Definitive take on the current state of the Somewhat Less Mighty Cautious Consumer

10+ charts on the Consoomer, then and now, and what to expect going-forward

preface: a Dangerfield rant

From Pandemania to merely fine Cautious Consumerism

‘21-‘22: Peak Pandemania

2023: Get Lean or Die Trying (and a lot of service shrinkflation)

2024: reap what 2023 hath sewn, and/or the Almighty Cautious Consumer

2025: low-hanging fruit picked, the somewhat less-mighty Cautious Consumer

What’s next?

more of the same, but with some shimmy n’ shakes

if you want to be optimistic . . . look at taxes

reasons for pessimism . . . topping out, and the delayed onset of tariffs

Concluding thoughts:

the marks are too damn high

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. 👋👋👋Random Walk has been piloting some other initiatives and now would like to hear from broader universe of you:

(1) 🛎️ Schedule a time to chat with me. I want to know what would be valuable to you.

(2) 💡 Find out more about Random Walk Idea Dinners. High-Signal Serendipity.The definitive take on the current state of the Somewhat Less Mighty Cautious Consumer

Random Walk tries not to write angry, but today, I can’t help myself.

Why am I annoyed?

Because this newsletter is chronically under-followed. Yes, really.

Big picture stuff that Random Walk has been writing about for the last ~2 years—often in an imagined dialogue with a consensus interlocutor that is some combination of wrong and confused—is beginning to dawn on said consensus with increasing regularity.

Being different, early and right, is, of course, not the annoying part. That part is fun and gratifying.

The annoying part is having to watch hot-shot experts and pundits stumble upon these suddenly self-evident Random Walkian truths to the seal claps of their vast and adoring audiences. That really chafes.

Random Walk’s grievance is the grievance substrate upon which all grievances are built: I’m not getting the respect that I think I deserve. They’re not the experts. I’m obviously the expert. Those seal claps ought to be mine!

That and a $5 bill can buy me a slice of pizza.

Not to pick on Derek Thompson, who seems like a genuinely smart and thoughtful fellow, but you’ll see why I’m irked. Last week he did a “did you know that all the jobs are healthcare jobs?” (which yes, around here, we know), and then this week he came back with “the economy is splitting into two, there’s a rip-roaring AI economy. And there’s a lackluster consumer economy.”

I mean, yes.

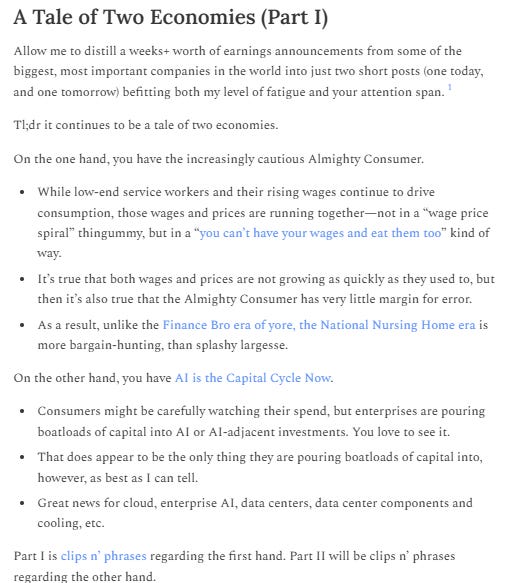

It’s almost like the exact thing I wrote 1.5 years ago in May 2024, when for whatever reason, armchair economists were still very insistent that the economy was ‘booming on all cylinders,’ or whatever:

It’s true now, and it was true then, and while it would surely make sense to pay greater attention to the ‘expert’ who’s been beating this drum for well-over a year (relative to the guy who just kinda half-stumbled upon it as some new thing), unfortunately that’s not how the world works.1

Anyways, I’m going to nurse my wounded pride with the age old remedy of defiance and contempt.

Random Walk is, in fact, the relative expert here on ‘what’s going on in the economy.’ If you want answers, ask me, not them, because I’ve been righter for longer.

<toddler footstomp>

The Definitive Take: From Pandemania to Merely Fine Cautious Consumerism

And since we’re on the subject of the ‘lackluster consumer economy,’ consider the what follows the definitive take on what’s actually happening in the consumer economy right now, including the steps that got us here.2

I’ll sprinkle in some charts, where appropriate, to illustrate my point.

2021-22: Peak Pandemania

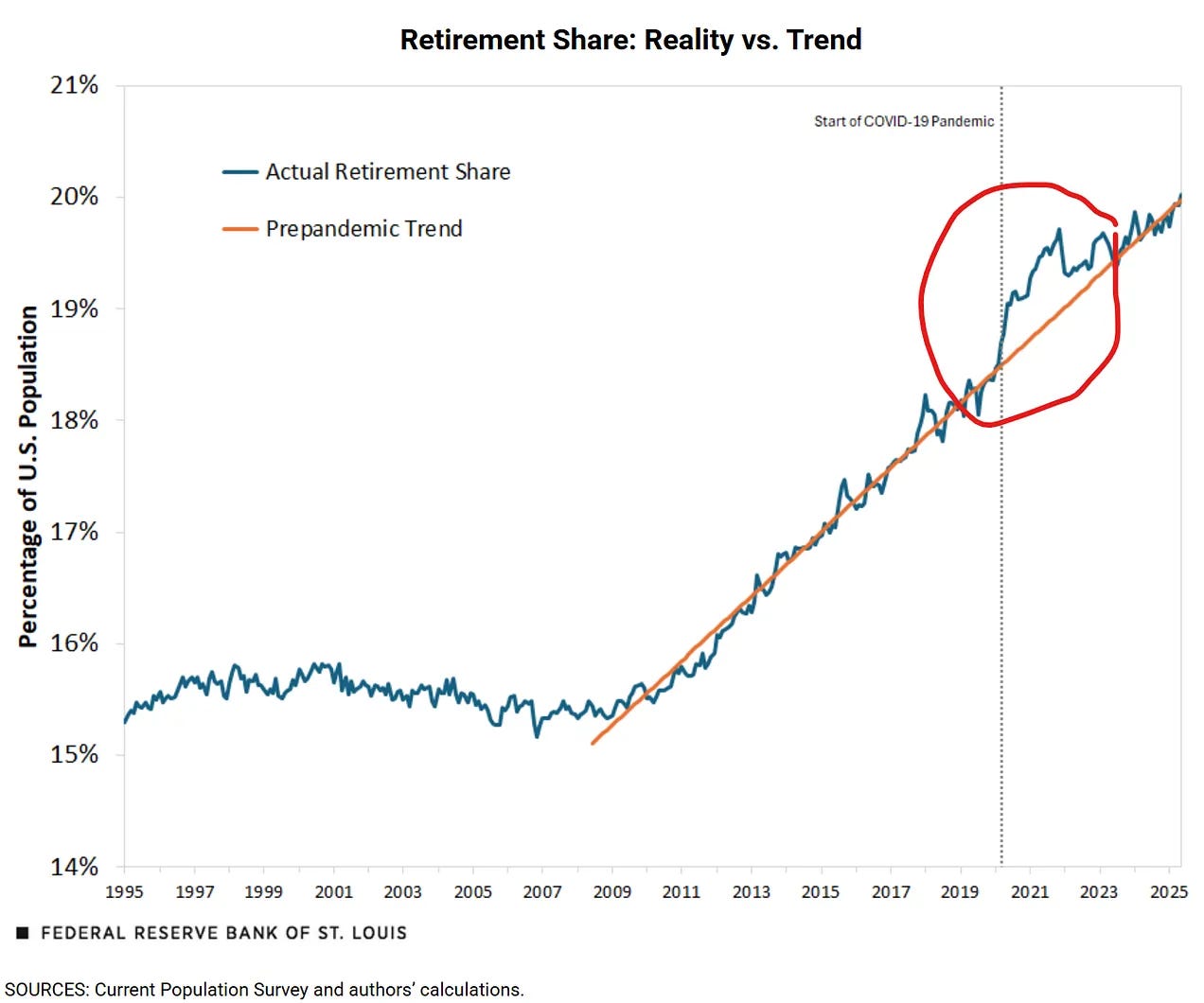

stimmies ran headlong into a labor shortage (i.e. the “pull-forward in retirement”), causing wages to explode, which led to an explosion in spending, which supported higher prices;

we all remember this period fondly for its ‘let the good times roll’ vibes, the very not-transitory inflation, and the total absence of any supply-chain snagglepusses—this was just demand on steroids that ran into something of a labor supply shock:

Pandemic ‘pull-forward’ of retirement, particularly among no-college ‘blue-collar’ workers via St. Louis Fed

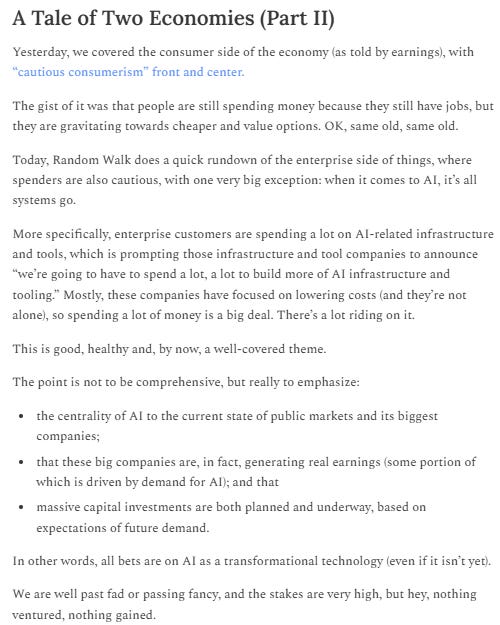

2023: Get Lean or Else (and a lot of service shrinkflation)

when stimmies + ZIRP ended—and millions of new arrivals gradually closed the labor shortage—those two demand drivers, i.e. (1) free money and (2) rapidly increasing wages, both began to taper . . . and if people didn’t have more money to spend, then prices could not go up, without putting the kibosh on demand—and so they didn’t, which, is why inflation began to taper, as well;

the other thing that firms did was cut costs, or at least keep costs in-check, particularly when it came to hiring, since it was people-costs that had increased so much (while people-supply could merely catch-up, and not really grow);

the other other thing that firms did, particularly, in high-touch service industries, is they “got more productive,” which is to say they threw fewer bodies at the same problems, and generally made those services worse. It’s what Random Walk has called “service shrinkflation,” and as-predicted, spending for those less-bang-for-the-buck services went south:

2024: The Almighty Cautious Consumer

2024 was a reap what 2023 hath sewn year;

consumers responded by continuing to spend more—because wages were still increasing (just more slowly), and the number of consumers was too, albeit almost entirely at the lower-end of the income spectrum—but that increase in spending became more cautious (aka The Almighty Cautious Consumer);

steadily increasing cautious consumerism was a boon for “value” offerings and ecommerce who could (a) meet higher-income shoppers ‘trading-down’; and (b) meet lower-income shoppers, who also happened to constitute the net-new additions to the shopping-force;

cautious consumerism, on the other hand, has been devastating for bigger ticket items, luxury goods, and those “high touch” services that increasingly offered less-bang-for-the-buck;

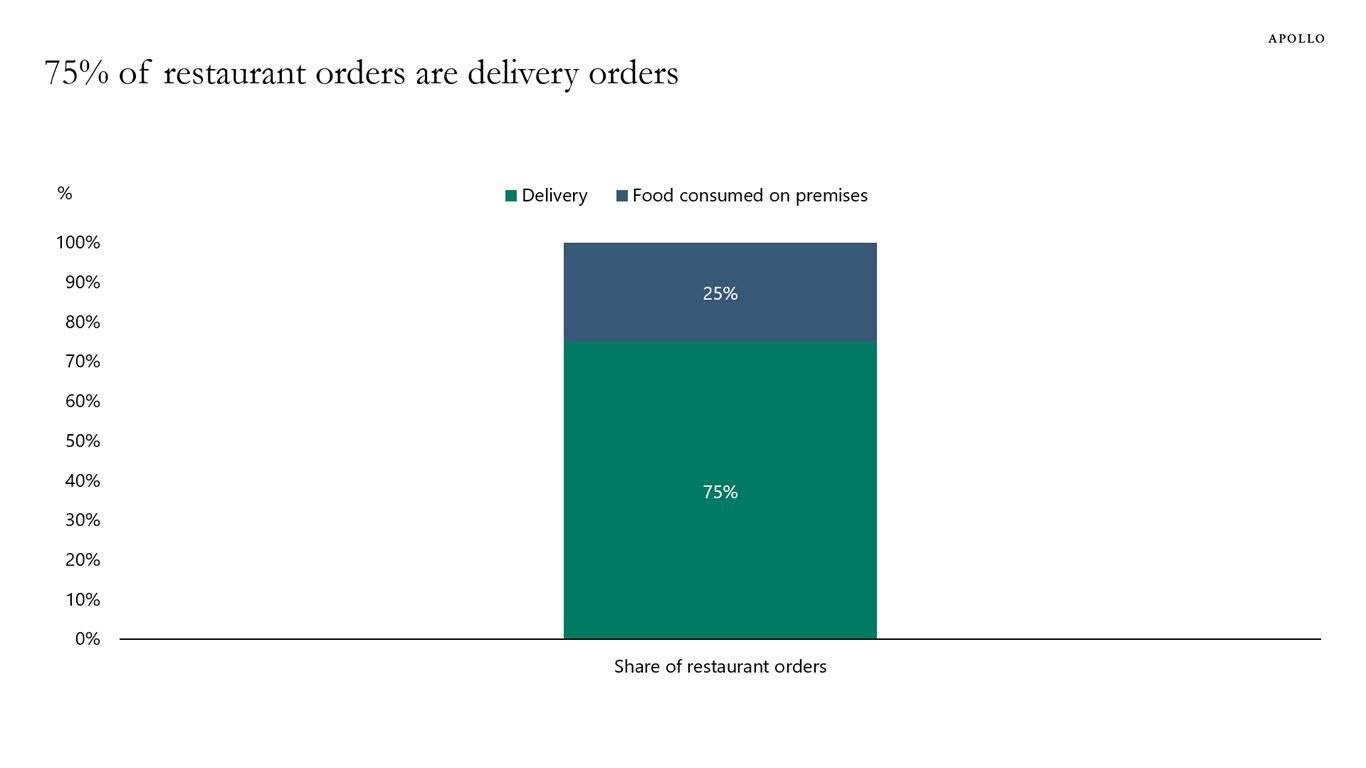

The exception has been the restaurant business, which, thanks to Uber and Instacart, has successfully pivoted to the takeout business (i.e. sell more meals, without hiring more servers);

2025: The Merely Fine Cautious Consumer

in the bigger scheme of the consumer economy, the Almighty Cautious Consumer setup worked quite nicely for a while: revenues and earnings went up—again, not for the luxury brands or big TV-makers, but for everyone else, the combination of bottom-line discipline with increased consumer spending cooked, especially against weak 2023 comps;

if you’re in the sort of business that can sell more without additional marginal cost—like a tech business or a Netflix—then you really cooked because you got to raise prices just for fun (and both revenues and margins improved);

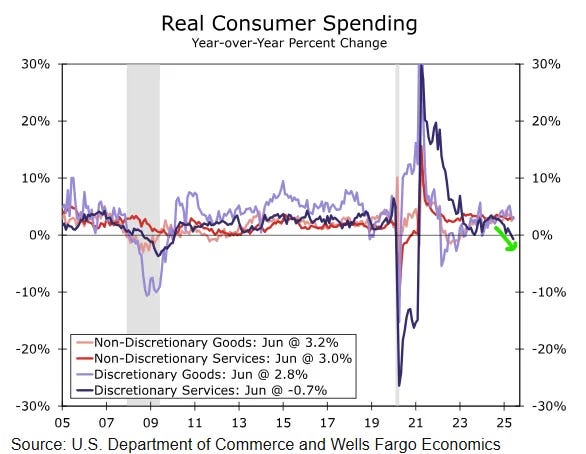

but, nothing lasts forever, and there’s only so many gains you can make by going down-market, and cutting costs where you find them. And as wage-growth and shopper-growth have continued to taper, so too has consumer spending;

. . . which brings us to the inevitable present: more consumer firms saying “uhh, revenue and earnings growth are both slowing down because ‘challenging macro conditions’ or whatever”

And that is where we sit right now: slowing top-line growth, and all the easy levers for margin-expansion, already pulled.

Slowing, does not mean stopping, however.

Total household spending is pretty much fine (and continues to be strong, where it’s been strong, and weak, where it’s been weak):

Keep reading with a 7-day free trial

Subscribe to Random Walk to keep reading this post and get 7 days of free access to the full post archives.