A chart dive on the PE-Direct Lending Scene

30+ charts on all things finance bro

fundraising still tough

‘mega-exits’ solid, but even with a bang up year in M&A, the vine continues to ripen

the premium to huge, while the middle goes missing

LPs flexing

GPs doing it for themselves

Private Credit is getting a little stressful (especially for tech loans)

How is performance, really? It depends on where you look

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. 👋👋👋Random Walk has been piloting some other initiatives and now would like to hear from broader universe of you:

(1) 🛎️ Schedule a time to chat with me. I want to know what would be valuable to you.

(2) 💡 Find out more about Random Walk Idea Dinners. High-Signal Serendipity.A Chart Dive on the PE/PC Scene

It’s been a while since Random Walk wrote about the Private Equity/Credit scene, mostly because the story has remained as-expected.

On the equity side, for funds and vintages of the prior regime, sledding remains mostly tough. Fresh capital has concentrated with the biggest shops, who dominate the action. Unsold inventory continues to pile up (although exits have improved) because the bid-ask remains too wide, and ‘value creation’ is harder than it sounds. It’s not that investments are doing poorly, per se, it’s that they’re not doing well-enough, relative to prices paid.

On the credit side, the biggest headwind is that yield un-inversion means that banks are bank in business again. Yes, there’s been some rumblings of poor loan performance, especially in tech, but it sounds more in periodic scaremongering than real fundamental challenges. I mean, there are some fundamental challenges in some pockets of the market, for sure, but the bigger picture seems pretty well under control.

Here’s 30+ charts to soak it all in.

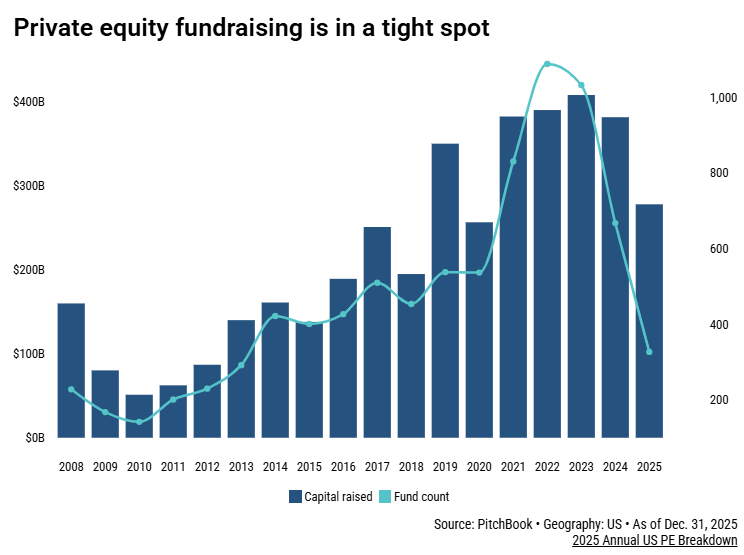

Harder to raise fresh $ for PE

First, for the thing that PE cares about most: fundraising. It still ain’t easy.

Fresh capital is relatively scarce, and has concentrated in the biggest firms and the biggest deals.

PE fundraising has retreated to 2020 levels, but fund count is lower than it’s been in ~10 years.

More capital for fewer firms, tells you what you need to know about who is able to raise money. On the outside, PE guys may keep a straight face, but on the inside, they’re crying a bit. This is not the industry they signed up for in 2021 when everyone could roll-up some carwashes and call it a day.

And yes, it’s about liquidity. Until PE returns money to investors, it will be harder to raise fresh money from investors.

Exits a bit better, but mostly a lot bigger

On the exit front, it’s not all good, but there’s been a lot more activity, of late, so it’s getting better, for sure.

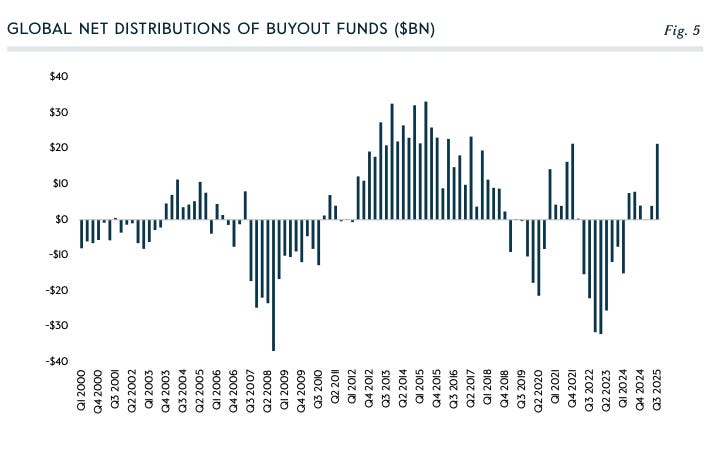

Global net distributions for Buyout specifically recaptured ‘21 highs:

~$20B in net distributions is a welcome change from the post-ZIRP dry spell.

It will, of course, take more than one good year to make up for all the ZIRP deployment (and post-ZIRP malaise), but it’s a step in the right direction.

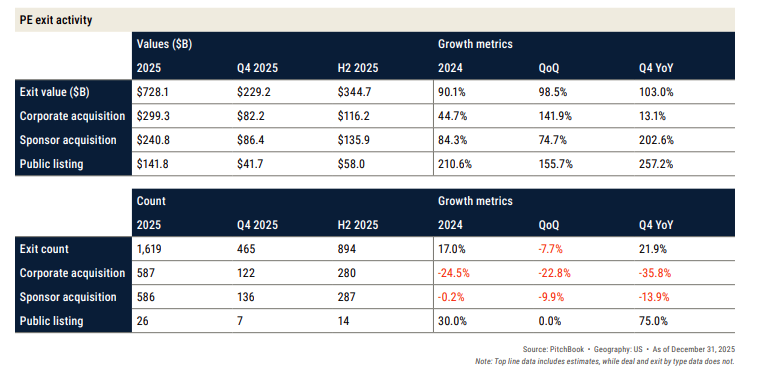

Across the broader universe of PE, exit activity was generally much better than last year:

Exit value nearly doubled, as compared with last year.

More exits are good, but beneath the surface, the return-to-exits hasn’t been evenly distributed.

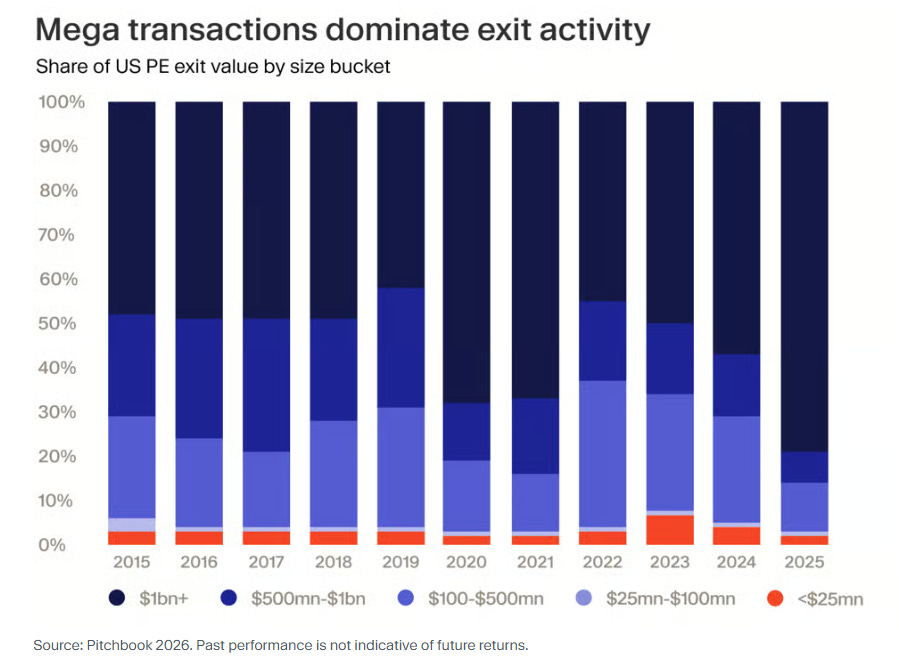

Activity has concentrated on the large size:

Exit activity . . . [secured] not only a second consecutive year of growth but also a rebound that ranks second only to the record levels seen in 2021 . . . In 2025 [] the US PE industry achieved double-digit YoY growth in exit count for the first time in the past four years. This rise in the number of exits is an encouraging sign of more assets moving through the system.

Still, mega-sized exits played a critical role in increasing the year’s exit value, accounting for more than double what mega-exits contributed in 2024 . . . it remains to be seen how quickly the rest of the PE inventory will be able to exit.

So, a pretty good exit year at the very mega end.

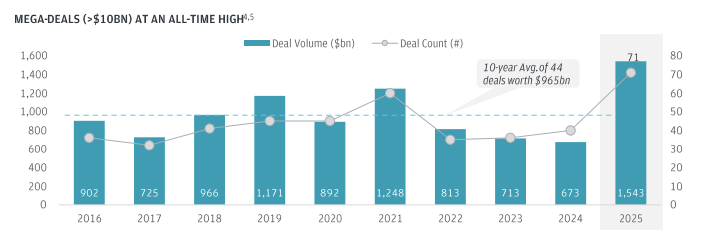

In general, “mega-sized” is generally a theme in deal-making:

For global M&A, “mega-deals” reached an all-time-high in 2025.

As a share of all exits, $1B+ deals captured an historically large share of overall exit value:

While mega-deal have exploded, it’s the $25M-$500M range that’s all but vaporized.

Big is the word.1

Capital has concentrated among the biggest players, so it’s the largest players who are active, and they will put a premium on the ability to put big money to work. It’s just as much effort to underwrite a $20M business as it is a $200M business, and it makes sense from the fund’s perspective to train its fire.

Premium for big is bigger than ever: