Insurance premiums are going up (reprise)

Daily Data: Insurers are losing money and it has nothing to do with climate change

In today’s dispatch:

home insurers lost money again

claims rose more quickly than premiums

pretty much everyone was a money loser, except one notable name

can’t blame climate change (but won’t stop trying)

why did climate change put all the solar panels in the way of falling ice?

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. Insurance premiums are going up (reprise)

The barebones economics of insurance are pretty straightforward.

Here’s what I wrote last time:

When it comes to insurance, the goal for the insurer is to collect more in premium than pay in claims.

It’s simple, really.

Premium is the revenue, and claims is the cost. If costs are more than revenue, you lose.

Insurers have a way of measuring their costs (which includes more than just claims) as a percentage of revenue. It’s called a “combined ratio,” and if it’s higher than 100%, the insurer is likely losing money

What I wrote last time is still true!

A combined ratio refers to all the costs—claims, admin, sales, etc.—as a percentage of premium (i.e. revenue).

Again, if an insurer’s combined ratio is more than 100%, then the program is losing money because the program is generating more cost than revenue. Pretty simple.

If an insurer is losing money, then it has a few options:

do nothing—the poor performance was an anomaly

charge more in premium to better compensate themselves for the risk

change underwriting to select different, more profitable risk

exit the market entirely; and/or

some combination of the above.

I’m simplifying obviously, but really that’s the gist of it.

A high number is not how you win

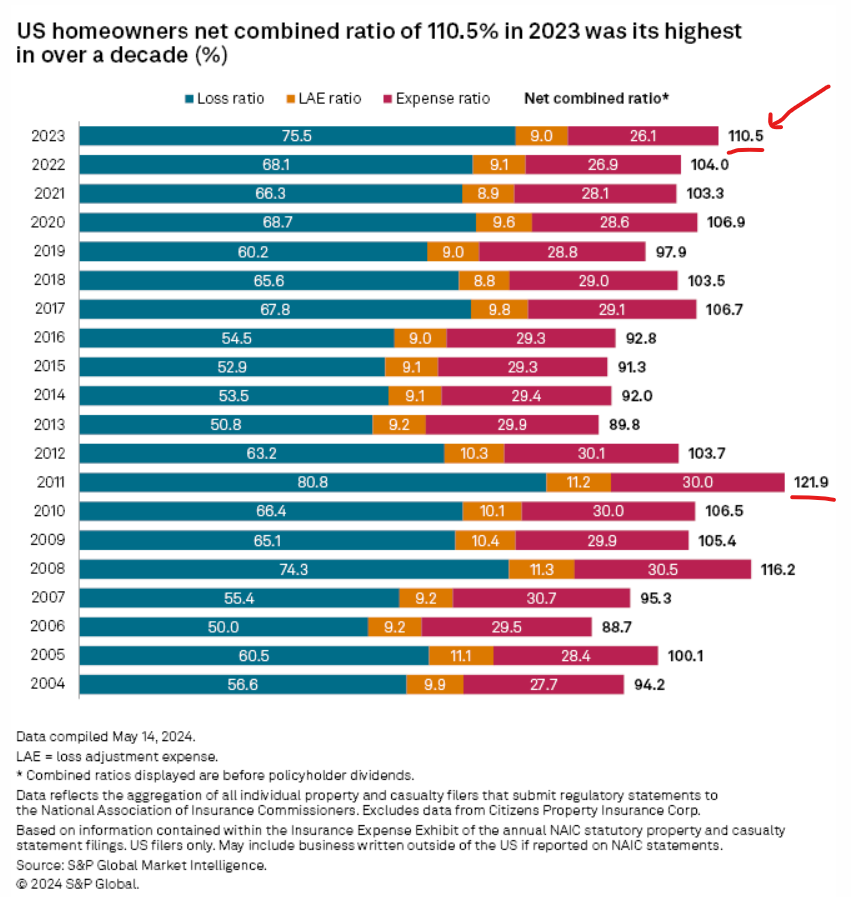

Anyways, home insurers ran their worst combined ratio in more than a decade, last year:

A combined ratio of 110.5% means home insurers paid ~$1.11 for every $1 received.

One doesn’t have to be an expert to know that’s not a good business.

But Random Walk also built and managed insurance products for a few years, so I can confirm: losing money on every premium dollar written is not a good insurance business.

Losses rose more quickly than premiums

The reason that the combined ratio got worse—even though premiums have gone up—is because underwriting losses have gone up even more quickly than premiums:

~10% increase in premiums will not cover a ~20% increase in losses.

You know what that means, right?

Pretty much everyone suffered (but Buffett’s new belle)

Were all the insurers bad at insurance, or did some do better than others?