End of the insurance premium hike cycle

A second-order effect of insurance cost spiral appears to be winding down, so perhaps insurance premium hikes will too

insurers took some lumps

the big winner: a different, “special” kind of insurance

the gap between special and less-special has narrowed

an insurance + data + AI easter egg

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. Insurance premiums no longer going up, soon?

Long ago, Random Walk made the claim that insurance premiums were going to continue to rise.

Premiums are a bit of a lagging indicator for Insurance company performance, and given that the primary bottom-line inputs to Insurance losses (i.e. capital and labor) had both increased, it stood to reason that Insurance Cos would have to raise their topline prices, accordingly.

Of course, the proliferation of bigger, more valuable homes in certain weather-challenged parts of the country didn’t help. That’s got nothing to do with a changing climate, and everything to do with, e.g. building massive solar farms where hail used to fall.

But mostly, if it costs more to fix things, and it costs more to reserve capital against those costs, then the bottom line is going to suffer. And so it did (and premiums went way up, as expected).

The good news is that, fast forward to the present, there’s now reason to be optimistic that the premium hikes are coming to an end (or at least slowing down).

How can I tell? Follow the second-order effects, that’s how.

🚨🚨I’m very pleased that today’s post is sponsored by the good folks at 10 East. 🚨🚨

These are smart people doing interesting work at the forefront of private capital markets. My words, not theirs. 🫵 Check it out.

10 East allows qualified individuals to co-invest alongside their principals in private credit, real estate, venture/private equity, and other one-off investments that aren’t typically available through traditional channels.

Led by Michael Leffell, 10 East sources, monitors, and provides institutional-level diligence to every offering.

Likewise, 10 East only shares opportunities that 10 East’s principal invests in, helping to align incentives.

E&S insurance to the moon

What do I mean “follow the second-order effects”?

Well, one side effect of rising insurance costs was the growth of the Excess and Surplus (E&S) lines market.

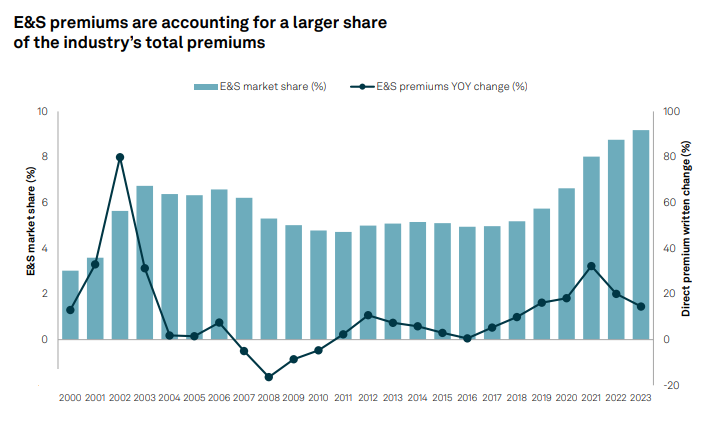

E&S share of total premium went from ~6% to just under 10% in ~4 years.

Why did E&S gain so much share?

You see, in order to raise premiums, an insurance company needs to get the blessing of the state insurance regulator. If the regulator says “no” to premium increases, then insurance companies can:

(a) lose money;

(b) tell the world that the regulators are bad and unreasonable; or

(c) simply stop writing insurance in that state, and tell the world “it’s climate change.”

Many insurance companies chose option (c)—just exit the market—rather than blame regulators (no matter how justified that would be).

And with that void, enter E&S lines who get to write insurance without any approved rates. That’s basically the whole idea behind E&S: to fill gaps in the “admitted” market, i.e. go where the approved lines won’t go.

Enter that void is precisely what they did. E&S insurers grew like gangbusters, scooping up the policies that traditional insurers couldn’t or wouldn’t take.

It’s a non-representative example (and specialty has other tailwinds), but publicly traded specialty-only carriers have performed pretty well: