Six charts no one expected to see when rates went up

Just some mysteries from the world of borrowing, risk, and price signals

And we’re back, after a marathon Jewish holiday season.

lossmaking smallcaps increase (and the crowd goes wild)

when rates go up, SMBs borrow more?

when rates go up, borrowers pay less(?) interest

it’s never been a less-risky time to lend

. . . which is why all the lending goes to lenders

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. Three Six charts that aren’t what anyone would have expected (and are somewhat hard to figure).

Lossmaking small caps go up (and the crowd goes wild)

The share of small caps with negative earnings continues to climb:

Loss-making small caps have become increasingly prevalent, essentially on-trend since the GFC (although even more so, lately).

At some point this trend has to roll over, right? I don’t know at what point that is, but they can’t all be lossmakers.

Plus, you know the old adage, that “Private Equity is just small caps with leverage”? If this is what small caps are doing without leverage, then it can’t be pretty with leverage.

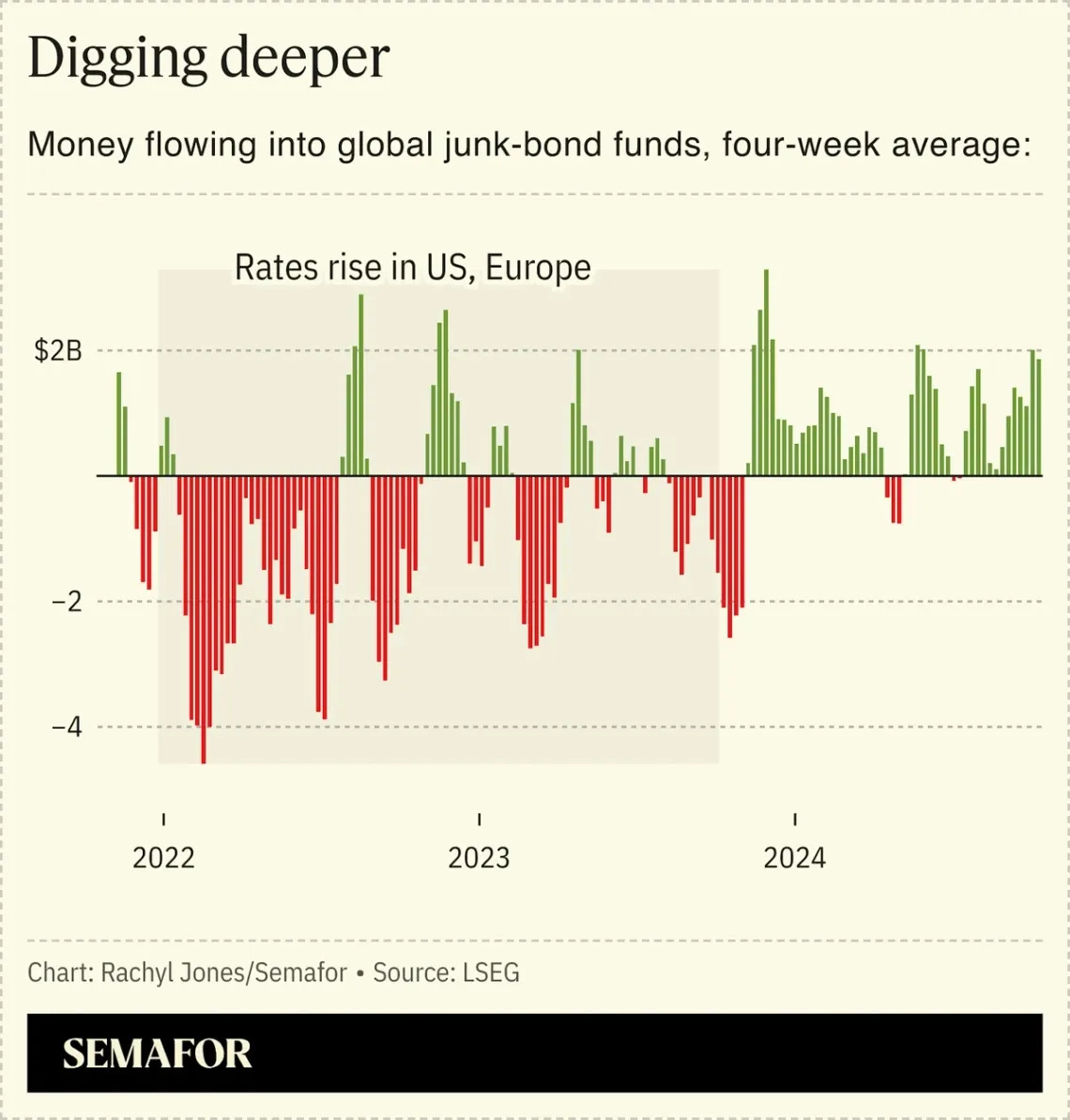

Gimme all the junk

Or maybe it can.

Leverage? We love leverage.

Sub-investment grade? Even better:

Inflows to “junk” rated debt took off like a rocketship.

The share of loss-making small caps may continue to grow, but that hasn’t stopped lenders from throwing more money at riskier companies.

Presumably, investors thought junk yields were attractive when everyone expected more cuts on the horizon. Query what they think now.

Junk at any price!

Demand for junk was so high that investors were willing to pay top dollar. The toppest dollar, you might even say.

The riskiest stuff is paying only slightly more than the “risk free” stuff:

Keep reading with a 7-day free trial

Subscribe to Random Walk to keep reading this post and get 7 days of free access to the full post archives.