A tale of two pandemic cycles

What if everything we know about the past is just the exception, not the rule?

Publishing note: Random Walk is going to experiment with a different publishing cadence over the next few weeks (more details forthcoming). I will endeavor to trade some frequency for depth, at least some of the time.

JPM weighs-in on what Random Walk’s been saying for a while: it’s Donna Summers’ time to shine

it was the best of times, it was the ‘roughly flat’ times

timing is everything, when it comes to income growth, especially for the post-GFCers in their prime

what if it’s ZIRP all the way down?

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. A tale of two pandemic cycles

Every now and again a highly credentialed group of experts will look closely at the data and declare “we see you Random Walk, and we are picking up what you are putting down.”

OK, perhaps not in so many words, but same basic idea.

It was the best of times, and now the ‘roughly flat’ times

In this case, JPM laid out a brief note on the post-pandemania shifts in purchasing power between income groups, which included a subtle comment on what, if anything, should be cause for concern.

The gist of it is (a) it was lower-income people who experienced the greatest tailwinds, but (b) from a real income perspective, actually, things have been pretty stagnant for ~1 year.

The great pandemic recovery hasn’t actually been so great. Not bad, but not actually that great.

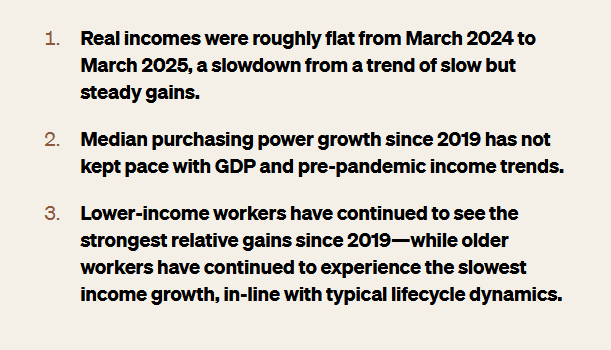

In JPM’s words:

real incomes have been flat for a year;

median purchasing power growth post-2019 has been ok, but not as good as before;

lower-income workers made the biggest gains.

As a visual, it looks like this: