The trouble with ETFs and other missives

passive flows; tax migration; tariffs are working; offices offline; Deutschland Unter alles

Publishing note: Random Walk is going to experiment with a different publishing cadence over the next few weeks (more details forthcoming). I will endeavor to trade some frequency for depth, at least some of the time.

the trouble with ETFs

high tax states v. low tax states

tariffs are ‘working’

offices offline

Deutschland Unter alles

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. ETFs are swallowing price discovery, and other missives

Five unrelated vignettes on various things.

Index and chill

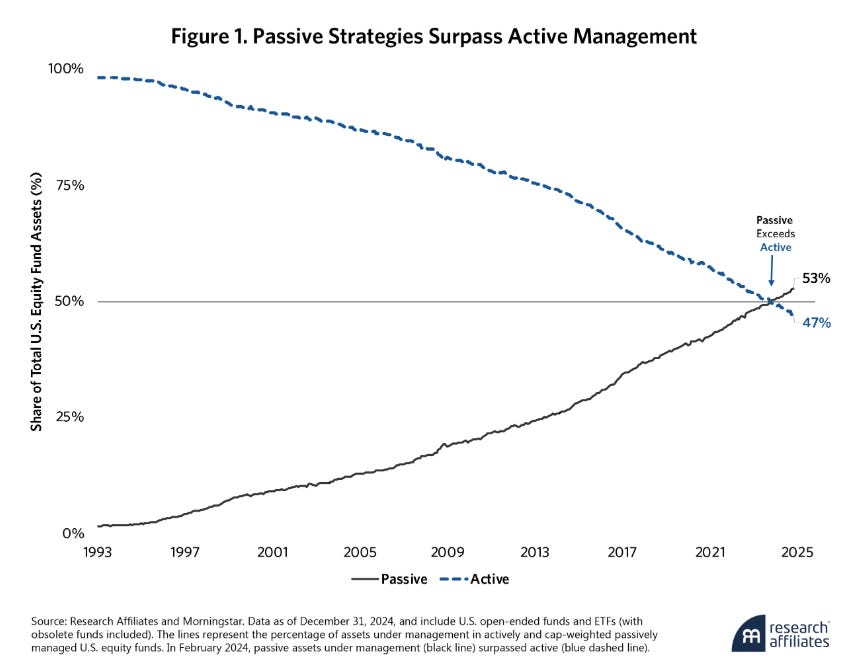

Passively managed AUM surpassed active management probably sometime in the last couple of years:

ETFs are estimated to own ~53% of US equity AUM.

Passive indexes are a helluva innovation, and they’ve eliminated much of the cost of just “putting money in the market” without doing much stock-picking. And let’s be honest, most people aren’t very good at stockpicking, including many people who do it professionally.

The logic of ETFs is, rather than try to pick winners, just pick a basket of names and be directionally right, with the benefits of diversification. It’s a great deal.

The problem with too much passive flow, of course, is that at a certain point, it’s unclear what the herd is indexing to—it may, in fact, just be chasing its own tail.

If Google trades better than the index, but the index trades on Google, then what does it all mean?

For indexing to work (according to its business logic), someone still needs to decide how much individual stocks are worth, based on that individual company’s performance.

That price-discoverer is not passive indexes, of course, because the whole point of passive is to track, but not lead—but if the majority of the market are just passive flows chasing prices driven by passive flows chasing prices driven by . . . well, you get the idea.

In RA’s words:

While passive products allow investors to get transparent diversified portfolios at low cost, the trend of increasing passive inflows has come with unintended consequences . . . passive flows perpetuate momentum driven mis-valuation because they are systemically coordinated and indifferent to fundamental information.

Investors' regular contributions to IRAs and defined-contribution retirement plans are mechanically allocated into passive products. These valuation-indifferent flows amplify any such mis-valuation.

Passive flows effectively crowd out sophisticated active investors trading on fundamental information

Passive investing makes share prices effectively correlated with themselves.

Or put another way:

Prices of stocks added to the S&P 500 increasingly move together . . . Such persistent structural effects stem from mechanical index-driven buying and selling.

This dynamic reflects coordinated price action rather than informed price discovery, thereby weakening diversification benefits within passive strategies.

So, again, rather than diversification, if there are no active managers doing real price discovery, then with ETFs you’re just getting a herd of wildebeests that certainly run together, but for what reason or what purpose or to what final ends, no one can be too sure.

It’s a momentum trade, all the way up.

High tax states v. low tax states

More migration data is incoming from Census, but these charts on tax migration were kind of fun.

High tax, poorly governed states have been losing their millionaires to lower tax states (for a while now, but even more so, recently):