A capital-lite economy

Random Walk at Night: An unexpected reason why high rates haven't mattered that much shouldn't have been unexpected at all

Random Walk has capital markets on the mind this week (and maybe all weeks).

As evidence of financial conditions ‘getting loose’ accumulates, some more thoughts on why things were never tight to begin with (and yet another reminder of why investors love technology companies so much).

It’s not that long, I promise.

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. A capital-lite economy

One of the underappreciated elements of the Tightening-That-Wasn’t is how “capital independent” or “capital-lite” our economy is, relative to the last time high interest rates were used to “tame” inflation.1

Why didn’t high rates cause a recession? Because we don’t need your stinkin’ rates.

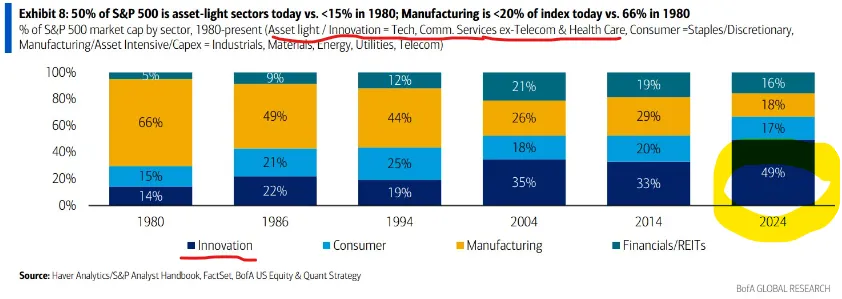

In the 1980s, 66% S&P 500 was comprised of Manufacturing companies, but that share is now ~18% (Mike Zaccardi, via Daily Chartbook).

By contrast, the “capital lite” part of the index, i.e. tech and service companies, went from a mere 14% to almost half of the index.

In other words, perhaps one of the reasons higher interest rates didn’t break the economy (or do much at all) is because the economy is just substantially less capital-intensive, and therefore less rate-sensitive, than before.

It’s an unintended, or unexpected, consequence of a “knowledge economy” that puts tech front and center, as opposed to the “build stuff” economy of yore.2

Tech is just showing off

There’s a two-fold irony, insofar as: