Started from the bottom now we're here

Mini-essays on adjustments for whom and how; fintech is big; uranium and other confusing metals; it's not a banking crisis, it's the plan. Reads on the biggest deal in AI, and more

The end is nigh! End of the week, that is.

First, the mini-essays:

Started from the bottom, now we’re here (or who is adjusting and how)

Fintech is still a big opportunity (or a reminder that VCs are smart sometimes)

Waiting for Uranium and other musings on rocks n’ minerals n’ metals

Don’t call it a crisis (reprise) . . . the banking non-crisis is still not a crisis. It’s the plan.

Second, the good reads:

Getting started with the Code Interpreter (i.e. the most exciting OpenAI roll-out)

Rapidly decreasing costs of AI

Goldman is trying to extricate itself from Apple

A beauty company is poised for a hot IPO

A Rabbi’s retirement lessons (or of Minsky Moments in Trust Cycles)

Please enjoy responsibly. Or irresponsibly. I don’t care. You do you. It’s the weekend, after all.

Random Walk Thinks

Started from the bottom, now we’re here

By educational attainment, the only group who worked remotely more in 2022 than 2021 were high school grads (no college):

Some part of this is just the realization that “lower skill” jobs can be done remotely as well. I think another substantial part of it is leverage—the most acute worker shortages have been at the lower end of the income range, so those are the workers who can demand more accommodations from employers.

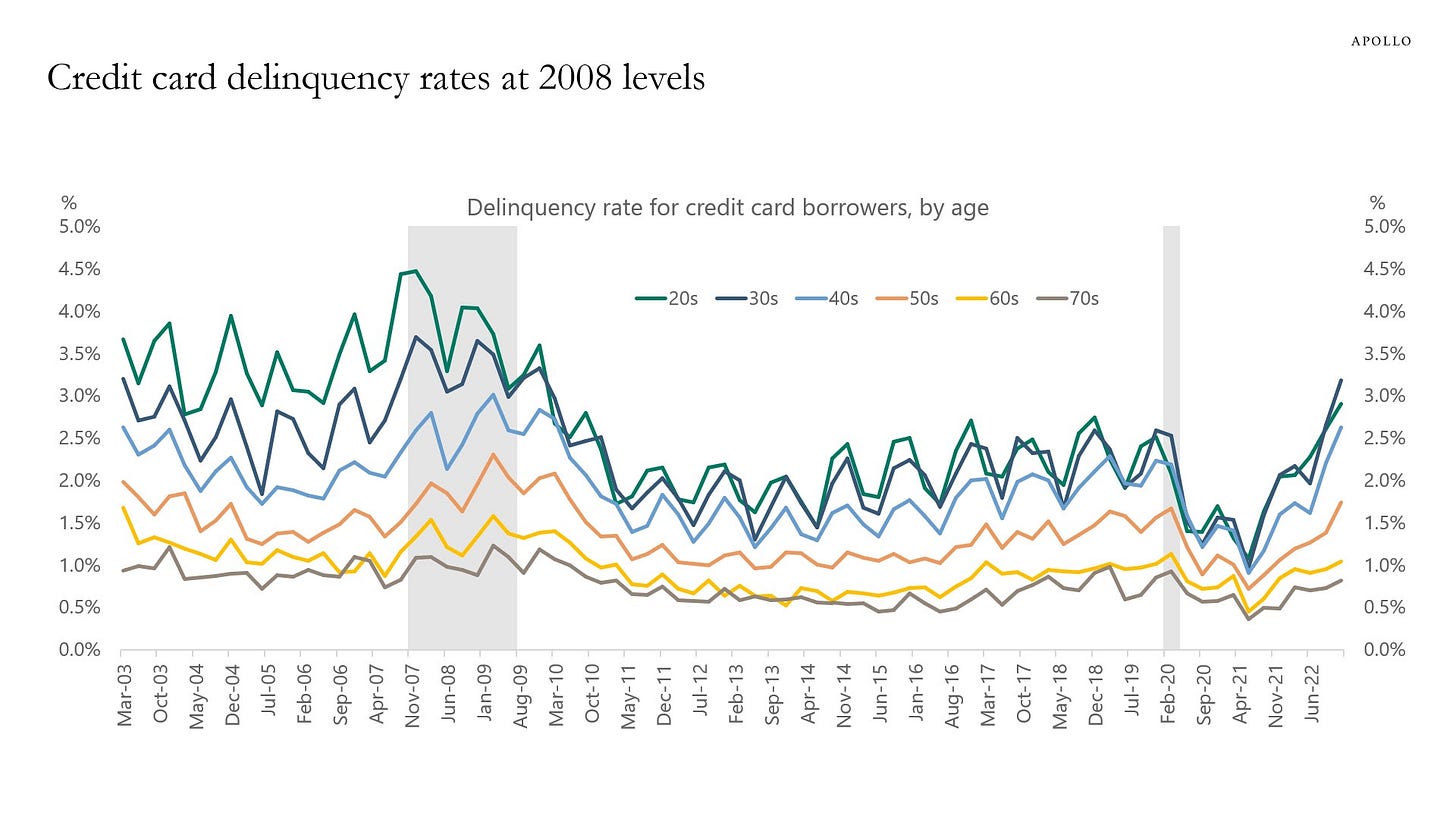

If, on the hand, you want to measure “bottom” by age, pressure continues to build. The younger you are, the further you’re falling behind on your credit card and car payments.

Credit cards:

Car payments:

I have a theory (albeit not a novel one) that expectations around wealth are “sticky.” Once people get anchored on a lifestyle, it’s hard to stop. Young people especially who came of age in the boom times—and pandemania was the cherry on top—perhaps have come to expect certain material things that would have been considered lavish perks only a few decades ago. That said, it’s not just young folks who may be struggling to adjust.

Everyone felt richer with their stimmy checks (i.e. “excess savings”) but, as a reminder, wages did not keep up with prices:

An adjustment is coming, and RW doesn’t care how many people buy Nvidia’s stock, because it’s still coming.

Well, spending is slowing (for now), so perhaps people are getting the message (or perhaps it’s another MoM blip):

I will conclude whichever one makes me sound smarter in retrospect.

Fintech is still a big opportunity

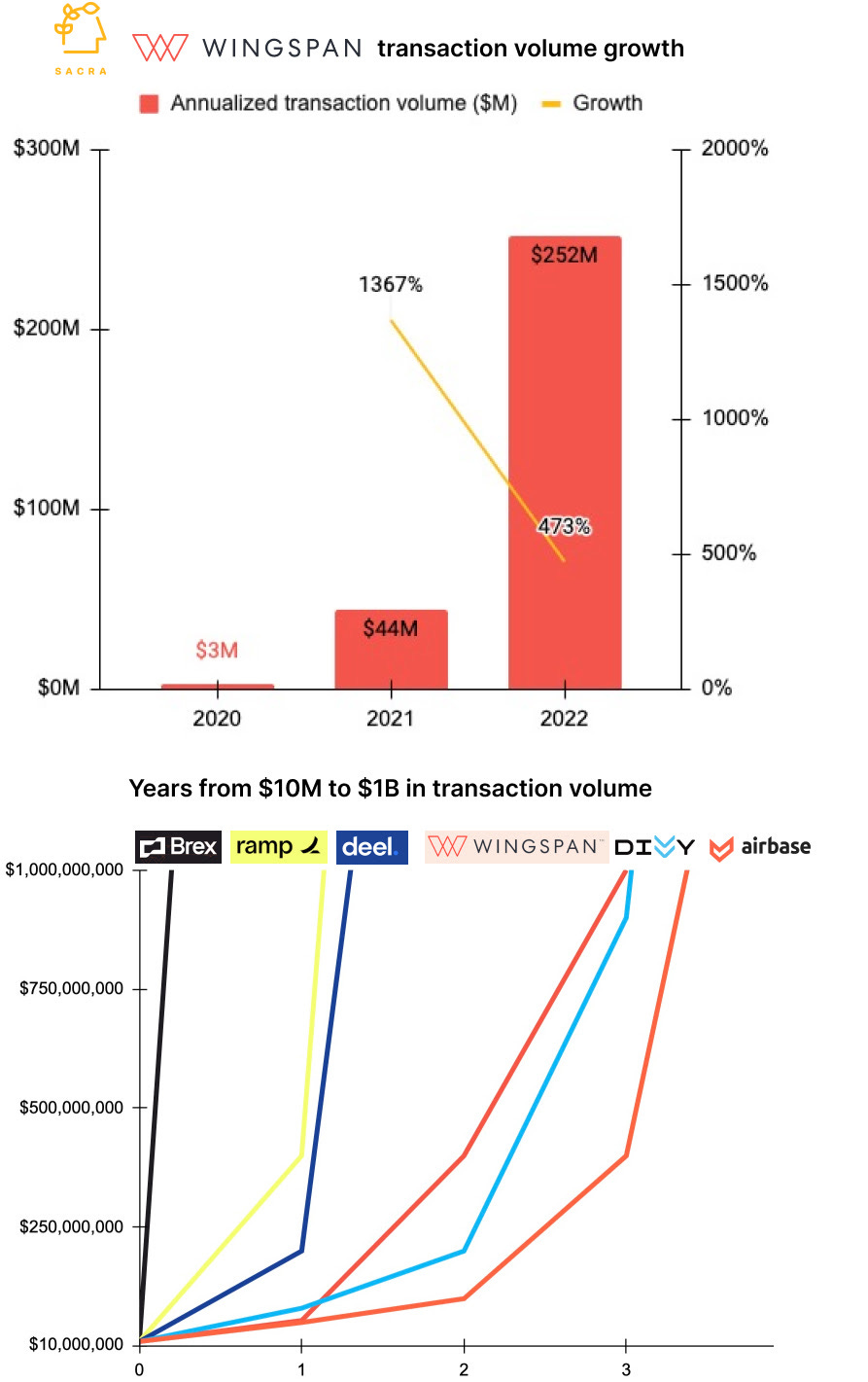

For years, fintech was the hot VC sector partly because of huge successes like Stripe (and VCs love a good “X-for-Y” story (Uber for Nurses, Stripe for LatAm, etc.). But the main reason fintech was prized is just that the opportunity to bring technology to banking, payments, payroll, AR, accounting, credit cards, etc. is huge. RW pokes fun at VCs from time-to-time, but when I saw this little Sacre write-up, it reminded me that “VCs are actually pretty smart sometimes.”

In this case, fintech is in fact huge, so credit where credit is due. To wit, Wingspan—a contractor payroll startup—has grown transaction volume by ~100x in two years (taking the report at face value):

That’s cool and impressive, but the part that made me say “VCs are actually pretty smart sometimes” was just how crowded “payroll” has become, and yet, not so crowded that there isn’t room for another success story:

In other news, Visa acquired a Brazilian payments infrastructure company Pismo for $1B in cash:

Founded in 2016 . . . São Paulo–based Pismo has quietly racked up a list of big-name customers, including Citi, Itaú (one of Brazil’s largest banks), Revolut, N26, Nubank and Cora. The startup processes almost 50 billion API calls and $40 billion in transaction volumes annually, and powers almost 80 million accounts and over 40 million issued cards.

For some context of the explosive growth Pismo has seen, at the beginning of 2021, it was doing less than $1 billion per month in transaction volume, according to Josua. It ended 2020 with fewer than 10 million accounts total.

Once again, fintech is a still very big opportunity.1

Waiting for Uranium

These are some unstructured thoughts around a general observation that elemental stuff—rocks, minerals, metals, etc.—seem poorly understood (by me at least), relative to their importance.

Keep reading with a 7-day free trial

Subscribe to Random Walk to keep reading this post and get 7 days of free access to the full post archives.