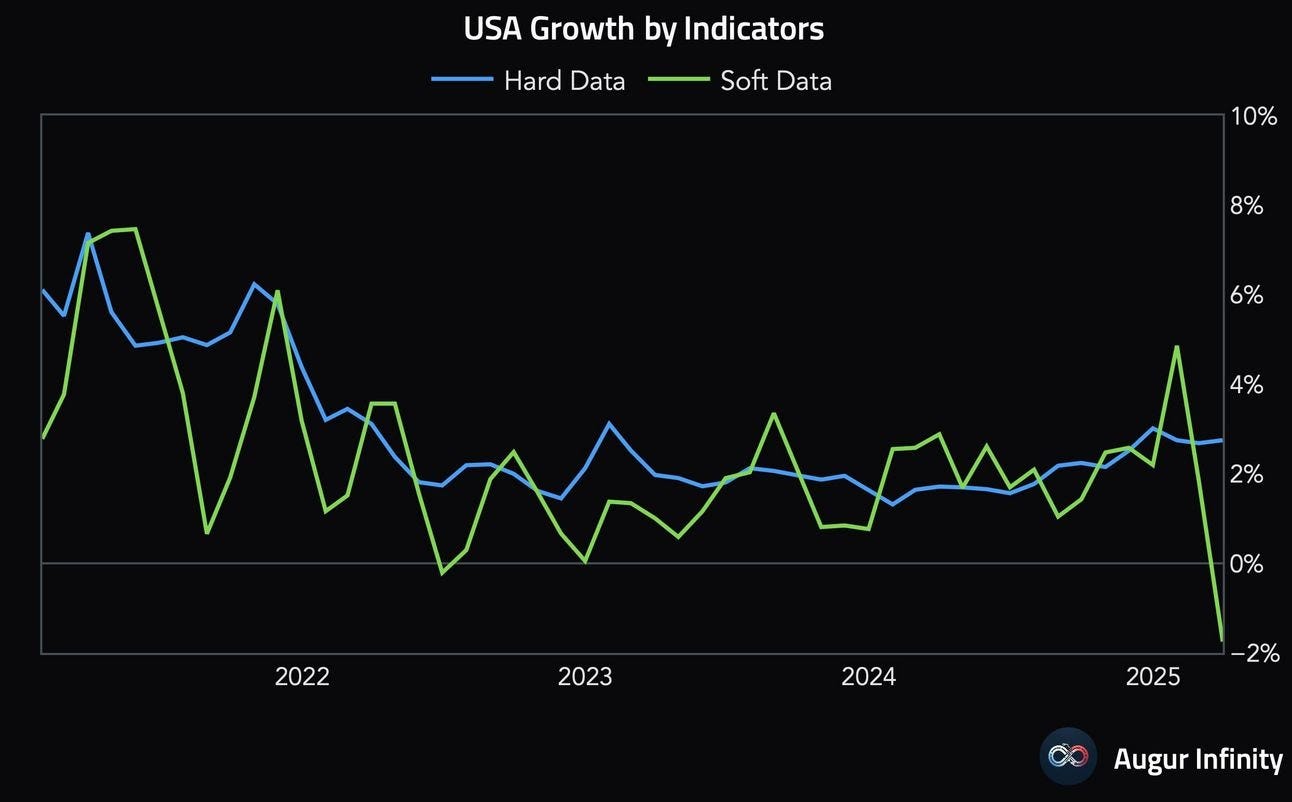

Random Walk has covered this at-length, but here’s a nifty aggregation of the soft and hard signals:

Augur Infinity via Daily Chartbook

Soft-data says “doom,” while hard-data says, “actually, not so bad.”

Whether that pessimism translates into actual deceleration, remains to be seen, but given the lack of any hard data corroborating a slowdown, the uniform shrillness of the hivemind is better understood as aspirational.1 I do believe the pessimism is genuine, and I’m loath to “blame the media” for fanning the flames of uncertainty (because ‘vibecession’ is a silly concept, and people are smarter than that), but for now, it’s just feels.

To be fair, tariffs haven’t actually kicked-in yet (in total earnestness), so that too could explain apprehension, but no action, but it’s still quite the reaction, given the “no action” part.

In the latest “everything is fine” entry, employment tax receipts (i.e. W2 income tax) continues to come in strong and healthy: