7 Charts on Real Estate Loan Performance

Daily Data: Some good, some not so good, but mostly as expected

Some of the stress that was foreseen has come to be, and for the most part, it’s fine.

Everything reads better in your browser or in the app. The footnotes especially, and Random Walk is really leaning into the footnotes. Plus, if you have the app, you can set delivery to “app only” and then my daily barrage will feel less like a barrage. Alternatively, sign up for Weekly Recap only.

If this email was forwarded to you, please click the shiny blue button:Daily Data

Seven Charts on Real Estate Loans

Not one, but now two, banks have issued an “oopsie, these real estate loans were worse than we thought.”

As the WSJ put it, “pain in commercial property hits banks on three continents.”

Anyways, Random Walk is unconvinced that this is a 5 alarm fire, just yet.

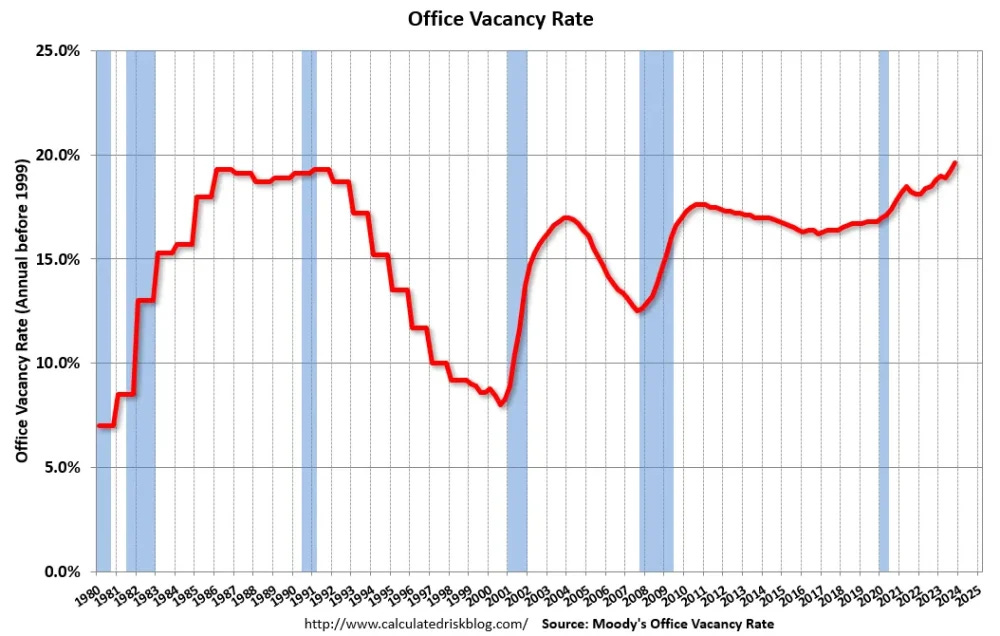

It’s true that office vacancy rates are at record highs:

Vacancy rates also increasing outside of a recession for the first time since the 80’s (which technically was the S&L crisis, so quasi-recession).1

But again, this isn’t new information. We always knew that losses were coming, and while those are painful (and perhaps somewhat larger than expected), forewarned, is in a very real sense, forearmed.

But, since it’s in the news, here are some charts on real estate debt.

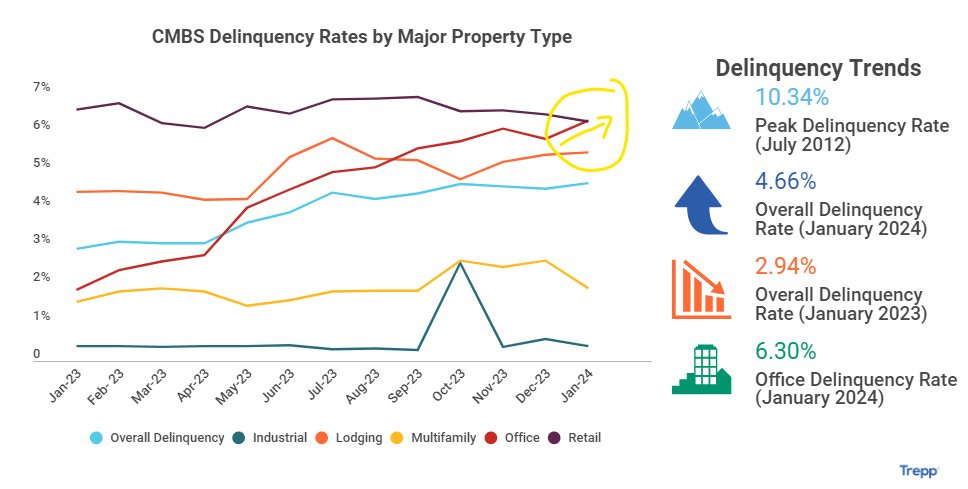

CMBS delinquencies are back!

After a tiny year-end decrease in delinquency rates, CMBS are heading back the other direction, especially for Office loans (via Trepp):

Every other segment, however, is as bad or better than before. It’s only office that’s gotten worse.

That’s good.

The little respite was fun while it lasted, but it was likely a function of year-end workouts with lenders closing their books, than some actual change in performance.

Now that the year has started afresh, there’s no need to write anything off just yet.

Show me the tightening!

As an aside, here’s a chart of annual CRE lending crunch growth:

Monetary policy was sooooo tight that lending reverted to <squints> 2017-19 levels.

Lol.

There was no tightening. Not after the BTFP, at least.

Point is, there is still money for these assets.

Will there be losses? Oh yah. Armageddon? Not likely, but there can’t be too many more “oopsies.”

Credit markets hate oopsies.

Single family owners are A-OK

Single family owners are totally fine (for the most part).