How're the banks (reprise)

Big bank earnings come in later this week, and the forecast calls for more "it's ok, but maybe a bit boring"

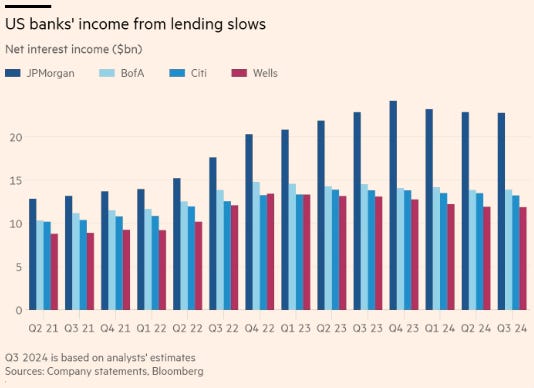

Bank lending profits decline

NIM still flat to down, but slightly better in some places

credit performance is good, but slightly worse than before

bankers leave the banking to non-banking aka waving the white flag to private credit

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. How’re the banks (reprise)

The big banks will be reporting for duty later this week and their lending businesses are expected to disappoint.

It touches on a theme that Random Walk has been wondering about for a while now, which is what exactly banking looks like in our ‘higher-for-longer’ new-normal? More specifically, Random Walk speculated that banks were becoming “boring” (which is something short of “zombies”), while the real lending action (and risk) migrated elsewhere.

You see, when rates went up, banks had to pay more for capital. In theory, banks could make up the difference by lending at higher rates, as well, but that assumes they can actually find a market for higher yielding loans.

That’s not an easy assumption to make, considering the bread n’ butter of bank lending, e.g. mortgages, cars and commercial real estate, are much less appealing when rates are high. It’s doubly hard when regulators are telling you to de-risk, and it’s triply hard when your competition—non-bank lenders, aka Private Credit—is growing like gangbusters, with comparably less scrutiny, and therefore comparably more speed and flexibility.

Basically, the shallow end of the pool (where banks could thrive) disappeared, while the deep end of the market is filled with better, faster swimmers. Hence, Random Walk had some doubts as to whether banks would actually be able to do much “banking,” unless and until rates came back down to something closer to the status quo ante (which isn’t happening any time soon).

Lending revenues are meh

So far, the “prediction” (but really, the speculation) has mostly held up.

Big bank lending income has been unimpressive for a while now:

Net-interest income has been flat to down all year, and is expected to stay that way.

Profitability has improved in some places, however.