New homes are partying like its 2020

Lennar reports; GSEs lean into Goodhart; never been a better time for a condo; cracks in unemployment?

Publishing note: Random Walk is going to experiment with a different publishing cadence over the next few weeks (more details forthcoming). I will endeavor to trade some frequency for depth, at least some of the time.

home values continue to fall, the builders report

GSEs and Goodhart’s Law

great time for a condo on the Gulf Coast of Florida

starting to show in unemployment?

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. Home values continue to fall

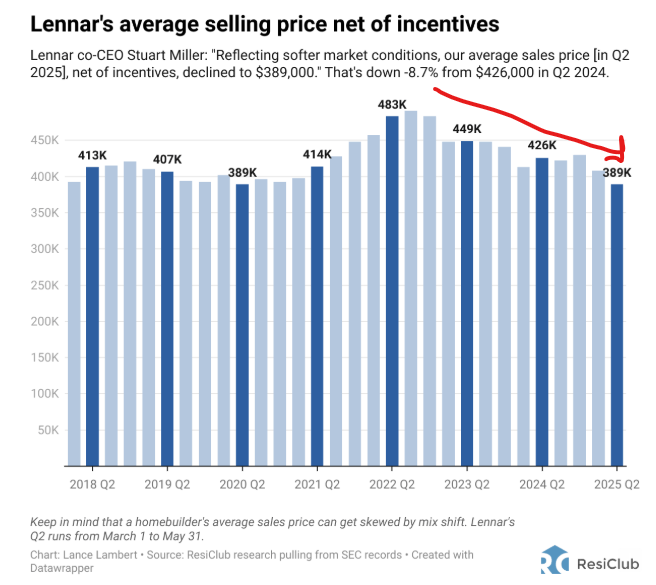

The homebuilder Lennar LEN 0.00%↑ reported this week to confirm what we already knew: home values are coming down, and have been for a while.

“Reflecting softer market conditions, our average sales price, net of incentives, declined to $389,000. As mortgage interest rates remained higher and consumer confidence continued to weaken, we drove volume with starts while incentivizing sales to enable affordability and help consumers to purchase homes.”

Average sales price, net of incentives, declined because when purchasing power declines, discounting is how supply meets demand.

How far has the average purchasing price fallen? Pretty far:

Average sales price is now $389K, which is the same as it was 5 years ago during peak Covid.

That’s quite the come down.

But look, that higher rates would drive home values down (as they’ve been doing for ~3 years) was entirely foreseeable. I mean, you had to ignore the exactly wrong hollering of Team Housing Shortage, but banish that brain worm, and the evidence has been plain as day.

And, of course, the builders have known from the start:

Incentives as a % of revenue for the biggest builders has been in serial incline snice rates went up.

Again, there’s nothing wrong with this.

Discounts via rate buydowns especially, are a great way to price-to-market, while keeping the headline price high, which makes everyone feel safe and secure in their home values. Plus, builder margins have (until recently) been pretty wide, so they’ve had lots of room to maneuver on price (while building smaller, cheaper homes).

But, don’t kid yourself about “all time highs” in home values, or whatever.

GSEs meet Goodhart’s Law

An interesting aside about rate buydowns, they offer yet another reveal on the ways in which the GSEs subsidize and/or distort the mortgage market.