5 Charts on BRICS (just because)

Manufacturing, goldbuggery, and a glimpse into the future. Plus, a watchlist update.

China routs German manufacturers

a look into the future

of goldbuggery (online)

Watchlist/Portfolio Update

three outperformers on the electrification of everything

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. 👋👋👋Random Walk has been piloting some other initiatives and now would like to hear from broader universe of you:

(1) 🛎️ Schedule a time to chat with me. I want to know what would be valuable to you.

(2) 💡 Find out more about Random Walk Idea Dinners. High-Signal Serendipity.5 Charts on BRICS (just because)

This started out as a grab bag of charts, but then some of those charts turned into full posts that will have to wait for next week,1 and so what’s left are (1) some fun chart asides that all happen to have something to do with BRICS; and (2) a little watchlist/portfolio update.

The reality is that I have more things to write about than time to write, which is why (a) I’m in the market for reinforcements, so if you know of anyone, send them my way; and (b) I’m encouraging you, the reader, to reach out and tell me what you’d like to see.

To re-emphasize this:

👋👋👋Random Walk has been piloting some other initiatives and now would like to hear from broader universe of you:

(1) 🛎️ Schedule a time to chat with me. I want to know what would be valuable to you.

(2) 💡 Find out more about Random Walk Idea Dinners. High-Signal Serendipity. Next one in September.

Now on to the BRICS show

China routs German manufacturers

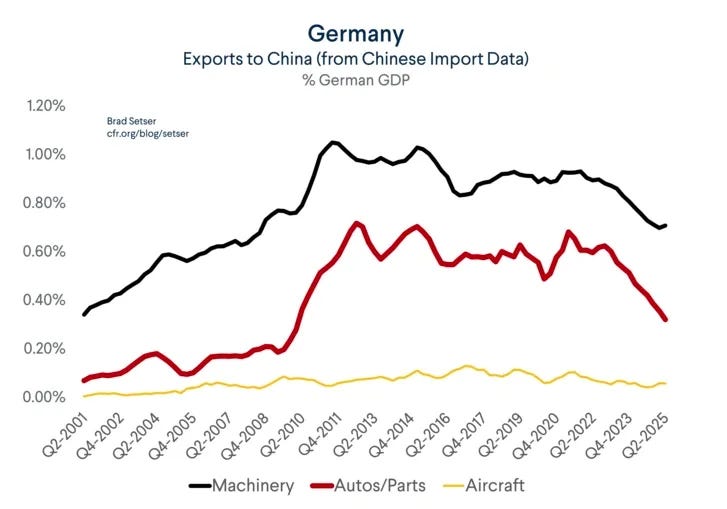

In the aftermath of the GFC, German auto exports to China tripled as a share of Germany’s GDP.

That export surplus held steady for ~13 years.

It took all of ~3 years for China to erase those gains, almost entirely:

German auto exports to China went from ~0.6% of GDP back to ~0.25% in ~2.5 years.

When China sets its mind to dominating a manufacturing vertical, it executes on that vision, rather quickly.

For China, selling more stuff to the world is a strategic necessity, given the steady decline of its own population. If domestic end-markets aren’t growing, then China has to find its end-customers elsewhere, which in this case, means everywhere.

For Germany, it’s good night, and good luck.

A glimpse into the Indian future

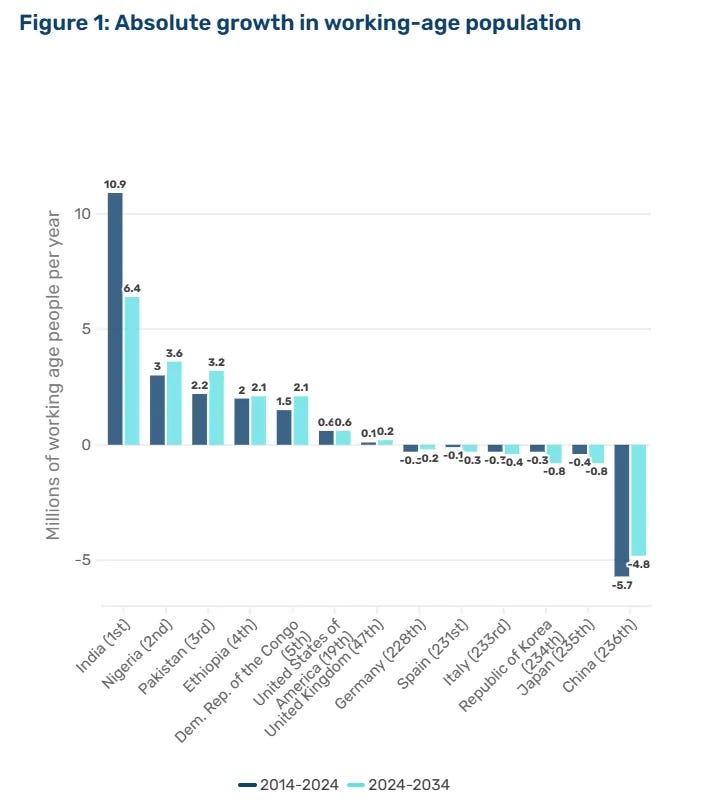

On a related front, if you want to peer into the ‘brute-force’ future of growth, look no further:

India paces the leaderboard in working-age growth, while China (and other parts of East Asia), plus Western Europe lead the decline.

Adding people is the most sure-fire way to drive raw growth (although not necessarily on a per/capita basis).

India is on the right side of the demographic curve, while the OECD is very much on the wrong side. China is especially on the wrong side, which in Random Walk’s view, explains a lot of its economic and industrial policy. Hoard stuff (metals, energy, food), build lots of robots, and sell as much to the rest of the world as possible.

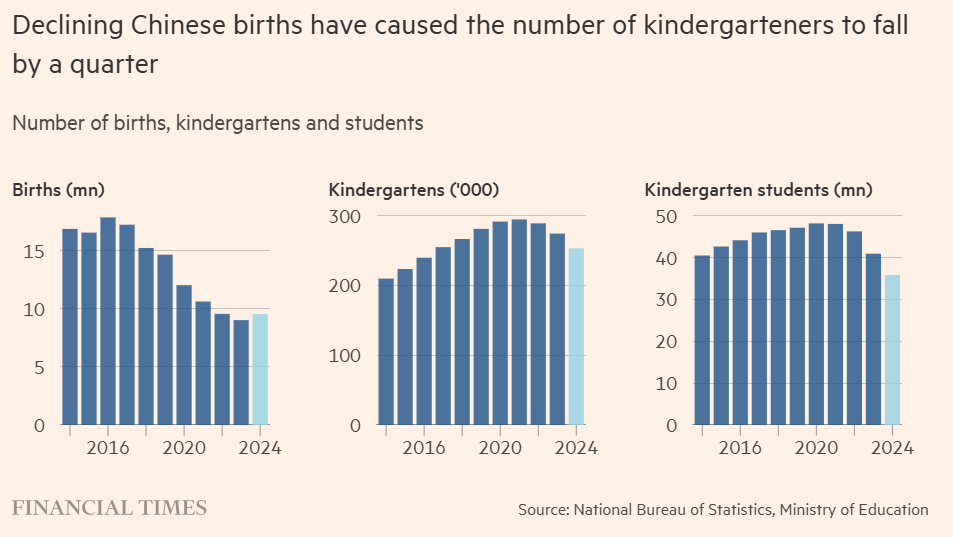

Now in China, but in the US too, eventually:

China’s kindergartens are shrinking

China is approaching its demographic winter differently.

BRICSian Gold bugs

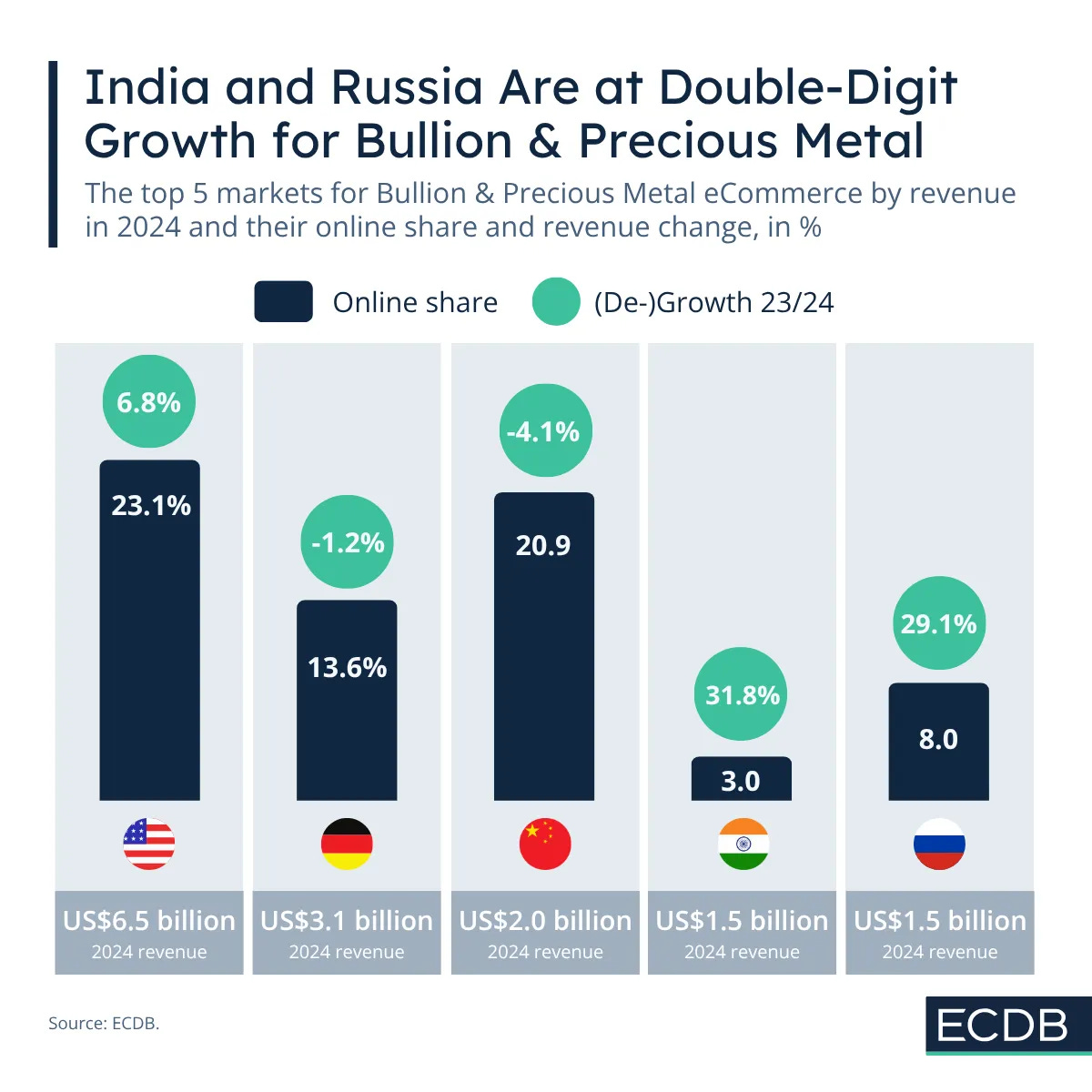

While we’re on the subject of BRICS, these are some impressive visuals on their fascination with gold.

China, Russia and India really like to buy gold and precious metals online:

Russia and India have been growing their online share of gold-buggery at a very healthy ~30% clip.

I don’t know why I find that amusing, but I do.

The US and Germany are actually the biggest markets, and China buys a lot too, but India and Russia are really getting in on the mix.

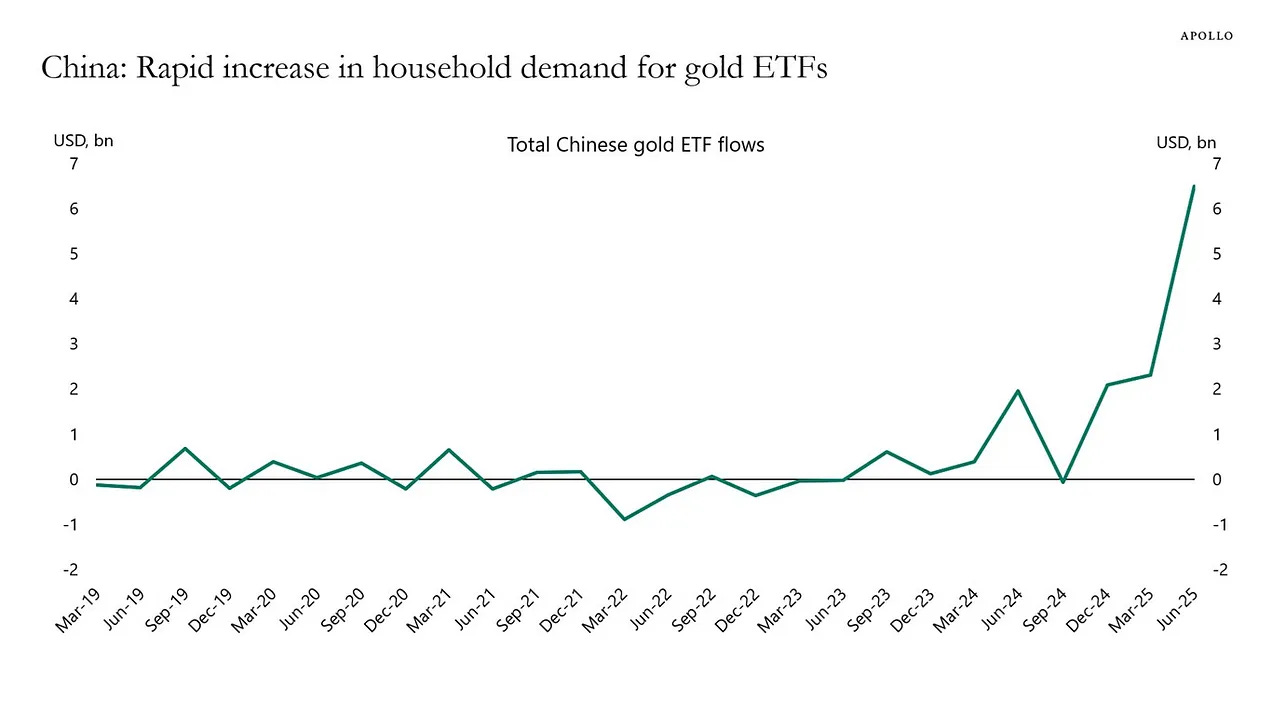

China also apparently really like Gold ETFs:

Net flows into Gold ETFs from China went from $0 to $7B in a quarter.

Seems like Chinese households had a sense things might get choppy on the reserve currency front!

Anyways, the dollar is still very much the world’s currency, but gold is making a big run.

Quick watchlist update

But before I get to those, just quickly a watchlist/portfolio update: