BNPelle of the ball

If you were looking for signs of consumer stress, all you would find is people happily buying things on the internet with credit

Nvidia does its thing and the crowd

goes wildfaceplantsFortunately, the hyperscalers are just getting started with their spend

BNPL contains multitudes, still

But what lurks in the black box of credit quality?

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. BNPelle of the ball

First, a prelude.

Nvidia to the moon (or not, whatever, the stock market is a mystery)

Nvidia reported yesterday, and while the company beat expectations for revenue and earnings, the stock price did one of these:

An after-hours selloff to the tune of ~7%.

Markets can sure be mysterious sometimes, and one can only imagine what might have happened if the-little-chipmaker-that-could-save-the-stock-market had reported some bad news.

Anyways, there will be plenty of headlines and analysis “explaining” why some set of facts are “good, but still disappointing” or whatever, and maybe some of them will even be partly right.

Who knows why the market does what it does (on any given day)? It’s pure conjecture, and it’s not Random Walk’s concern, at the moment.

As best as anyone can actually tell, Nvidia is still the only game in town, and all the evidence suggests that its customers are focused, committed, and loaded with cash:

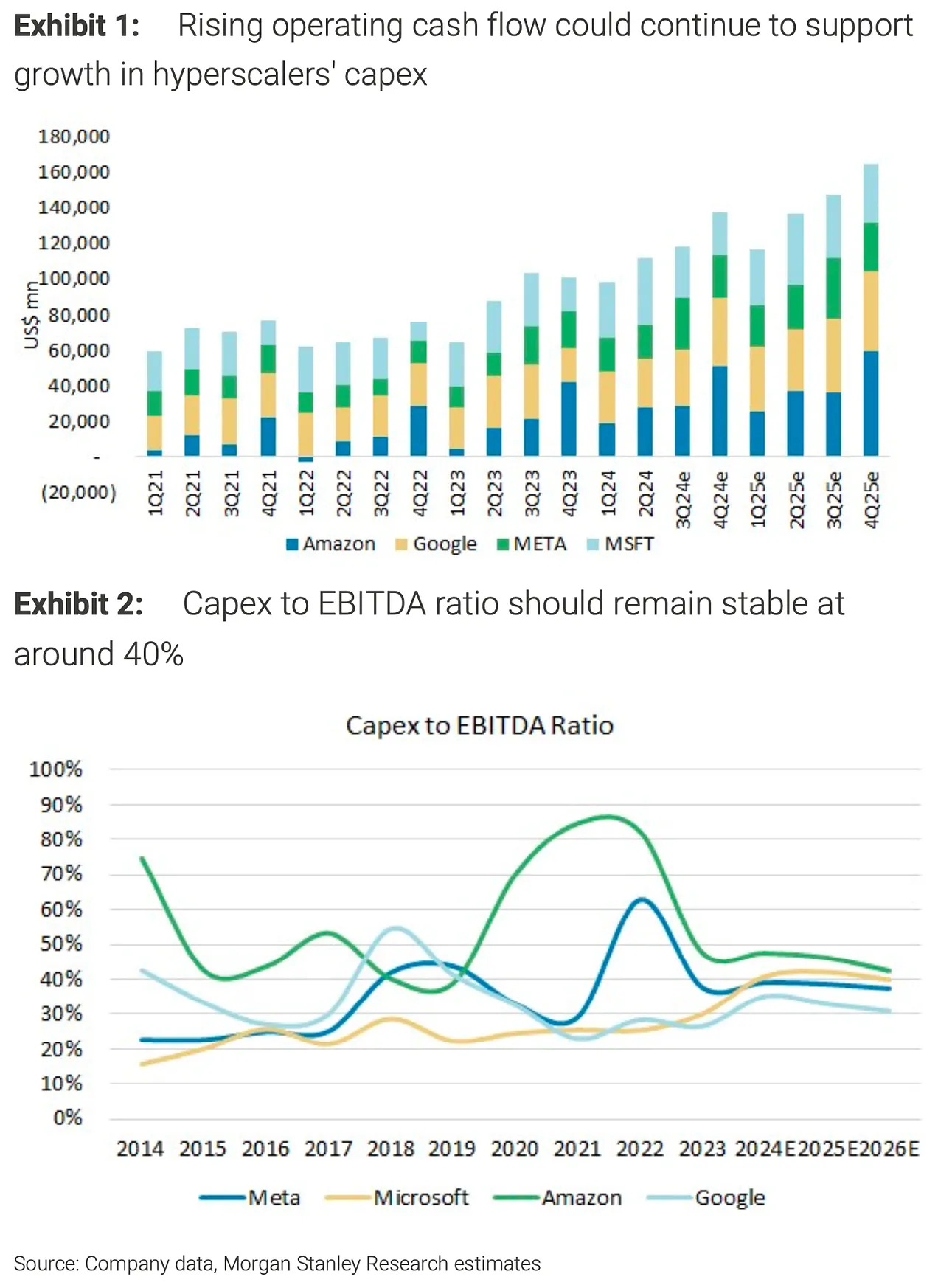

Morgan Stanley/Daily Chartbook

If the Big Four keep spending 40% of profit on AI Capex, then AI spend should continue to increase (assuming Big Four revenues continue to increase, which why not?).

It’s also not just the Big Four hyperscalers, of course. There are others out there “hoarding” the GPUs:

Elon is after the precious H100s too.

The AI arms race is a weird game right now, where no one can afford to lose, and staying in the game involves spending as much money as you possibly can.

Good incentives, all around, and very happy hunting for Nvidia.

BNPL contains multitudes, but which one is it this time?

But, this post isn’t supposed to be about Nvidia.

It’s about another company that’s one of Random Walk’s favorites, the BNPelle of the ball: Affirm AFRM 0.00%↑1

Random Walk has written variously about how BNPL contains multitudes. The very short version is that:

on the one hand, surfing the wave of an e-commercification of everything, Hey Small Spender, and rapacious demand for high yield assets (like consumer credit); but

on the other hand, a black box of consumer credit where low income consumers could get head-over-skis unbeknownst to the normal channels of credit quality.

BNPL is also terminally caught between a rock n’ a hard place, as a “financial inclusion tool” (that’s insufficiently inclusive), but also a “financial predation” tool (that preys on the financially fragile).

Presumably, it will be whichever one generates the most convenient outrage at that particular point in time.