To the big funds, go the spoils

Fundraising still favors the brandnames, but the animal spirits are on the march

mega vc hogging all the aum

it’s not just vc, tho

times to raise, are less timely

animal spirits to the rescue?

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. To the big funds, go the spoils

Fundraising is still tight, and it’s becoming a megafund game. But if the Animal Spirits are truly unleased, maybe relief is right around the corner?

Mega-VC hogging all the AUM

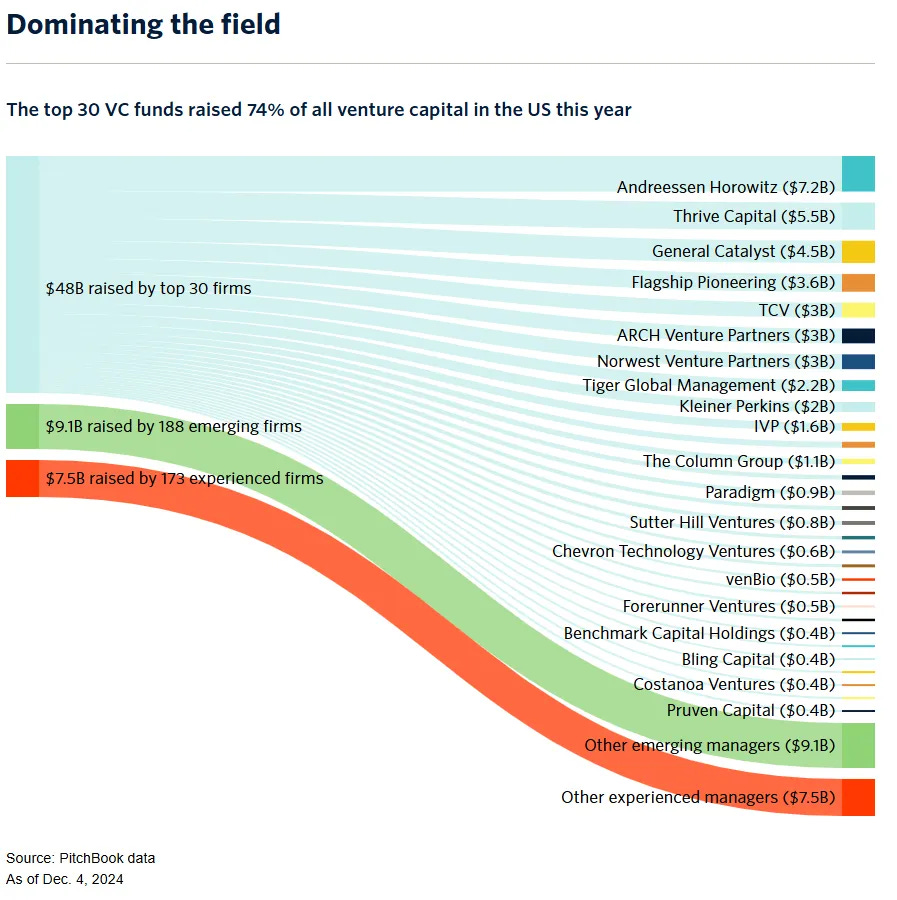

This chart has been making the rounds, but it’s a good chart.

Plus, it’s consistent with Random Walk’s directional view of ‘where things are going in private capital,’ and the universe demands that I highlight data that makes me right.

To the big funds go the spoils:

~75% of venture capital was raised by the “Top 30” funds.

This is the asset-class resizing.

The number of investable risks is, in fact, smaller that the recent growth of the industry was hoping.

No Exits for Private Capital means that (a) there isn’t as much LP liquidity to deploy; and (b) LPs are much less willing to deploy what they have to a notoriously illiquid asset class.

The LPs that can deploy are massive, with only so many funds big enough to absorb their commits (and only so many funds that can satisfy a bias towards known commodities, aka ‘flight to safety.’)

So, it continues to be tough out there for smaller and/or emerging managers.

The “good” news for EMs is that EMs grabbed a slightly larger share of the remaining 25% than “other” experienced managers.

Random Walk doesn’t really know how to interpret that with any confidence (nor does anyone else), but to satisfy my priors, it suggests that non-whale LPs still support venture, but they are putting a premium on differentiation (as they should).

On the other hand, for the generic VC playing what it had hoped to be an AUM game, it’s hard to compete with the mega-fund multistrats with all the rizz.

Not just VC, tho

A word of caution, however, about drawing any sweeping VC-specific conclusions: the fundraising drought is not unique to VC.