Prices say panic, but data says otherwise (even more cont.)

More comforting data from the slightly lagging frontlines

more evidence that consumers did not pullback even a little

consumer confidence is not a signal

the headwinds are there, but they’re the same as they ever were, and tariffs ain’t got nothing to do with it

a funny thing about uber drivers

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. First, sign up for your free trial of AlphaSense, because why wouldn’t you?

A plug for our sponsor, AlphaSense

AlphaSense is actually an amazing one-stop-shop for:

expert calls (especially since it acquired Tegus),

company-filings, and

analyst research;

plus, it’s got a pretty neat generative AI-search tool that I’ve been playing with a lot (which makes searching across the corpus of information much easier than before).

It’s a genuinely fun and very useful platform, and as part of the sponsorship, Random Walk readers have ACCESS TO A FREE TRIAL, which you’d be a fool not to try (just by clicking through the link below):

FREE TRIAL! FREE TRIAL! FREE TRIAL!Give it a shot. It’s a great platform.

Prices say panic, but data says otherwise (even more cont.)

Another installment in the ongoing series of ‘actually the world is not ending (any more than it was a year ago).’

And now:

Retail spending > retail confidence

Here’s yet even more evidence that anyone blaming The Great Uncertainty and/or tariffs for “consumer softness” is probably lying.

If you try to raise prices for an inferior service? Yeah, then it’s possible demand got a little soft. If you set some absurdly high growth targets that are 2x wage growth, that too is probably a good reason to lower expectations.

But actual, real-live consumer softening?

No dice.

Check out this data from CNBC/NRF retail monitor.

Can you spot the consumer softness? Yeah, me neither:

Total retail sales (net of gas and cars) grew 3.38% yoy in February. Exclude restaurants, and yearly growth rises to 4.11%.

4% growth is pretty darn good.

Now, if you got the impression that December (8.4%) was the new-normal, then I can see why you might be disappointed. I can also see why you might be an idiot, but we all have our moments.

Here’s another fun one.

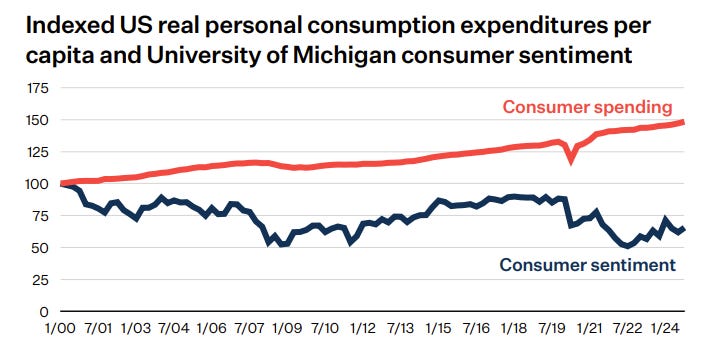

“Consumer confidence” is collapsing! Doom is nigh!

Actually, it turns out that consumer spending has basically no relationship to sentiment, at all.

It looks like the last time that a decline in consumer sentiment meaningfully preceded a decline in spending was 2007.

It seems fair to conclude that consumer sentiment is pure noise, at least with respect to spending.

Look, it’s possible that retailers are worried that spending might slowdown, but there’s no evidence that anyone has actually slowed down (outside of the higher-end discretionary categories that have been slowing for a while). And remember, that tariffs caused a slowdown was the claim to kick off the panic—a panic that seems deadset on making itself a self-fulfilling prophecy.

Is it possible that businesses (rather than consumers) have slowed their spending? Perhaps, but the evidence mostly indicates that businesses ramped-up spending (perhaps to front-run tariffs).

There are headwinds, but they’re not new (and they’ve got nothing to do with tariffs)

Look, if you want to be worried about something, it’s that growth is normalizing to something less-impressive than what people expected.

And with asset prices keyed to historically high multiples of earnings (which only makes sense if you expect earnings to continue to grow a lot), then more realistic expectations could reset those multiples lower (bringing asset prices down with them).

Here’s the thing though: that growth would slow given that people-growth would slow should have been an obvious possibility—so obvious that it’s hard to believe it’s been that overlooked.

Healthcare makes all the jobs and job growth is a foreign born story (still true)

That job growth has been a healthcare and foreign born story has also been obvious (notwithstanding the shrillest efforts of the ‘firing on all cylinders’ crowd).

Likewise, it remains a bit of a mystery of where else growth will come from, once the labor-supply catch up was all caught up.

The slow and narrow labor market is still very much a thing: