WFH is good, actually

6 great datas: feeling liquid, what AI bubble (and someone is definitely wrong)? Netflix is undefeated, Hardly working, Office rents have nowhere to go, Motor City, China. Finally, WFH is good.

Welcome to another Tuesday edition of Random Walk.

First, Scatterplots, or six great datas to win friends and influence:

Feeling liquid

What AI Bubble (and someone is definitely wrong)?

Netflix is undefeated (and coming for your children)

Hardly working, or why labor markets will lag, not lead

Office rents have nowhere to go, but down

Motor City, China (redux)

Second, a Great Wall of Text:

WFH is good, it’s not going anywhere, and that’s how it ought to be (and anyone who tells you otherwise is a bad person who should not be trusted).

Thanks for being here, tell a friend, follow me on twitter, and, as per always:

Scatterplots

Feeling liquid

Random Walk is worried about liquidity. The very short version for the uninitiated is that it’s the free money that brought us up, so it’s the (lack of) free money that will bring us down.

While Random Walk loves to be right, Random Walk also loves to be wrong, and on this question, at least some data suggests ‘y so glum, Random?’

Small businesses, for their part, seem to be getting loans without much of an issue:

If you want to be pessimistic, you’d notice that (a) factoring appears to be less popular than before (possibly a discount to future cash-flows); and (b) approval rates are down across the board, with the exception of alternative lenders (“shadow banks”) who are now stepping into the breach.

Otherwise, not bad. Not bad at all.

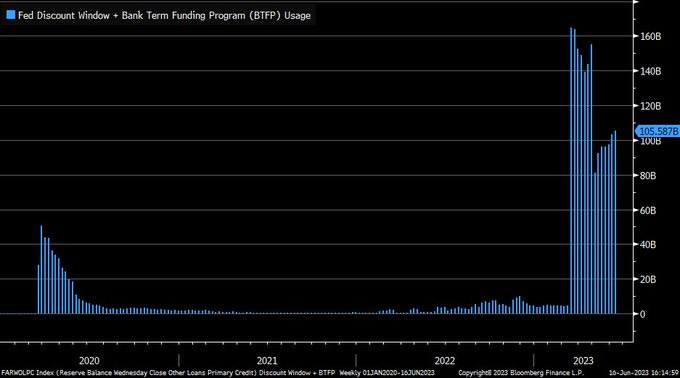

Make no mistake, the Fed is fighting a War on Deflation as a result of its War on Inflation, as both of its emergency liquidity facilities are seeing a bit more action lately:

But if they manage to pull this off without doing more than bankrupting a few office real estate investors? Then tip ‘o the cap to Mr. Powell.

What AI Bubble?

While there are plenty of anecdotes of overheated AI valuations, Tomas Tunguz says “actually not so much”:

It’s not entirely clear to me how Mr. Tunguz is selecting for AI v. not-AI, but taking his analysis at face-value, there has been very little premium to AI startups. It turns out that venture capitalists may be smarter than we given them credit for.

Meanwhile, in the public markets, either everything is the exact same risk or someone is definitely wrong:

Currently the U.S. Gov’t (generally considered the safest of the safe) is offering the same yield as the stock market (which is offering the same yield as corporate bonds). Three very different risks selling for the exact same price. Surely that can’t be right.

Netflix is undefeated

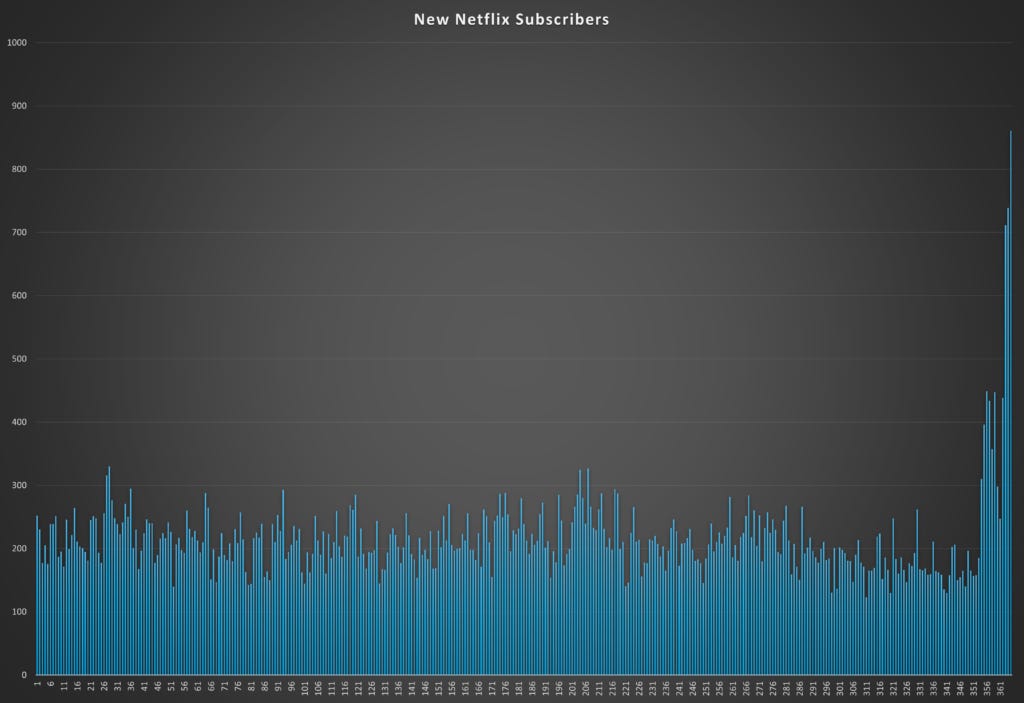

Netflix put the kibosh on password sharing and everyone said “screw this! I’m going outside to enjoy the fresh air . . . and then I’ll buy my own subscription to netflix as soon as I get home.”

From Consumer Edge, the effects of password non-sharing were pretty immediate:

Cable is dying, but RW supposes that cable’s bundled model will simply recreate itself over streaming. It’s a fun natural experiment in stubborn equilibria, but also a significant changing of the guard.

Also, Netflix is coming for your children:

Cocomelon cannot be entirely safe for a child’s brain. If you’ve ever tried to keep a small kid rooted to a single place, it’s pretty much impossible . . . until you turn on cocomelon. Those rosy-cheeked hellspawn are like digital quaaludes, and kiddos are powerless to resist their hypnotic charm. The samizdat starts ‘em early.

Hardly working

In yet another in a long line of mixed signals, it appears as though we’re working less (on an hourly basis) than we did before:

To RW, this underscores the false comfort of a “strong” labor market. The labor market is “strong” because we have a secular shortage of workers, and not because we’re busy as bees (a claim which is validated by the anecdotes in the article, for what it’s worth). Firms would rather “over hire” than run the risk of not being shorthanded (because hiring someone has been such a pain).

That’s not true of everyone of course. Nasty whispers of mass layoffs just seem more common these days, although that could be because gloom sells. Take Fuzzy, the pet insurance start up that raised $44M just 18 months ago. The founder just disappeared from linkedin and twitter, and the company just evaporated into the night, with unpaid bills and payroll, and apparently offer-letters outstanding. Goodbye, quiet-quitting, hello, quiet-firing.

Office rents have nowhere to go but down

Asking-rents for NYC office have been flat (to down) since 2015:

This is from the NYC Comptroller’s report on the tax implications of CRE’s decline. The comptroller says everything is awesome, in case you’re interested.

I’m not really sure what I was expecting, but not that.1 On the one hand, it’s

Keep reading with a 7-day free trial

Subscribe to Random Walk to keep reading this post and get 7 days of free access to the full post archives.