AI lending spree (10+ charts)

Debt has entered the picture and taken over the stage, and that's better than people think

AI lending hits the big time

lending to derisk?

equity is priced to earnings growth (put it on repeat)—mind the mean reversion

CDS let your pricing light shine down

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. 👋👋👋Random Walk has been piloting some other initiatives and now would like to hear from broader universe of you:

(1) 🛎️ Schedule a time to chat with me. I want to know what would be valuable to you.

(2) 💡 Find out more about Random Walk Idea Dinners. High-Signal Serendipity.AI lending spree (10+ charts)

That the AI Capex would shift from “paid for with big tech profits” to “financed with debt” is something we’ve all seen coming.

AI Lending has entered the big time

Well, it’s no longer on it’s way. It’s most definitely here:

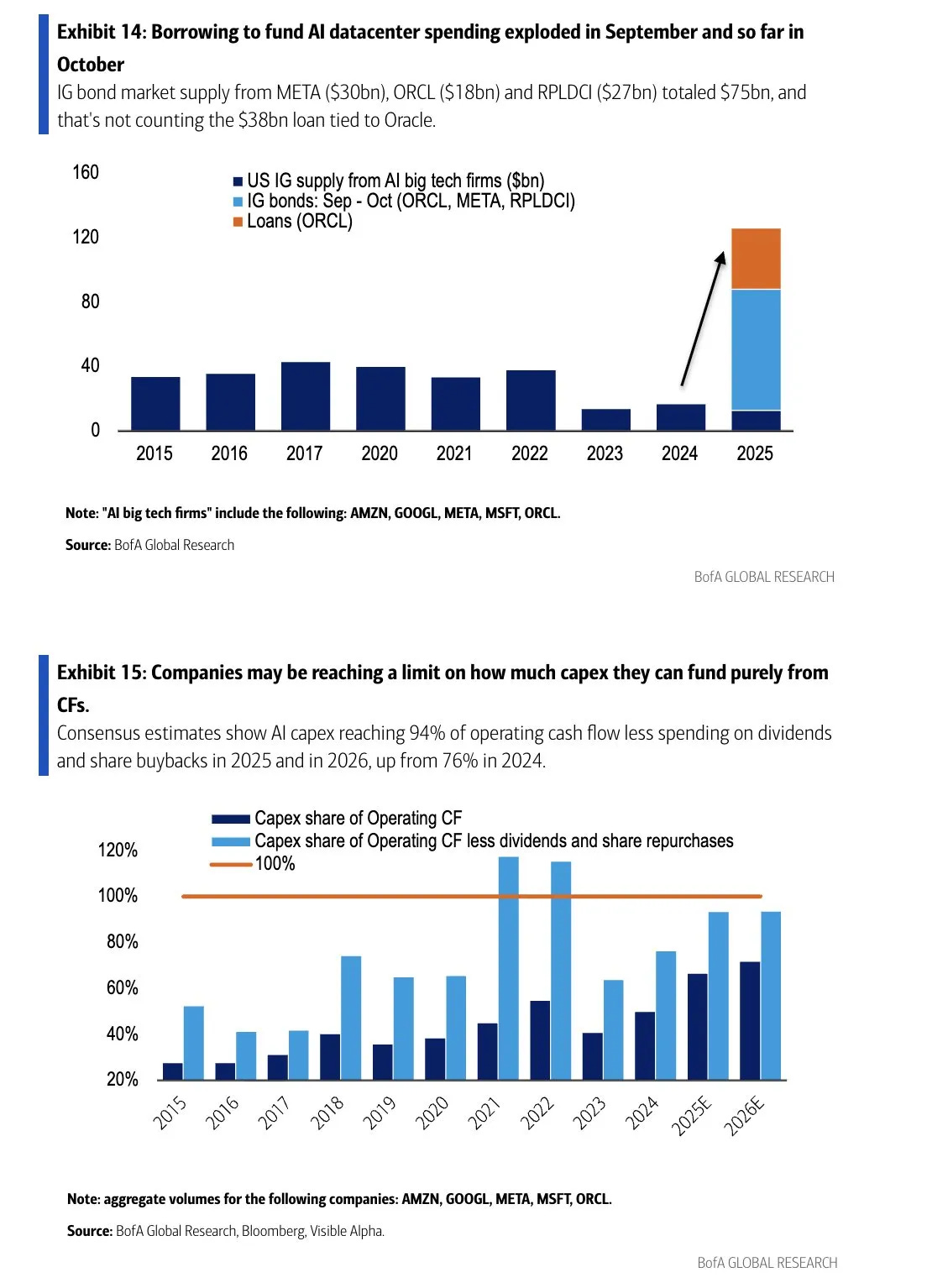

Investment grade issuance and lending for AI-related projects “exploded” in September, going from ~15B to ~$120B basically overnight.

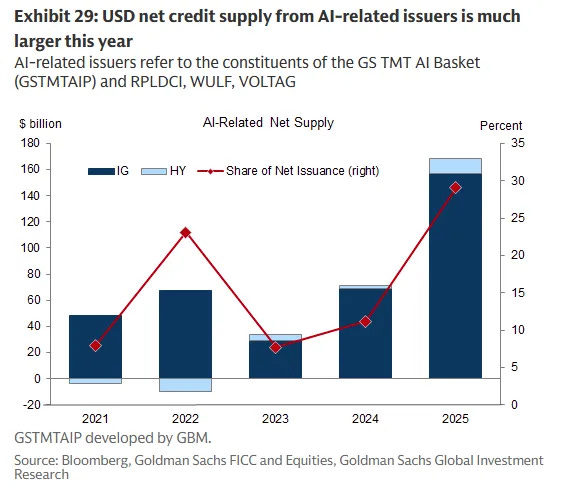

As a share of net-new issuance, AI-Bonds are now a very big deal:

~30% of new issuance is AI related (and Goldman tabulates a slightly larger total size of issuance than BofA, for reasons I can’t divine at the moment—the FT says $200B, fwiw).

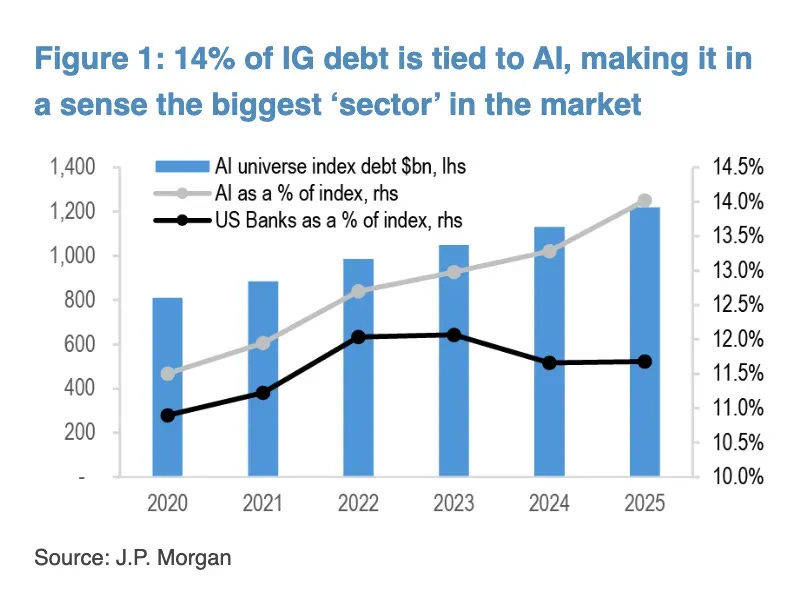

Here’s another way of looking at the rapid rise to prominence of AI-debt:

~14% of investment grade debt is tied to AI, making it “the biggest sector” in the IG market.

Debt is officially a very big part of the AI Capex Supercycle. 30% of new issuance, and 14% of the IG market overall (or $1.2T), is not just an up-and-comer, it’s the main event.

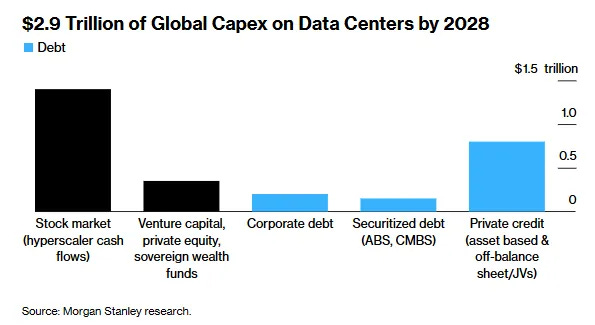

And debt’s role is expected to get even bigger as time goes on, with private credit playing a big part:

Morgan Stanley estimates ~$8000B of AI capex financed by private credit by 2028.

That $800B of off-balance sheet direct lending is supposed to dwarf the $200B of corporate debt (which seems like an undercount given the $160B already raised).1

Why is this happening?

Well, the simplest explanation is per the chart above: hyperscalers are running out of cash to pay for it all themselves. BofA estimates that Capex as a % of free cashflow (net of dividends and buybacks) is ~80%. That doesn’t leave a lot leftover for buying even more GPUs with cash.

Lending to derisk?

There are other reasons, as well.