The IPO market is open, same as it ever was, and always has been

Public and private market investors are throwing money at companies like never before

Publishing note: Random Walk is going to experiment with a different publishing cadence over the next few weeks (more details forthcoming). I will endeavor to trade some frequency for depth, at least some of the time.

public market multiples are historically high

private market multiples are historically high

the secret to solving the ‘liquidity crisis’ (isn’t actually all that hard)

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. The IPO market is open, same as it ever was, and always has been

With a few successful IPOs in the bag, there’s been chatter about how “the IPO window is back open.”

And that means that it’s as good a time as any to remind everyone that the IPO market was never closed. It’s been wide open this whole time.

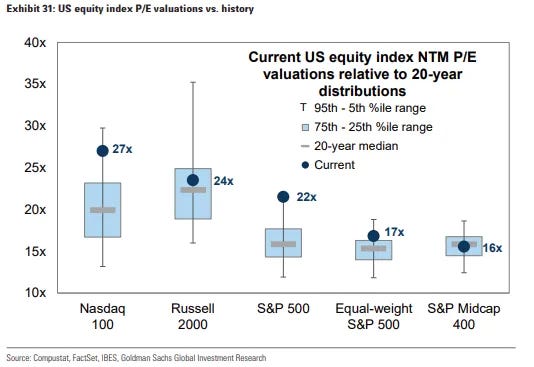

Indeed, public markets are still paying historically high prices for stocks:

Goldman Sachs

Earnings multiples for the largest indexes (even by equal weight) are in the 95th percentile or higher.

If you’ve got something to offer, the public markets would love to have you. Heck, even the private markets are back to paying historically high prices.

Yes, literally historically high prices in the private markets: