'Hot' CPI is just noise (except for *maybe* one thing

Gotta get those eggs, tho, because they're hot hot hot

the hottest categories of price increases

if there’s one to care about, it’s the one exposed to both tariffs and deportations (or slower immigration)

mind the supercore, but probably not yet, and not this

bonus: flows into cryto (reprise)

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. ‘Hot’ CPI is just noise (except for *maybe* one thing)

The CPI exceeded estimates by 0.1 percentage points and it’s safe to conclude . . . nothing.

Just a wiggle.

Drug prices ripping

Wanna see what it looks like?

Here, courtesy of Bankcreek and their nifty visualization tool:

gas

used cars and trucks, plus insurance (more on that below)

prescription drugs (???)

eggs

Ignore gas. Eggs is bird flu, which shouldn’t be ignored, but it has nothing to do with secular inflation (or not).

Prescription drugs is . . . I have no idea, and as best as I can tell, no one else does either, so let’s chalk that one up to noise.

Maybe this has something to do with it?

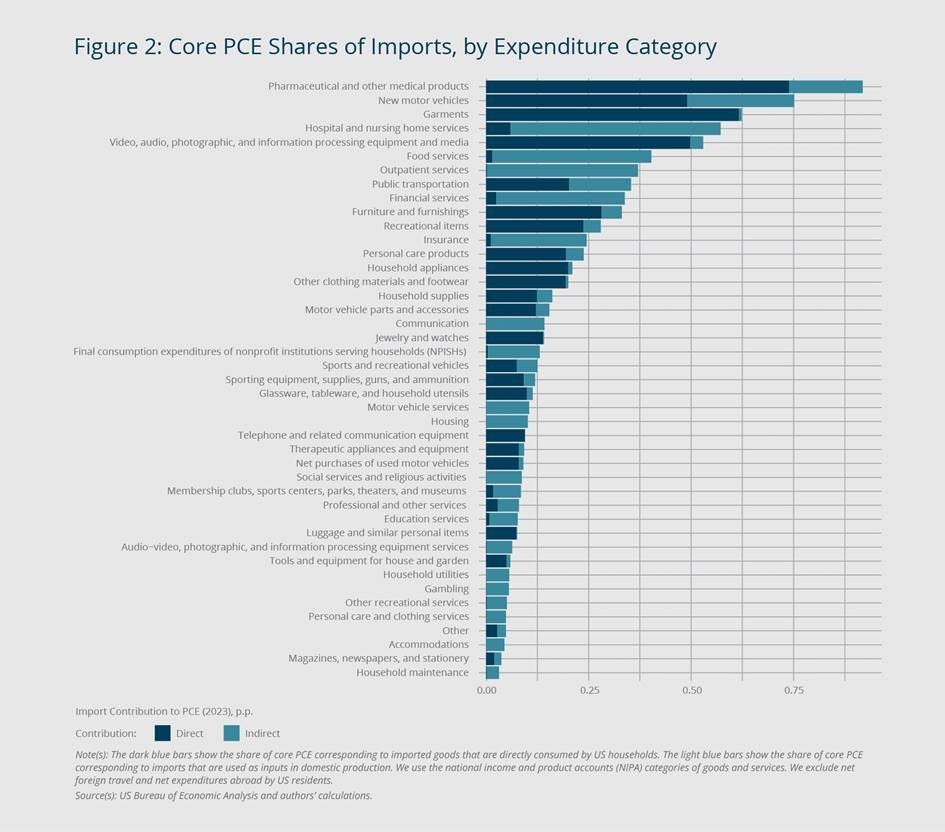

The share of PCE attributable to imported Pharma is ~0.7% (by this estimate).

So, in theory, drug prices would face cost-pressure from tariffs, but it seems awfully soon for that effect to show up in the CPI.

It’s probably just noise.

Here’s what Bankcreek says, fwiw:

Now, we happen to know a thing to two about U.S. drug pricing, dating back to our Chief Analytics Officer's work with 46brooklyn. And from that knowledge and experience, all we can say with confidence is we have no faith in the meaningfulness of this measure.

When analyzing drug prices, mix is the single biggest factor, which is nearly impossible to fully control for in these types of analyses. Moreover, given that this is supposed to be the consumer's perspective, you also have to throw in changes in insurance coverage to accurately split out the cost share. This is an impossible task to do on a small scale, let alone for the entire country

So, ignore drug prices for now.

Autoparts and insurance also ripping

That leaves cars and insurance.

Well, that one could be trouble.

If there was any industry exposed to a double-whammy of labor shortages and tariffs, it’d be auto repairs (and by extension, auto insurance). Construction too, but that’s depressed by capital costs, so let’s not worry about that for a moment.

Plus, in this case, the price change doesn’t appear to be just noise and/or seasonality—the additional spending shows up in the transaction data, as well: