Random Walk at Night: Real Estate Dispatch

Checking in on homes, and things continue to be exactly as everyone refuses to see

Random Walk at Night takes a look at the real estate market and sees more of the same. Others are starting to see it too.

Everything reads better in your browser or in the app. The footnotes especially, and Random Walk is really leaning into the footnotes. Plus, if you have the app, you can set delivery to “app only” and then my daily barrage will feel less like a barrage. Unfortunately, substack does not yet have a “Weekly Digest” option, but I’m hectoring them aplenty.

If this email was forwarded to you, please click the shiny blue button:Random Walk at Night

Real Estate Dispatch

Random Walk’s view of the housing market has been simple and consistent: high and rising interest rates would drive high and rising mortgage rates, which would drive home prices down.

The reason is straightforward: with high rates, homebuyers cannot afford yesterday’s prices. So either people would have to get substantially richer, or prices would have to come down.1

The last part wouldn’t happen all at once or right away.

First volume would collapse because sellers would be reluctant to capitulate to the new normal (and the beauty of the 30 year mortgage means sellers don’t have to capitulate).

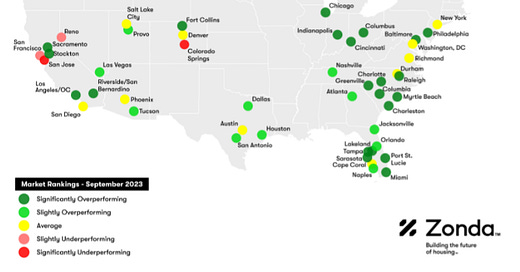

But, if you wanted to find price discovery, look to the homebuilders who would (a) be the only game in town; and (b) would disguise price declines with things like rate-buydowns.

Eventually though, prices would start to come down across the board, unless rates went down first.

In the meantime, most of the losses would be “unrealized” losses.

This is an oddly controversial theory, despite being simple and intuitive, and thus far, totally correct.

Well, the controversy isn’t odd, given how many people are invested in selling or owning ever more expensive houses.

Likewise, the illusion of high prices lends credence to the sHoRTaGe bros, and the Fair Weather YIMBYs who would love to wrangle zoning authority for themselves (on the pretense of “affordability”).2

And while the willful blindness persists, there are cracks starting to show.

For example, while the “affordability” narrative fades a bit, it’s been replaced by the Buy v. Rent calculus.

You see, ‘falling rents’ is a narrative violation for the perpetually bullish theory of shelter’s supply-and-demand, so we must stare and wonder “that it’s never been a better time to rent instead of buy.”

It costs a lot more to buy a house than rent because when you buy a house you get the pot of gold that’s buried in the yard, but when you rent it, you only get to live there.

Another theory, of course, is that the “equity” piece of shelter is wildly overpriced.

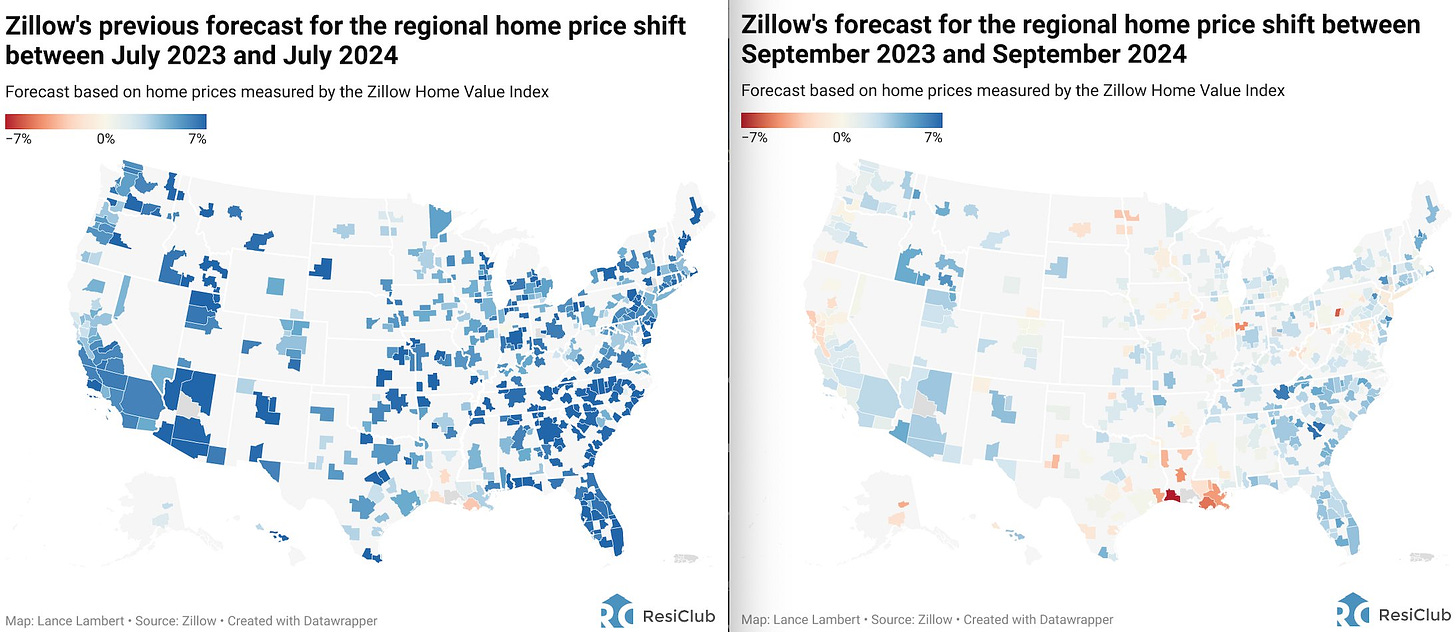

Zillow, famously bullish in its projections, has quietly made some downward revisions to its forecasts:

The map is getting a lot less blue.

Even Goldman is starting to get a little bearish, even if their optimism is still right around the corner:

Keep reading with a 7-day free trial

Subscribe to Random Walk to keep reading this post and get 7 days of free access to the full post archives.