Bankruptcies spike!

Because incendiary headlines are fun, but underneath the hood, things are a little o' this, and a little o' that. That might be the new normal though, and we'll just have to get used to it

bankruptcies spike!

a credit card bonanza…is it stress or strength (or both)

is normalization turning into stress (reprise), or is the new normal just stressful?

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. Continuing to riff on the theme of middling . . .

Yesterday Random Walk made the point that, sure, the labor market is now all caught up, so it’s not growing all that much, but on the flipside, people are generally very employed, and maybe even making and spending a tad more money than before.

So that’s not great, but not exactly bad, either.

Bankruptcies spike

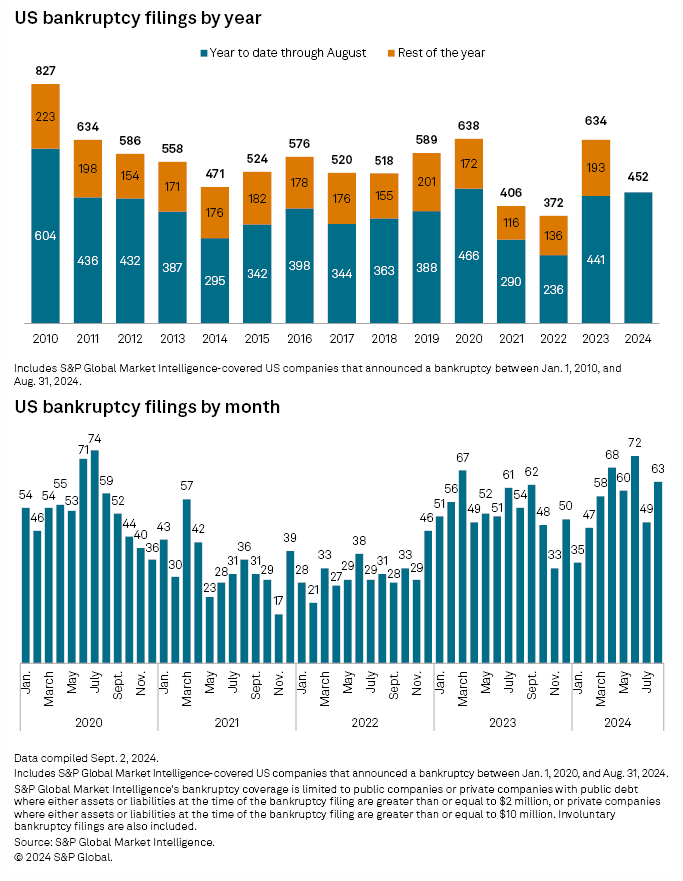

Today, Random Walk would observe that bankruptcies spiked in August (after a calming dip in July):

Year-to-date bankruptcies are now higher than they’ve been since 2010 (excluding 2020, which was peak pandemic).

Plot twist, right?

In terms of what kinds of businesses are going bankrupt, it’s unsurprisingly Consumer Discretionary leading the way:

Consumer discretionary represents ~25% of the bankruptcies where sector data was available (which covers ~60% of the bankruptcies).

So lots of companies are going bankrupt, does that mean that actually things are not fine and stress is coming?

It’s certainly possible, but I still don’t think so.

That consumers haven’t been able to reach for discretionary items has been true for a while now. Bankruptcies were sure to follow. There are also lots of companies that probably got life extensions during peak ZIRP that never ought to have happened, and now that ship has run its course.

Some pain, mixed with the mild gains, just seems par for the course.

Credit Card bonanza

Here’s another example of little o’ this, and little o’ that.