3 vignettes on asset values

Too high? Too low? Just right? What do Real Estate, VC and PE have to say for themselves?

We’re back. One victory lap, one ‘more of the gloomy same,’ and one green shoot of Spring.

home values are not so high (says the smart money, and not just Random Walk)

VC asset values are not so high (or at least, someone is very wrong about marks)

PE asset values . . . getting to just right?

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. 3 Vignettes on Asset Values

Three mini-essays (and five charts) on asset values, and whether they are what they seem.

Home values are not so high

Longer-term Random Walk readers know the deal on home values.

there is no housing shortage; and

home values are not going up (despite what indexes appear to show)

Without rehashing it all here, the tl;dr is that interest rates are the straw that stirs the housing drink.

When rates are low, values go up.

When rates go high, values go down.

It’s that simple.

Of course, that owners have the 30-year luxury of holding (rather than selling) means that fewer transactions clear at prevailing market prices, and therefore losses stay “unrealized.” That creates an illusion (for some) of an “affordability crisis,” when, in fact, we have a “bid-ask crisis,” if any crisis, at all.1

This should be obvious, but people get very emotional when it comes to housing, so it stays edgy and contrarian.

Anyways, the good news is that it’s perhaps not so edgy or contrarian, at least when money is where the mouths are.

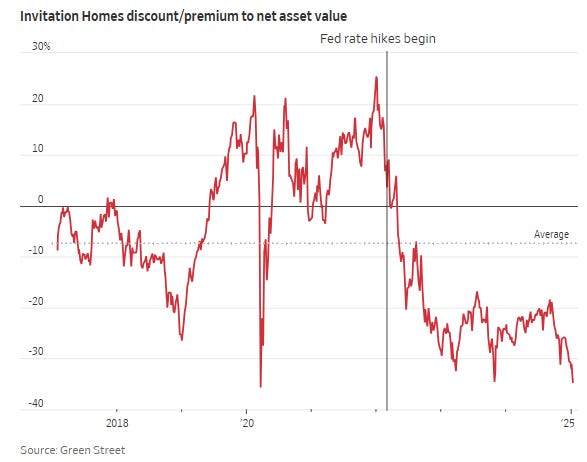

For the publicly-traded single-family landlords, Invitation Homes INVH 0.00%↑ and American Homes 4 Rent AMH 0.00%↑, investors aren’t buying the “all time high in home values” canard.

Investors are instead discounting the value of their single-family inventory by 20-35% (at least according to Green Street).

In other words, if you took all the single-family homes that Invitation and AMH owned, and then multiplied them by their respective index-values, you could come up with a number for what those homes are worth in-total—let’s call it “net asset value.” That NAV should be reflected in the value of those companies.

And so it is, but in this case, investors are saying, “yeah, but we think the actual value is a lot less than that.”

For Invitation Homes, the discount is especially stark:

Invitation Homes discount to NAV is ~35%.

As per the WSJ:

Put another way, while the average house in the metro areas where Invitation Homes owns its properties sells for $415,000 . . . the company’s share price implies that investors think $310,000 is more appropriate . . .

“Share prices are signaling that single-family-home prices are too high and are not sustainable,” says John Pawlowski, a managing director at Green Street. However, he points out that home values can remain disconnected in public and private markets for longer than for commercial real estate because prices are set by owner-occupiers rather than investors.

It’s not that home prices are too-high, so much as “the average” price derived from historically low volume of sales is not actually the average price, but that’s just a quibble.

The point is that smart money is telling you where home values have been going, and the answer is not “up.”2

Indeed, the WSJ points out what Random Walk pointed out many moons ago: smart money is out-the-game:

Owners of 1,000+ properties haven’t bought a meaningful share of homes in over two years, or since rates went up.3

So, the big investors in single family homes don’t even register as buyers anymore, but sure, home values are higher than ever.

Smart money knows what’s up.

VC asset values (still) too high

Random Walk (and by now, everyone) has written at-length about the correction underway in private capital, and VC specifically—it’s yet another thing, that I will not rehash in full.

Suffice it say that while I’m always on the lookout for green shoots, or something new and different to say, the story largely remains the same: it’s tough sledding out there.

Too many companies were funded with too much money, and now that higher rates have repriced those assets substantially lower (because, as per above, that’s how it works), they cannot be sold (or raise more money) at prices that will generate returns for investors.4

And so, VC have struggled to generate returns, and therefore have struggled to raise new funds, and therefore have struggled to write checks to startups. A “right-sizing” correction is well-underway, which is painful, but also presents opportunities of its own.

Anyways, while, I might have a few more things to say as full-year 2024 data trickles in, I found this chart (while not new n’ different) to be both striking and illustrative of the overall setup (which is still pretty gloomy, in the main):