Random Walk at Night: Where does VC go from here?

Can they unleash their inner Buffet? Not likely. RW offers some alternatives.

Random Walk offers some deep thoughts on the present and future of Venture Capital.

What’s a unicorn-hunter to do, when unicorns are suddenly as rare as . . . unicorns? For one thing, don’t wait for the public markets—they won’t help you. Perhaps, instead, try to find the VC within.

Everything reads better in your browser or in the app. The footnotes especially, and Random Walk is really leaning into the footnotes. Plus, if you have the app, you can set delivery to “app only” and then my daily barrage will feel less like a barrage. Unfortunately, substack does not yet have a “Weekly Digest” option, but I’m hectoring them aplenty.

If this email was forwarded to you, please click the shiny blue button:Random Walk at Night

Where does Venture Capital go from here?

It’s been a while since we last checked in on Venture Capital, and partly that’s because not much has changed.

Things weren’t great before, and they’re still not that great.

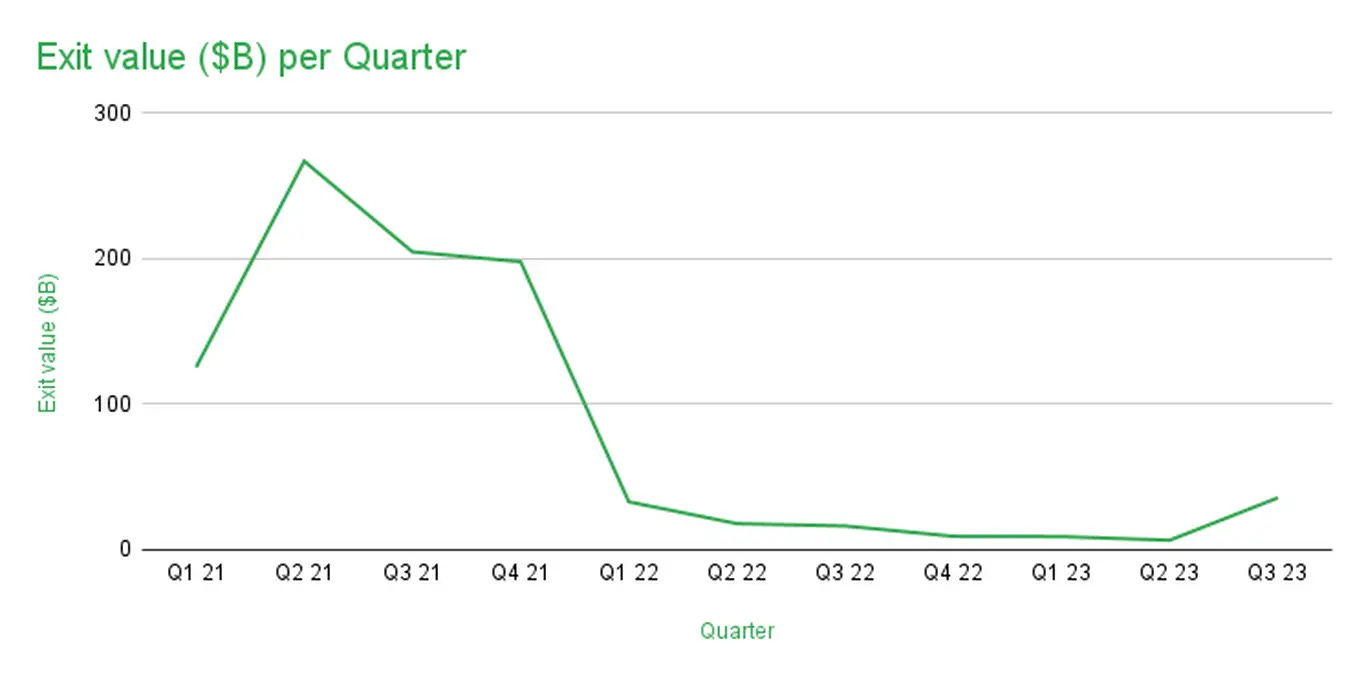

There are no exits:

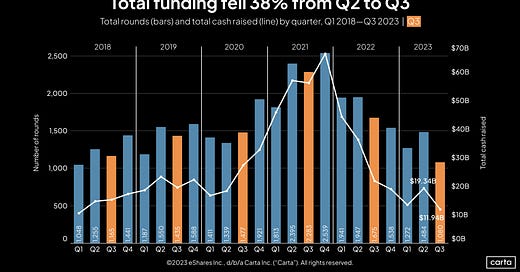

Fundraising is still the pits:

I could go on, but suffice it to say, it’s just no fun out there.

But there’s a deeper problem afoot, that bears a bit more consideration.

What does Venture Capital even do in a “longer for higher” world? Where does it go from here? Why does it need to be?

In a world where the “risk free rate” is closer to ~5%, the appetite for extremely risky, loss-making companies that maybe one day will rise like a search engine from the Northern Californian fog just isn’t that high.

Ahh, no worries, we’ll just de-risk. Tech companies will just focus on profitability and bottom-line, instead of grow-grow-grow.

It makes sense at a superficial level, but there’s a problem: that’s not what venture capital is for, and relatedly, that’s not what venture capitalists know how to do.

“Small businesses” are not venture capital businesses.

Venture-backed companies are supposed to be losing a bunch of money in the early going. The whole dang point of seeking venture capital in the first place is that there is no way to get from point A (idea) to Point B (real business), without spending lots of money, and no ordinary financier would underwrite that sort of thing. If you could be a real business right out of the gate, you’d find a more reasonable (and less-expensive) source of capital, like, a bank loan or something.

Venture Capitalists, for their part, are supposed to be able to identify the sorts of entrepreneurs and opportunities that are worth investing in before they start using fancy words like “profit” or “free cash flow.”

VCs are not value investors, they are moonshot investors.

Unfortunately for VCs, chasing moonshots just isn’t as appealing when there’s plenty of glowing moon rocks yielding 5% just lying around. And it’s not like they can just pivot to “value,” because VCs don’t know how to do value, it’s not clear that “value” really needs VC anyway.

So what will they do?

Random Walk will tell you.

Tech companies have pivoted to boring, and boring doesn’t do 100X

Let’s start with an observation from the public markets, specifically about the financial performance of software companies.

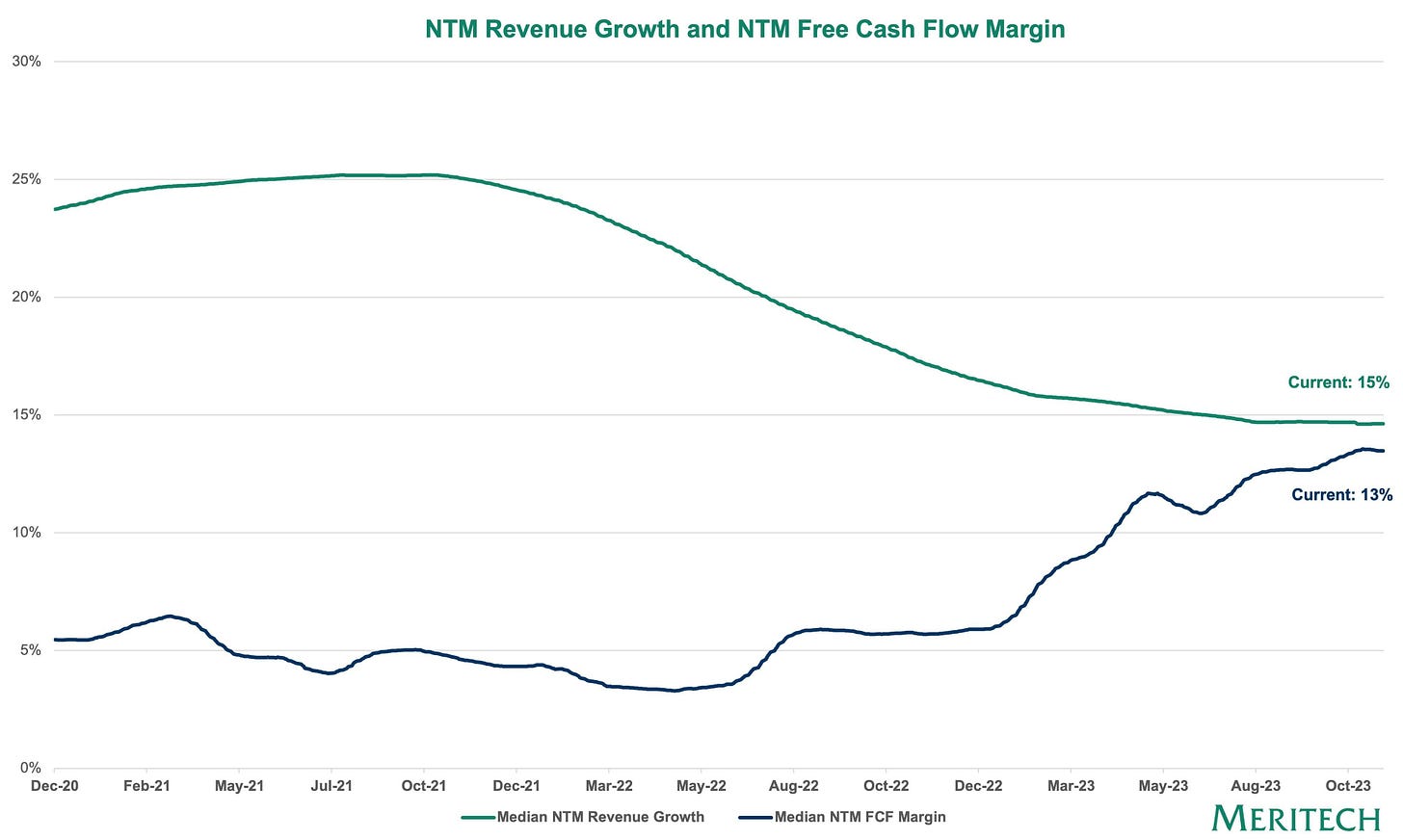

Public SAAS companies have very obviously traded revenue growth for profit growth:

Revenue growth has gone down, but free cashflow growth has gone up.

It turns out that tech companies can actually make money, when they set their minds to it.

Bottom-line discipline is more boring, but making money is the actual point of the game. That loss-making companies have learned to stand on their own two-feet as profit-making companies is terrific. Kudos to them.

There’s a problem, however.

Keep reading with a 7-day free trial

Subscribe to Random Walk to keep reading this post and get 7 days of free access to the full post archives.