How's it going on the private side?

"in private markets, no one can hear you scream"

FT takes a rigorous, quantitative look at private marks

checking in on default rates

forecast says . . . it’s going to get worse (but barely)

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. First, sign up for your free trial of AlphaSense, because why wouldn’t you?

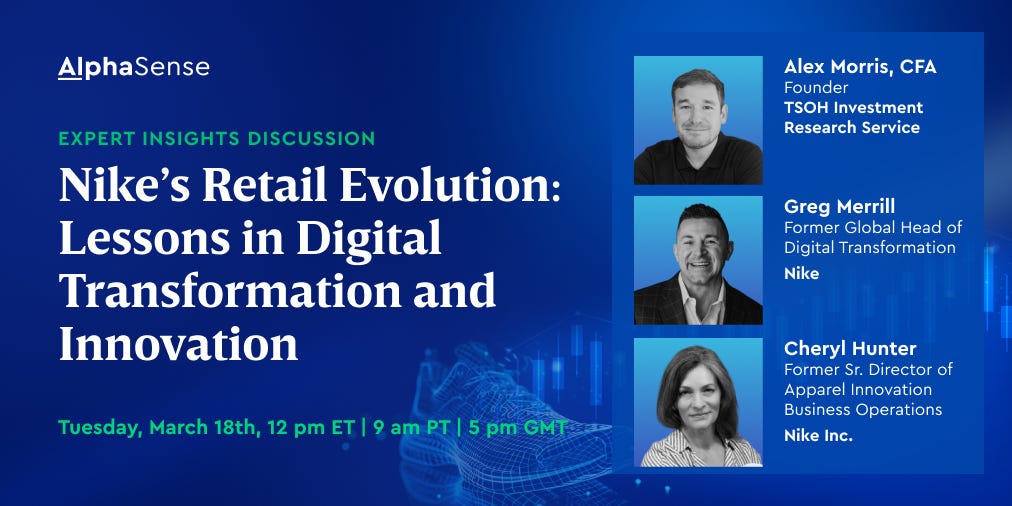

AlphaSense Expert Call with Nike

Another reminder to sign up for your free trial of AlphaSense, because there’s really no good reason not to.

Also, register for this discussion with Alex Morris, of the great The Science of Hitting newsletter:

FREE TRIAL! FREE TRIAL! FREE TRIAL!Give it a shot. It’s a great platform.

The marks are too damn high (reprised again and again)

While volatility roils the public markets, there is always that enduring question of what’s happening out-of-sight in the land of privates.

Random Walk has observed many times that private marks are a *bit* more resilient than is probably warranted (even if ‘low vol’ is one of the purported benefits of private investments).

To be fair, there is certainly some truth to the core proposition that being able to pick one’s spot (rather than respond to daily ups and downs) is an advantage that private managers enjoy. But it’s also a way of denying reality, and extending-and-pretending for a turn-around that may never come.1

Anyways, the folks at the FT were wondering what private managers were doing, given the drawdowns for the publicly traded asset-managers, and they took a stab at forecasting private market returns.

After some heavy computational work, the FT did their best:

While Apollo, KKR, Blackstone, etc. all have seen share prices fall substantially, private firms are just a flat line, with a little up and to the right.

No volatility here. Nice one FT—I laughed. Got ‘em good.

“In private markets, no one can hear you scream,” indeed.

We’ll see how it goes.

Default rates continue to . . . improve?

So far, there hasn’t been much evidence that private credit has gotten head-over-skis, but again, it’s hard to tell. And some of the chicanery (e.g. PIK lending) seems really ripe for catastrophe.

On the other hand, depending on how these loans are structured, it’s possible that defaults are manageable. These funds pride themselves on their ability to not only lend, but also run the companies they lend to (in the event of a foreclosure). That’s their “equity upside” right there.

So, how are the lenders doing?

In the latest count, it’s been relatively smooth sailing (just as before):