AI revenue goes mobile (and why 'Will Data Centers Crash the Economy?' is the wrong question)

What do job openings, Data Centers, and app downloads have to do with each other? Everything

Will Data Centers Crash the Economy (prelude)? Hint: it’s not quite the right question to ask

Where would the fallout be? Well, AI is the Cycle Now (and the Labor Market is Tight, but not Strong, reprise ad infinitum (hopefully)

Evidence that AI is earning its keep (on mobile)

Consumer AI usage is changing, deepening, widening

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. 👋👋👋Random Walk has been piloting some other initiatives and now would like to hear from broader universe of you:

(1) 🛎️ Schedule a time to chat with me. I want to know what would be valuable to you.

(2) 💡 Find out more about Random Walk Idea Dinners. High-Signal Serendipity.AI revenue goes mobile

This post was intended as a lighthearted look at some nascent AI-related revenue, and wasn’t drafted as a response to

’s question: Will Data Centers Crash the Economy?But, since it touches on the subject, it makes sense to offer some introductory context.

A ‘Data Centers Crashing the Economy’ prelude

The question should really be broken into two parts:

(1) is AI Capex a good investment?; and

(2) how bad will the fallout be, if it’s not?

Random Walk has touched on these bits variously over the past couple of years, and this post will fall into the first bucket, but let’s briefly reprise a response to both questions.

AI Capex is a lot, but AI revenues are also a lot

The fact is that while while AI investment is absolutely massive right now, AI-related revenues are pretty massive, as well.

Random Walk will dig into some pockets of revenue below, but more broadly, the anecdata around AI startups achieving historically quick paths to $100M in revenues abound. Plus, all the hyperscalers report demand in excess of supply.

The point is that AI is no Cisco, at least in the sense of generating very meaningful revenues (and profits). AI investment is also not quite in-line with previous ‘bubble’ cycles, but it’s getting close.

Now, there’s an open question as to how enduring those revenues will be v. every company in the world feeling compelled to give AI a spin, but I’m not sure how one would answer that, at this point. It’s definitely something to watch for.

For now though, there’s plenty of reason to think that AI is earning its keep (and, again, I offer some more reasons below).

The most proximate pain of ‘AI Fallout’ would fall on the most profitable companies in history

On the second question (how big is the fallout, if not?), well there are reasons to think it won’t be that bad.

First and foremost, the molten core of this investment is coming straight from hyperscaler profits, as opposed to lots of leverage and/or bets on the farm.

In general, there just isn’t all that much private sector leverage, relative to crises past, and so cascading ‘Minsksy Cycles’ are less likely to be in the offing. Random Walk has feverishly looked for signs of chicanery in the ‘shadow’ parts of the economy, and repeatedly come up (mostly) empty.

Now, an AI slowdown would almost certainly do some serious damage to the stock market, but there’s no specific reason to see any broader contagion risk . . . absent, perhaps, all the leverage that’s currently tied up in the stock market. In other words, if AI blows-up, it may not bring down the banks (and all the life-savings and working capital contained therein), but it could blow up all the life-savings that retail investors are currently day-trading on Robinhood.

Again, hard to say, but ‘AI crashing the economy’ doesn’t really keep me up at night.

The biggest proximate “pain” from an AI collapse will be massive write-downs from some of the most profitable companies in history, whose profits do not, by and large, depend on AI.

Painful, but not the kind of paralysis and ‘lights-out’ firm-destroying permanent capital impairment that we saw in 2008.

AI fallout won’t crash the economy, but the economy might ‘crash’ for lack of better alternatives (or how are people just now noticing that healthcare makes all the jobs?)

Truthfully, the bigger “fallout” issue is that AI is really the only pro-cyclical thing we got going on right now.

It’s the Deus Ex Machina solution to secular stagnation. Without AI to invest in, and drive expectations of growth, well, we’d probably slide into recession, for lack of better alternatives. For the people currently employed by the dollars building data centers, where would they go, if those dollars went away?

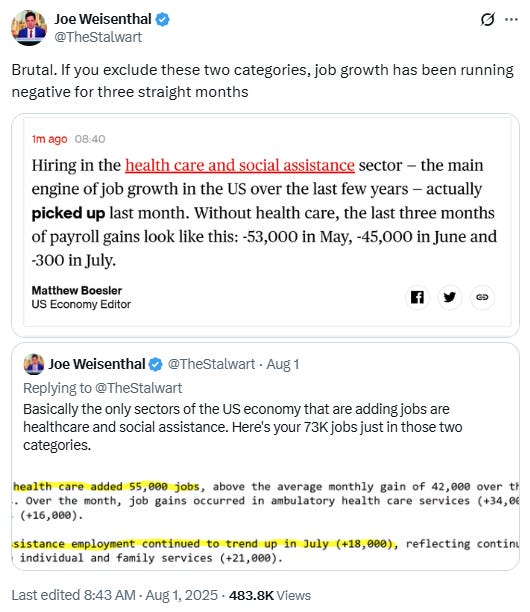

Indeed, if you caught Friday’s “scary jobs surprise,” and you’ve been reading Random Walk long enough, you’d know, of course, that while it might be scary, it’s not remotely surprising:

Healthcare makes all the jobs? You don’t say.

Ima just leave this here, for anyone that wants to brush up, but yes, we haven’t had a strong job market in a long time.

And once the ‘catch up’ finished in Spring 2024, the decline in net-new jobs has been obvious and worrying:

Three-month change in payrolls has been in steady decline for over two years.1

The point is that we’ve been creaking to a slowdown for a while now (and tariffs ain’t got nothing to do with it). People should be concerned about the lack of breadth in the labor market (and well-before Friday).

AI, by contrast, was a reason not to be concerned, because it was something (indeed, the only thing) other than unsustainable healthcare-driven growth to drive us forward.

Take data centers away, and there isn’t all that much exciting—Doing More With Less is the name of the game, and AI is the biggest player in that game, by far.

And now, on to the originally drafted show . . .

AI revenues go mobile

Is AI earning its keep?

Here’s some evidence that it might be.

AI is the Capex Cycle Now

NB: excuse some repetition here, but I’m going to stick with the original intro, as drafted.

With Google, Microsoft MSFT 0.00%↑, and Amazon AMZN 0.00%↑ in the bag, there is little doubt that the AI train is very much full-steam-ahead.

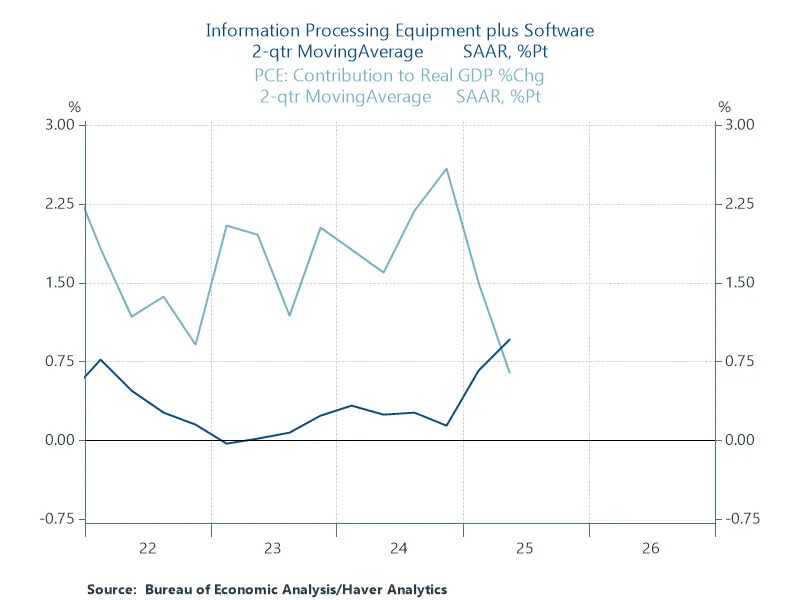

There’s an argument that AI-related CapEx is now more important to growth than even the Almighty Consumer:

Information processing + software is driving ~0.8% of GDP growth, which is slightly more than PCE.

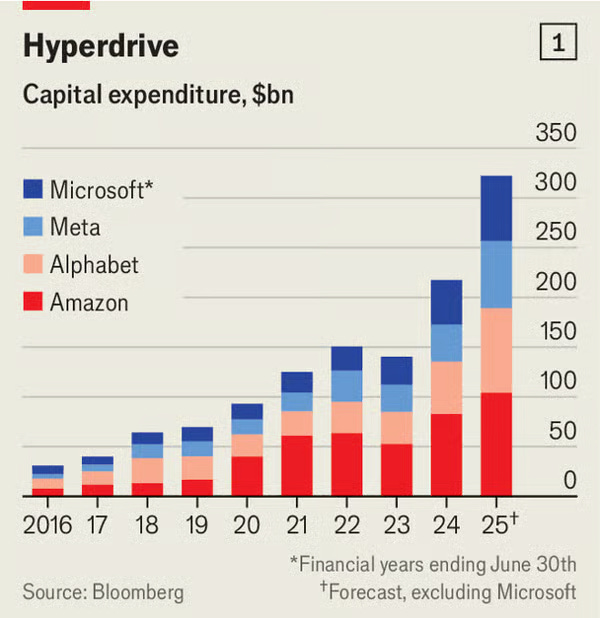

The Hyperscalers are spending a lot a lot of money on building out their AI-related infrastructure.

I mean, just look at this:

Capex expectations from the world’s biggest companies are only getting bigger.

Hyperscalers are showing no signs of slowing their roll when it comes to AI.2

And given accelerating revenues in their cloud offerings, can you really blame them? If AI is the entire economy, then the entire economy is either living in the cloud, or will be soon.

On the one hand, that should increase confidence in the strength of the AI tailwind. On the other hand, it should erase any doubt about the centrality of AI Capex to the cycle.

AI is the sun, the moon, the everything, right now.

Better hope it works.

AI Mobile Revenue is Cooking (and usage is ‘generalizing’)

Well, idk if this counts as “working,” but there’s some data that suggests that AI is rapidly monetizing via mobile.

Keep reading with a 7-day free trial

Subscribe to Random Walk to keep reading this post and get 7 days of free access to the full post archives.