Prices say panic, but data says otherwise (cont.)

More data from the slightly lagging frontlines

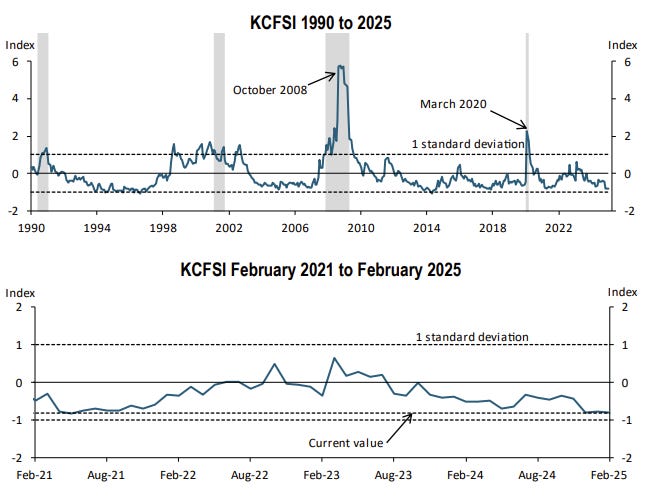

KC Fed weighs in “no stress”

more evidence of a two-off headfake, not a trend

lenders and payment cos, big and medium: “nothing to see here”

about those airlines

what do the big kid lenders say?

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. First, sign up for your free trial of AlphaSense, because why wouldn’t you?

A plug for our sponsor, AlphaSense

AlphaSense is actually an amazing one-stop-shop for:

expert calls (especially since it acquired Tegus),

company-filings, and

analyst research;

plus, it’s got a pretty neat generative AI-search tool that I’ve been playing with a lot (which makes searching across the corpus of information much easier than before).

It’s a genuinely fun and very useful platform, and as part of the sponsorship, Random Walk readers have ACCESS TO A FREE TRIAL, which you’d be a fool not to try (just by clicking through the link below):

FREE TRIAL! FREE TRIAL! FREE TRIAL!Give it a shot. It’s a great platform.

I was at a conference all day, so this will be brief (and include some notes from the conference.

Prices say panic, but data says otherwise (cont.)

Sell-off moderated a bit yesterday, and while the future is unknowable, Random Walk continues to observe that the present and past reflect little or no “stress” or “softness” or whatever.

KC Fed says “less stressful” in February

I’ll be honest, I don’t really know what or how this is calculated, but the timing was hilarious, so I’m rocking it.

Dated for immediate release, March 11, 2025: The KCFSI suggests financial stress decreased slightly in February:

KC Fed says that February was about as least stressful as its been since the fall of Communism.

But woe is unto the uncertain!

If calamity is inbound, financial conditions ain’t showing it. Maybe.

Don’t mistake a two-off for a trend

Here’s some more evidence that people have confused a weather-blip, and Washingtonians’ wildly inflated sense of importance, with an actual economic downturn:

spending declines in Texas, NY, and Illinois in the last two weeks of Feb have reversed completely

While the entire Acela corridor (and all cities in the aggregate) slowed in January, everyone recovered by February. Except for D.C. That got worse. Did you know that D.C. is the highest GDP/capita city in the US? It’s because of all the products they produce.

So, yet again, no meaningful evidence of additional consumer pullback because “tariffs.”

Lenders and payment providers: “everything is fine”

Random Walk was at the Wolfe Research Fintech Forum yesterday (and today), which includes lots of execs from well-known consumer fintech, payments, and banking companies.

Some of you may recognize these companies, for example Visa and Mastercard, but also Affirm, and Ramp.

Anyways, all of them were asked some version of “do you see any evidence of a slowdown?”

Here is what they said (and I’m quoting from bad notes and memory, so not verbatim):