Commercial real estate turning a corner (and other real estate charts)

10 Charts on commercial real estate to inform and delight

Commercial real estate turning a corner?

CMBS special servicing rates keep rising (and that’s good)

net-new distress is smaller

conditions are getting Sloos

desiderata on REITs, who loaded-up for a mortgage origination binge that wasn’t, permits per capita, and the Fall’s hottest construction material

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. Commercial real estate turning a corner

Random Walk keeps trying to call the bottom . . . eventually I’ll get it right

CMBS special servicing rates increase

One reason to be optimistic that commercial real estate is turning the corner is that special servicing rates are beginning to rise.

CMBS special servicing rates climbed to 9.14%, with office driving the lion’s share of the increase.

But special servicing is bad. It’s what happens when the borrower falls behind and a third-party comes in to manage things. How can that be a sign of optimism?

Special servicing can be a good thing, if it means that lenders are calling the bottom.

If lenders are reasonably confident that they can find a buyer for the asset, then rather than kick-the-can on underwater loans, lenders will begin to take matters into their own hands. Plus, how much more can-kicking can lenders actually provide? Eventually, you grit your teeth, take your losses, and move on.

So, you see, higher special servicing is a sign of cleaning house, rather than worsening conditions.

Does Random Walk know for a fact that that is what’s happening?

No, I do not. But it’s a theory, insofar, as the dust appears to be settling.

10-year rates are relatively stable (around a 4 handle, but stable),

Class B and C Office isn’t getting better (but it’s not getting worse), and

new supply has mostly been on ice (to give demand a chance to absorb).

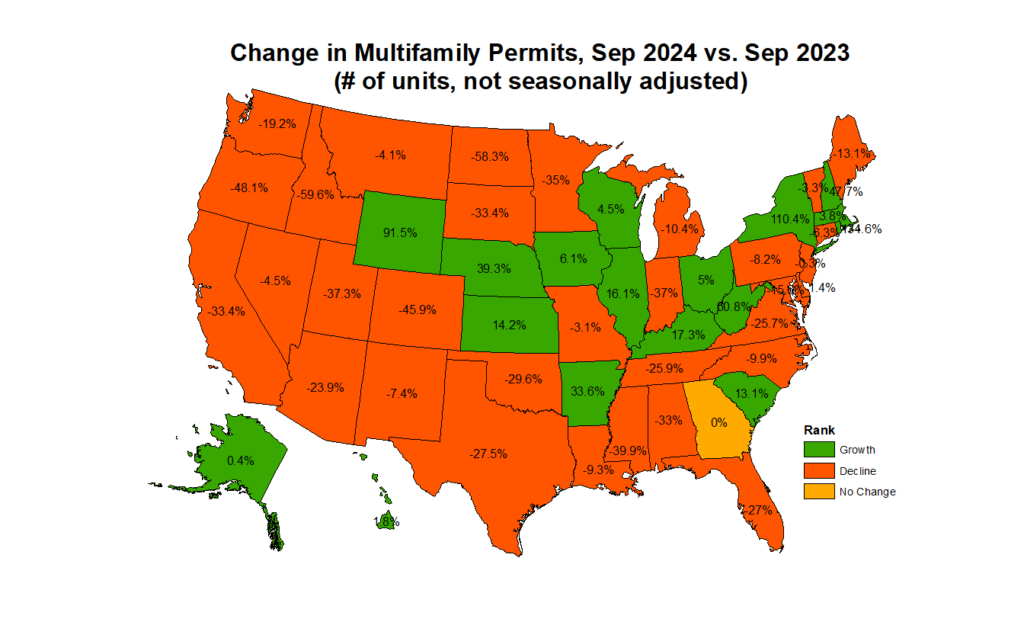

I mean, pretty much everyone (but NY) is pencils-down on multifamily:

Yoy permitting is deep red negative in all the places that matter except for NY, which has more than doubled since last year.

What better time to start putting money to work, then when the bottom is now in sight?

Net-new distress is smaller

There’s other evidence that the CRE market more generally is bottoming out, as well.