Real estate dispatch

Rents-not-rising, but some markets are (a lot) better than others, a tale of four regions, good and bad news from CMBS, Bye-bye biotech, hello loneliness (reprise)

Rents are not rising

the national story obscures the regional one, and the regional one has some unexpected surprises and rockstar cities

good and bad news from CMBS, because this time it’s different

bye-bye biotech, hello loneliness (reprise), and no love for dirty water

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. Real estate dispatch

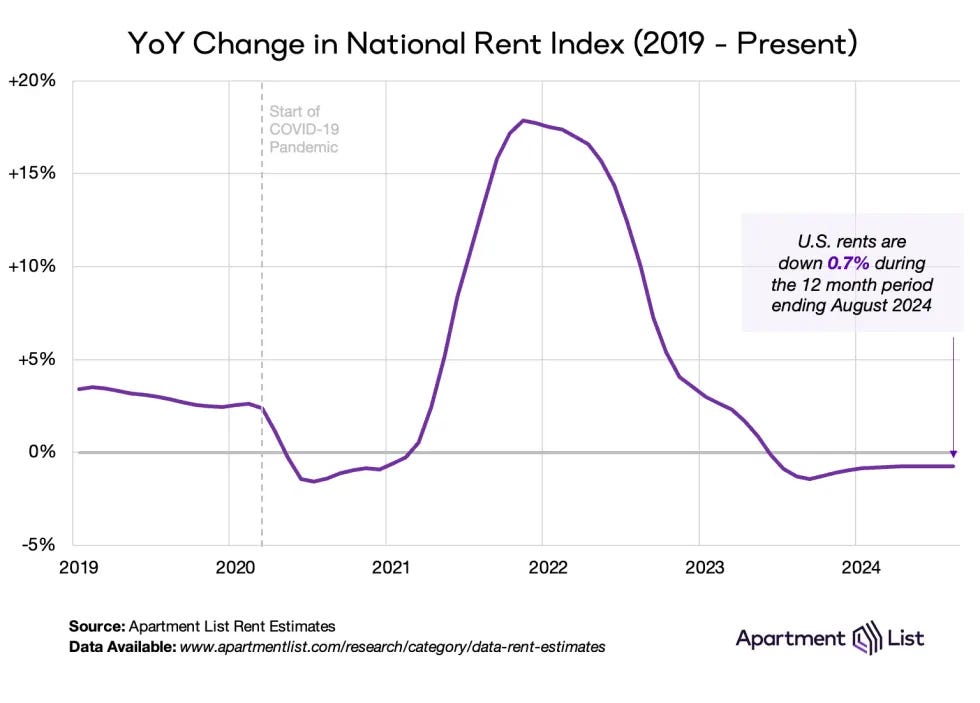

Nationwide, rents are somewhere between growing modestly-to-flat-to-down.

Yoy rents are -0.7%, but are still roughly 20% higher than they were back in 2020.

A more recent cut using Real Page data shows basically the same thing:

Flat, but not negative, rent growth nationwide (for basically a full year, now).

Rents aren’t growing all that much because incomes haven’t grown that much, and because there’s lots of new supply to absorb.

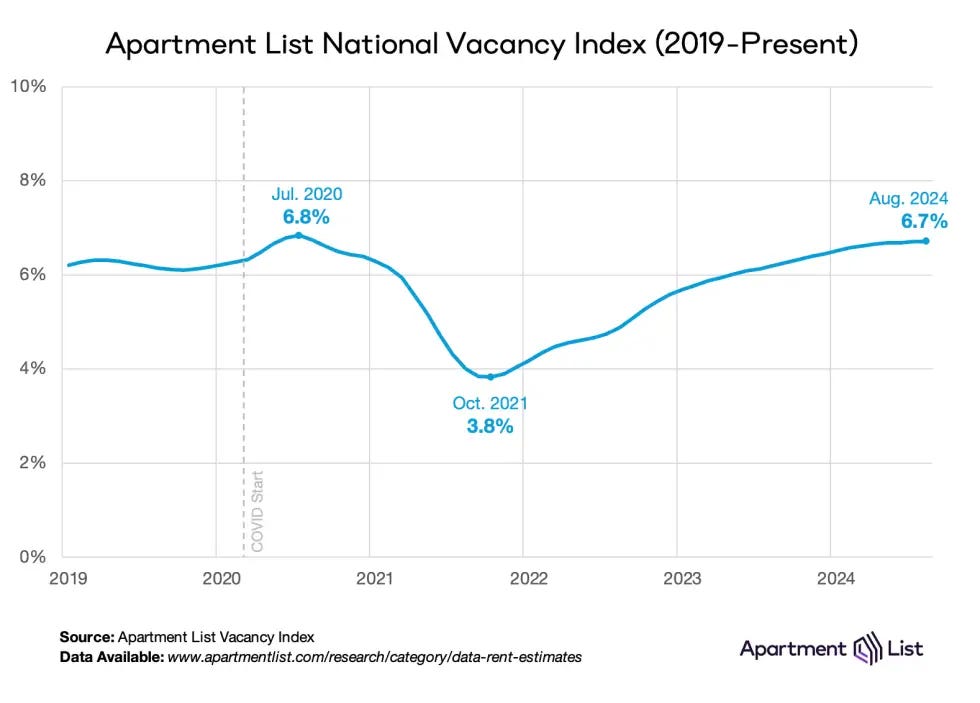

Vacancy rates are now modestly above pre-pandemic levels:

With a 6.7% national vacancy rate, it’s hard to find the housing shortage, such that one might exist.

One very clear implication of rents-not-growing is that developers are going to tap the breaks on new supply (and so they have).

That’s especially true given that labor and capital costs have increased so substantially. The hope is that not-building for a bit will cause rents to rise, and eventually give way to a new up-cycle in a year or so, but we shall see—and the MBA just revised their forward estimates of lending activity.

Anyways, all of this is old news and stuff that Random Walk has written about before.

So, what’s new and interesting?