Private capital under pressure (republished)

Random Walk at Night: Still no exits, and there isn't enough rescue money for everyone

This post seems to have resonated, so I decided to republish it, just in case anyone missed it.

Behold!

exit liquidity is tighter than the Global Financial Crisis

should be a big deal, but hasn’t been a big deal

PE’s broken business model, in a single slide

the temporary fix: picking up hundos in front of a steamroller

secondaries will not save you

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. Private capital still not exiting

Pitchbook put together an awesome look at the current state of things in private capital markets, and since that’s a thing that RW ruminates on often, ima dig in.

At the end of it all, I’m not really sure which observation is more striking.

The fact that (a) Private Equity is in the midst of a liquidity recession worse than what followed the Global Financial Crisis (GFC) or (b) that it hasn’t really mattered all that much.

This is the highest prestige, best-performing asset class and it’s completely stuck (without any clear or certain path to rescue), and it’s all pretty chill, really.

It’s like that scene in Space Jam where the superstars lose their talents, but even more so, because perhaps it turns out that they weren’t so talented in the first place, and yet, instead of Paul Westphal and Danny Ainge freaking out, all is calm.

Exit-liquidity is worse than the GFC

First, an updated look at the long-running theme: No Exits for Private Capital.

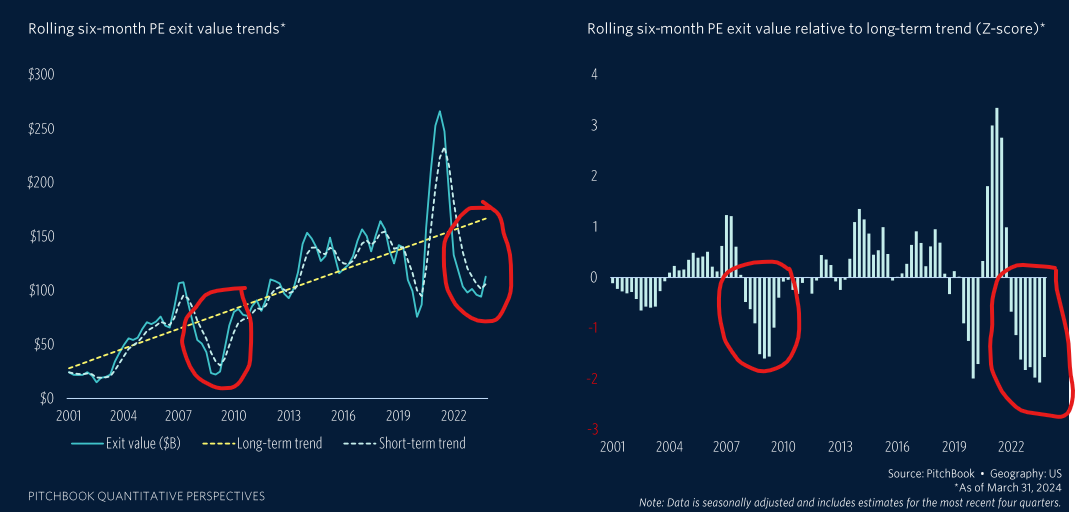

Pitchbook took a stab at trying to quantify the exit draught in PE and the visual is pretty remarkable:

The drawdown in exit-value relative to trend is more substantial now than it was 2008-2010, which was the peak of the GFC.

There are simply no exits in private capital. Portfolio companies continue to ripen on the vine, and LPs continue to not get paid.

Look at exit rates, by deal vintage:

Anything that came of age ~2022, so starting with the tail-end of the 2016 class, is just staying on the books, longer and longer. The more recent the vintage, the farther from trend.

All that means is that there is an increasing pile-up of unsold companies.

2016 deals that would normally have been sold in 2022, are still on the books in 2023 and into 2024 (when 2017 and 2018 vintages would have been sold, but weren’t).

It should be a big deal, but it hasn’t been

This should be a pretty big deal.