Random Walk at Night: Real Estate Dispatch

A series of somewhat unrelated observations about real estate and migration

Random Walk at Night finds the opportunity to gather some unrelated thoughts and figures about real estate, migration and the like. If you nerd about about this kind of thing, feel strongly about “shortages” or the “next hot/weird thing,” you will enjoy it. If not, well, you’ll still enjoy it because Random Walk is great.

As a reminder, please do tell your friends how great Random Walk is, and of course, subscribe, if you haven’t already. Random Walk is like Audrey II. It must feed on new readers to live.

Editor’s Note: everything reads better in your browser or in the app. The footnotes especially, and Random Walk is really leaning into the footnotes. Plus, if you have the app, you can set delivery to “app only” and then my daily barrage will feel less like a barrage. Unfortunately, substack does not yet have a “Weekly Digest” option, but I’m hectoring them aplenty.

If this email was forwarded to you, please click the shiny blue button:Random Walk at Night

I’ve been collecting thises and that’s about real estate generally, and rather than wait for the perfect post(s) to weave them together and tie them off with a bow, Random Walk will deliver them to you seriatim (sort of).

Prices are not what they seem

The WSJ finally offered up some version of what Random Walk has been saying for a while: home values are not as undefeated as we’d like to think. Or at least, that may be what “Wall St.” thinks:

So institutional money is backing off home purchasing and investors are treating Single Family REITs as though the houses they own are worth ~20% less than what the asset values would suggest.

If you’re a permabull on single family homes because “shortage,” then go buy these REITs.1

Sellers capitulating?

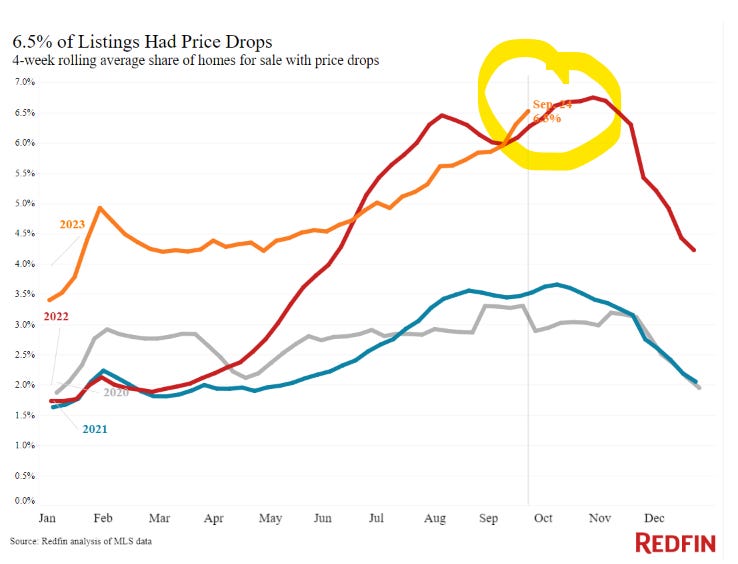

If you’re like Random Walk, and think the “supply shortage” has nothing to do with “lock-in” (or a shortage), and everything to do with sellers-not-wanting-to-capitulate-to-the-new-normal, then you would expect to see a steady creep of price reductions as sellers gradually capitulate to the cold hard reality of higher rates.

Is this what victory looks like?

Price drops are in fact creeping up (for now), during a period when they typically start to rollover and fall.

Does that settle the issue? No, of course not, but common sense is nonetheless on Random Walk’s side, even if narrative is not.

Rates are the thing that changed most dramatically. Not demand and not supply.

Remember, if you think this:

Had an effect on this:

And you should accept a relationship between the two, because of course a huge demand subsidy like free money to buy houses would drive up the price of houses . . . then the opposite of free money should have the opposite effect on prices.

How this is contrarian, idk, but apparently it is (although perhaps not for much longer). It cannot be that high rates make prices go up and low rates make prices go up.

Catastrophe? No. Mean reversion? I would think so.

Three places that surprise

Meanwhile, poking around Redfin’s data, I noticed two surprising markets amongst the list of “places people are moving to and/or from” and that added a third, when I got to further digging.

Where people move to and from is of perpetual interest to Random Walk, so these asides are perhaps more compelling to me than most, but if you like Real Estate generally, then you might find it interesting.