No more Miss Lonely-Deals

Silver linings in PE/VC and an unlikely signal of optimism

PE has some pick up (but has a lot more to go)

“we underwrite earnings now”

venture town, feeling like old times (for better and for worse)

No more Miss Lonely-Deals

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. No more Miss Lonely-Deals

Random Walk would prefer to say something new and different about the current state of illiquidity in private capital, but there hasn’t been all the much different to say (dunking on the NYT, notwithstanding).

It hasn’t gotten any worse, however, and there’s some evidence that it’s getting better. Certainly people were feeling more optimistic when rates came down a bit, so there’s that.

Private Equity pick up, but a lot more to go

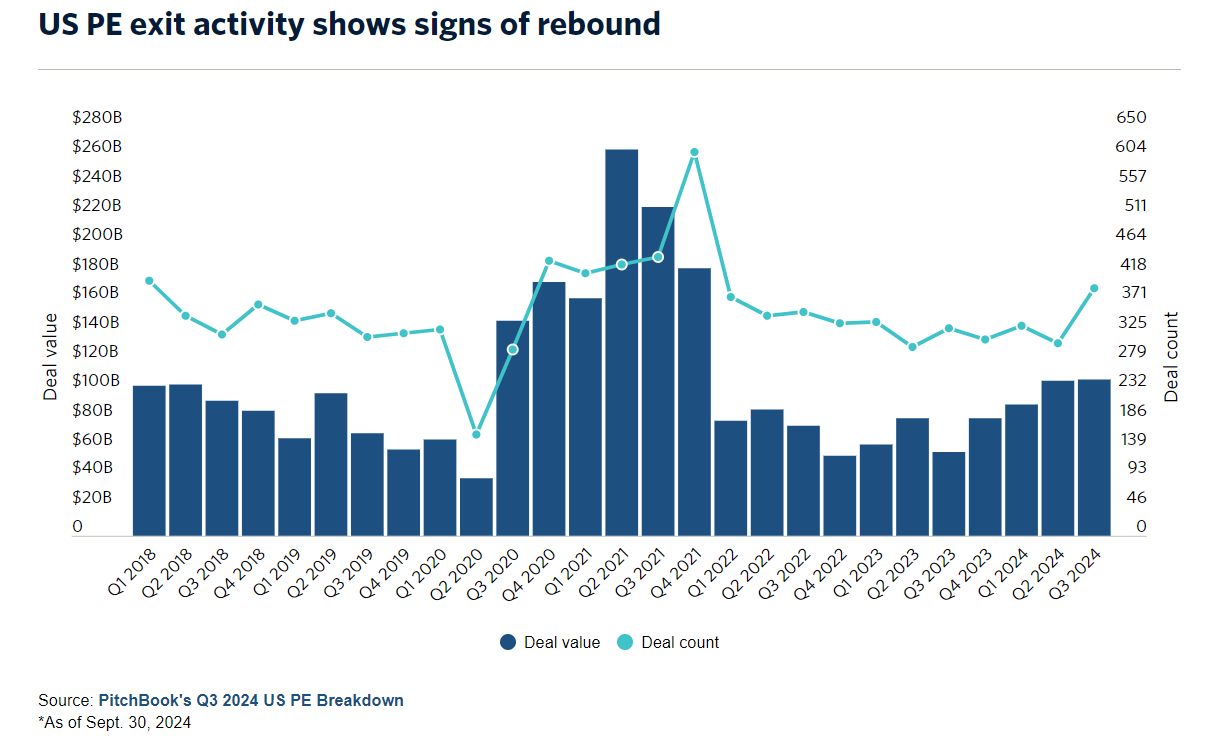

For Private Equity, Q3 exits actually picked up a bit, so that’s encouraging:

Total exit value for US PE was ~$107B last quarter, which is the highest it’s been since ZIRP.

Taking a longer view, you could even squint and say exits are back to pre-pandemic levels, almost.

Of course, that still leaves all the investments that were made during the pandemic, and there were a lot of those.

The sum of portfolio companies held by PE funds surged to 11,567 in the last quarter, around a 26% increase from 2018. If exits continue at the current rate, it will take GPs more than eight years to clear their shelves of existing inventory, a daunting task given that the typical PE fund lifespan is 10- to 12-years, Clarke said.

“There’s a lot more catch-up to do to alleviate the main problem: too many companies to sell and too short of a time to conduct those sales, which can translate into a disorderly process,” he added.

Moreover, just as the exit activity struggles to regain momentum, dealmaking is quickly getting back on its feet, forming a widening chasm between deployment and realizations.

Currently, the PE industry maintains a $300 billion gap between capital deployed and capital realized. The difference has narrowed but not fully closed.

Can’t stop, won’t stop.

There was a decent amount of optimism that rates were coming all the way down and dealmaking was right around the corner.

It turns out that there was, in fact, some dealmaking, but not nearly enough (and rates are not coming down, as much as people seem to hope).

The bid-ask spread is still just too wide.

Buyers of PE assets have become more realistic about companies’ ability to grow and expand margins.

They are no longer taking the promise of future earnings improvements at face value, as they might have done in a frothy market . . . Instead, acquirers are basing valuations on actual trailing-12-month EBITDA figures.

More specifically, buyers are not accepting various add-backs and pro forma adjustments—revisions to financial forecasts—advertised by sellers, which could include projected growth from new branch openings, customer wins, price increases or synergies from an add-on acquisition.

In other words, seller’s aren’t ready to cop to new multiples, and buyers are doing crazy things like insisting on using TTM profits to value companies, instead of, y’know 10x seller projections to the year 2030.

And PE shops aren’t ready yet to sell at big discounts, because then their LPs might start asking questions.

Rate-cut chicken continues. In the meantime, Private Credit gets antsy (with no buyouts to fund), and PE rediscovers “value creation.”

Venture town, feeling like old times

The story is somewhat similar in VC-land, albeit slightly worse.