10+ Charts on Various AI Themes

Capex; gpt5 bullish disaster; death of middle market tech services; consumer AI revenues; and AI the job maker

Just some short riffs on various AI themes

when capex becomes debt-financed;

gpt5 is bad and that’s good;

ai is eating pe-backed lunch?;

more revenues for consumer AI;

AI the job maker

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. 👋👋👋Random Walk has been piloting some other initiatives and now would like to hear from broader universe of you:

(1) 🛎️ Schedule a time to chat with me. I want to know what would be valuable to you.

(2) 💡 Find out more about Random Walk Idea Dinners. High-Signal Serendipity.10+ Charts on Various AI Themes

I didn’t finish a different post that I was working on, but I did this one instead.

It is good.

ICYMI

Data-driven real estate, with Lance Lambert of ResiClub Analytics

Lance Lambert founded ResiClub Analytics to be the go-to place for data-driven insights on the for-sale real estate market.

AI Capex, of cashflows and/or debt

On the question of AI Capex crashing the economy or not, Random Walk made the point that one of the major mitigants is that the molten core of that investment is coming straight from hyperscaler profits.

As in, pretty much all the profits:

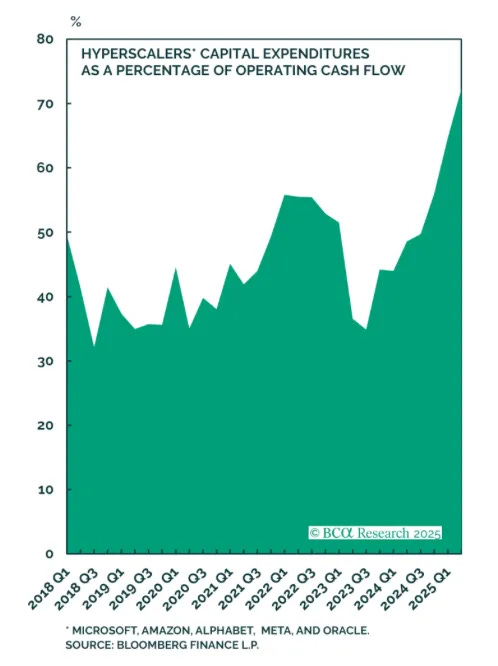

Hyperscaler Capex has passed 70% of Hyperscaler operating cashflow.

So, it’s still true that capex is being funded primarily by profits. But it’s also true that that cannot go on forever.

Debt will have to enter the picture, and indeed, it already has:

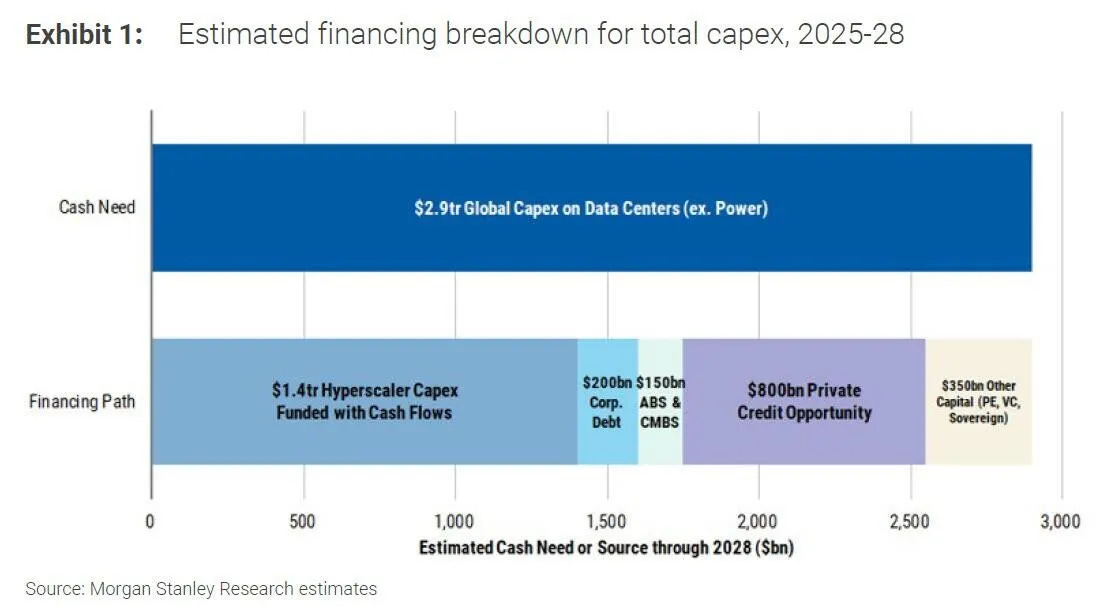

Morgan Stanley estimates that ~$1.6 Trillion of projected AI capex over the next three years—a little more than half—will be financed with debt (from various sources).

First of all, $2.9T is such a big number. I mean, it’s 10% of GDP. And that $2.9T doesn’t even include the power/grid investments that are necessary to make this happen (as expectations for power demand is that it’s gonna double over that same period).

Second of all, yes, $1.6T is a lot of borrowing. Presumably, it’s well-capitalized borrowing, but yeah, draw your own conclusions.

AI earning its keep

On the subject of “is it worth it?” much has been recently around the negative unit economics for some of the rockstar AI code-gen companies.

The short of it is that codegen companies like Replit and Cursor—some of the fastest growing companies in history—have been giving away compute for less than it costs.

“Oh no,” you think, “that’s a bubble, right?”

Well, obviously that’s not sustainable in the long run, but (a) there’s a long history of venture capital subsidizing the early-innings user-growth until scale and operating efficiency make it all work (e.g. Uber); and (b) that likely means that AI could be generating a lot more revenue than it already is.

My impression is that anyone who is using AI codegen isn’t going back. If costs were to double to tomorrow, customers would still keep using it.

Let me give you another example that’s closer to home.

The new ChatGPT5 is awful.

“wait, that’s bad too,” you think.

Not so.

Allow myself to quote myself, quoting Joe Weisenthal:

o3 is pretty great. ChatGPT5 is the opposite of that.

I want my o3 back.

But, if GPT5 is bad, why is that a reason for optimism?

Because the whole point of GPT5 appears to be an antidote to the negative unit economics of o3. My measly $20/month GPT Plus subscription likely doesn’t cover OpenAI’s costs of letting me use o3, so Altman has deliberately given me this dumber, useless model instead . . .

And you know what? I may have no choice but to splurge for the $200/month subscription to get o3 back. I haven’t done it yet, but I’m thinking about it, and I can’t imagine I’m the only one.

That’s good for OpenAI.

It may not be good for a lot of the nascent AI companies ‘disrupting’ legacy saas by selling below-cost AI products, but it’s good for OpenAI and the rest of the AI big dawgs.

End of a middle market tech services era

As a related aside, one question that I get a lot is ‘what’s going to happen to all those legacy saas cos’?

As I’ve written before, I’m inclined to think that at least some of the BigCos will capitalize on their distribution and data advantages (not to mention balance sheets) to get even better. Consider that a strong opinion weakly held, but stronger-held in the near term.

That said, I’m far more bearish on another species of legacy techco: