Apollo's moonshot

Random Walk digs deep(ish) on Apollo's plan to rule all the alpha

PiK loans between friends, a prelude

Apollo’s grand vision, in four parts

Massive TAM

Reindustrialized, definitely not-shrugged

Silver Tsunami is counting on it

The fourth institutional revolution, or how Apollo entered the “replacement” business

All alpha will be private

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. Apollo’s moonshot

Random Walk has written a lot about the changing shape of private capital markets.

On the private equity side, there’s correction underway.

The biggest issue is the growing pile of unsold companies, which were bought back when money was free (and now can’t be sold without a massive discount, that no one wants to face).

That’s led to the emergence of various “extend and pretend” can-kicking exercises—and aspirational asset marks—but also the growing realization that managers need to develop new models for generating returns (or rediscover old ones), now that “invest, wait, raise more money, sell, repeat” is off the table.

On the credit side, equity’s pain, has been credit’s gain.

For investors, it seems safer, and it’s yield generating, which after all the illiquidity of PE/VC, is a welcome change. You might even call it a sea change.

Also, now that cheap equity capital is suddenly hard to come by (for the PE/VC Finance Bros, especially), lenders are back in the catbird seat.

Finally, to meet this incredible demand for loans, an entirely new model of banking has emerged, that doesn’t actually involve any banks (for better and for worse). Instead of deposits, Private Credit invests retirement savings, and offers every different flavor of loan (exotic or otherwise) that bank could only dream about—often to other private equity managers.

And perhaps the most amazing thing about all of this is that, despite all the change, everything has been pretty fine.

The handoff from equity to debt, from banks to non-banks, from deposits to life-insurance, from growth to profit—it’s all gone down, mostly without a hitch. Or at least, without any seismic hitches that anyone outside the industry would care about.

For now, at least.

Put the tab on the tab, aka PIK loans between friends

It’s possible the other shoe is yet to drop—at some point, the backlog of unsold companies does have to clear—and every day there are anecdata implying that “extend and pretend” may be running out of rope.

The latest mini-alarm bell is (again) on the rise of Payment-in-Kind (PIK) Loans:

PIK income as a share of lending income for publicly traded Private Credit funds is reaching new highs.

PIK income is the equivalent of “putting it on the tab,” where the “it” is the interest the borrower already owes. In other words, it’s like putting the tab on the tab.

Apparently, Blue Owl funds do this a lot:

Low-teens to low-twenties percent of revenue attributable to PIK loans for the Top 10.

These funds have to return 90% of revenue to investors, so if revenue is actually an IOU, that can create some issues. But, a lot of this is, in fact, part of the plan.

It’s probably fine, and also, not the point of today’s post.

Apollo lays out its vision (in memes)

Anyways, Random Walk finds this stuff fascinating, but regardless of what I think, far more interesting is what one of those giants of Private Equity Credit thinks, in this case, Apollo.

And not just Apollo’s episodic market color—the kind of stuff that Random Walk often surfaces—but Apollo’s longer-term vision for asset management, more generally.

Apollo put all that stuff together for a bonanza of an investor day a couple of weeks back, and Random Walk has endeavored to pull out some highlights of interest.

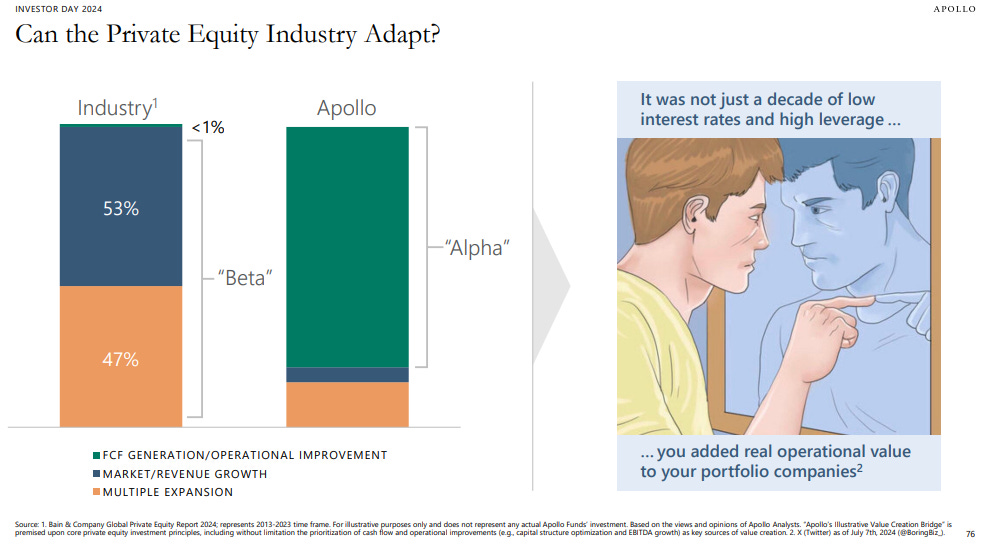

I mean, it doesn’t get any better than Apollo trolling the rest of the private equity business:

Apollo Investor Day Presentation

PE’s returns have been explained mostly by their extraordinary ability to wrangle cheap money, and not any particular skill at making businesses better, but don’t tell them that.

I love that Apollo finds memes on twitter, just like Random Walk.

The Moon Shot for the 4th Institutional Revolution

No. I promised longer-term vision, and that’s what I will provide.

Apollo is trying to build a new kind of asset management and financial services firm. It’s part bank, part investment bank, part lender, part hedge fund, part equity, part debt, part market-maker, part consumer, part enterprise . . . . and you get the idea.

Apollo wants to build the everything firm.

And I don’t think I full appreciated just how ambitious the plan actually is.

Apollo wants to bring everything under the auspices of private capital markets: investment grade bonds, actively managed equity, and hybrid debt-equity that wouldn’t fit in any public market box for corporate finance.

If before, private markets was just for the funky and/or high risk stuff, then in the near future, Apollo plans to make private markets for all the stuff, including stuff you’ve never heard of.

I certainly won’t do it justice here, but these are the four big ideas that caught my eye.