Are homebuilders on the march?

Little thinks on Europe's fade, the power of Swift, the need to FEEL, and the curious case of housing starts. Plus reads on EV charging, the Vision Pro, Status>Babies, Water Barons, and Minksy Moments

Welcome to the weekend, my best beloveds. It’s Random Walking time.

First, the thinks:

The almighty American Consumer and the fade of Europe

The power of Swift

Demand for feels and experiences

Are homebuilders really on the march? Should they be?

Second, the reads:

EV Charging the battle between utilities and convenience stores

Benedict Evans divines the future of the Vision Pro

Chasing status at the expense of family

Water barons of the Colorado River

Of Minksy Moments and Credit Cycles

Cormac McCarthy the humble polymath

If you like it, shout it from the rooftops. If you don’t like it, pretend that you do. In all events, have a nice day.

Random Walk Thinks

The Almighty American Consumer

I happened to watch Sum of All Fears to quell a bout of insomnia the other night (it worked). Aside from the eerily relevant plot involving a clique of hardliners attempting to stoke global war between Russia and the US, there’s a hilariously irrelevant subplot involving the aspirations of European nations to restore their economic swagger.

Perhaps with better leadership and foresight that may have once been possible (or perhaps not, idk), but as of now, it seems pretty ridiculous. Europe is a rounding error, at least as a market for goods:

OECD includes some non-European countries, as well, so European consumers are slightly more irrelevant than the chart suggests.

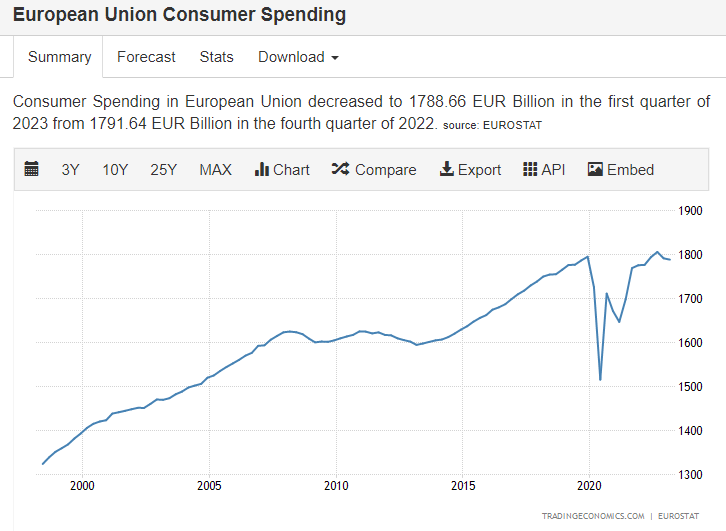

The GFC hit EU consumers like a ton of bricks:

Anyways, no further commentary for now, especially since I can’t do better than this:

. . . he’s not wrong.

Swifty power

When Taylor Swift is in town, the Average Daily Rate (“ADR”) that hospitality companies charge gets a healthy bump:

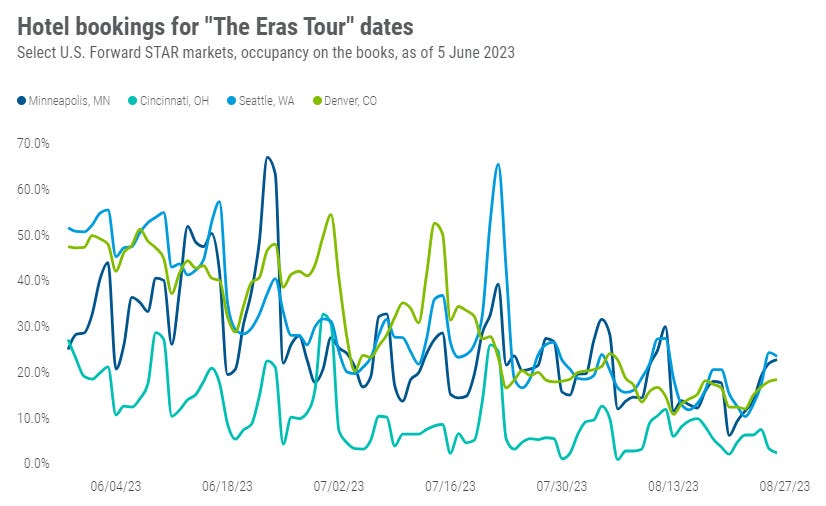

This data is three weeks old, but you can still see Swift concerts driving hotel bookings well in advance—Seattle especially, but also Denver:

Two things jump out: (1) Swift is a force of nature; and (2) Vegas is big enough as an entertainment hub that Swift doesn’t make a dent. (While the LV housing market is creaking a bit, the convention market is not . . . more on that later.)

RW has made this observation before, but travel is the discretionary spend that has held up quite well, thus far.

Global leisure bookings are still ~25% higher than before the pandemic and Rev Par is up pretty much everywhere except for the staggering failure of leadership and civic virtue that is San Francisco and, to a lesser extent, Chicago:

Even amongst the young n’ restless, who appear to be cutting back everywhere else, travel looks like the last thing to go.

I just want to feel something

To put an even finer point on it (and bring Swift back to the fore), experiences are still very much in-demand (relative to goods). [Oddly enough, that demand may be driven in-part by sitting on your butt watching netflix.] Between pickleball vacations, and the growth of Airbnb’s experiences business (and short-term rentals more broadly), it’s almost like people still do want to feel something, at least some of the time (Cocomelon and Netflix notwithstanding).

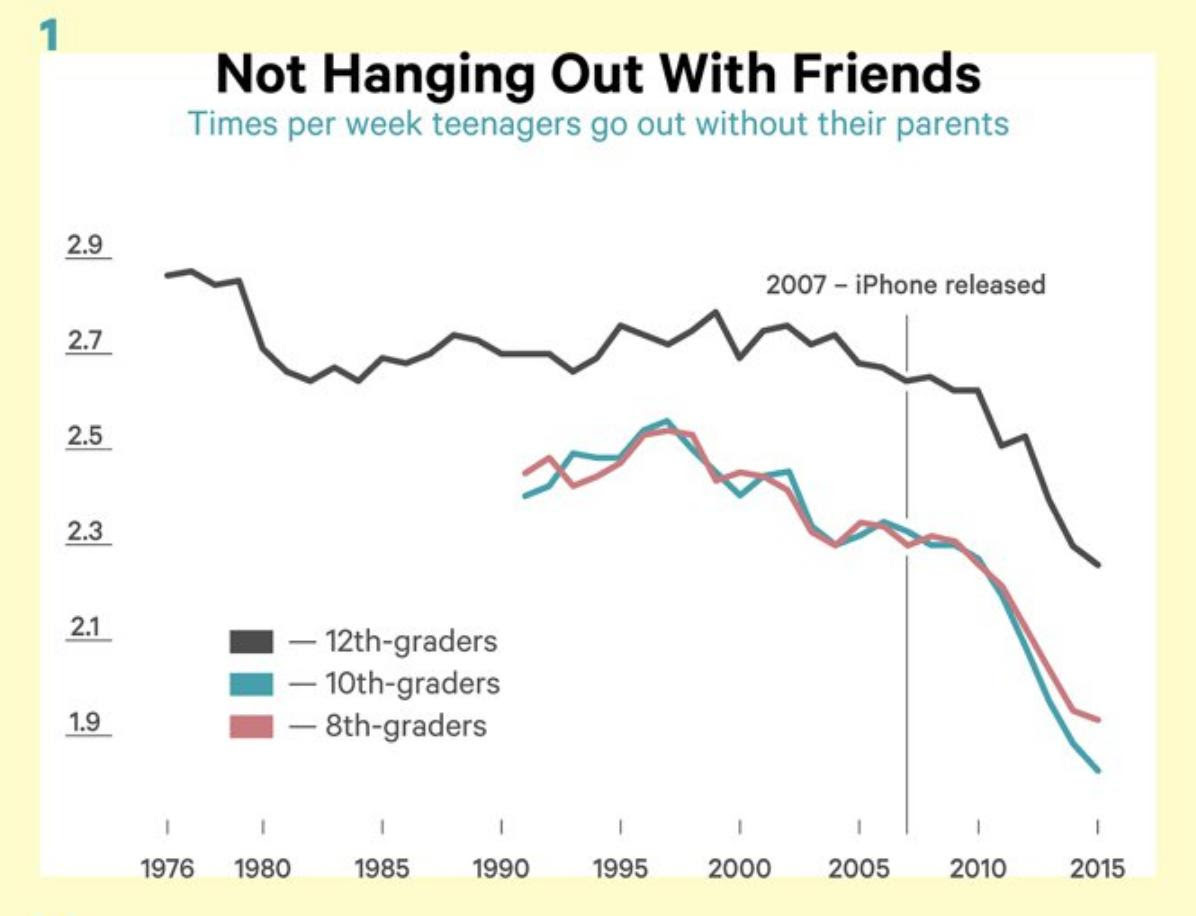

I genuinely have no idea whether there is any actual connection between the two, but permit ole Random some free association: the need for experiences always makes me think of charts like these (that make young people especially appear very sad and alone):

Note that y-axis scaling on this chart is a definite chart-foul (and the data is likely bad-to-garbage), but the dropoff is noticeable just the same.

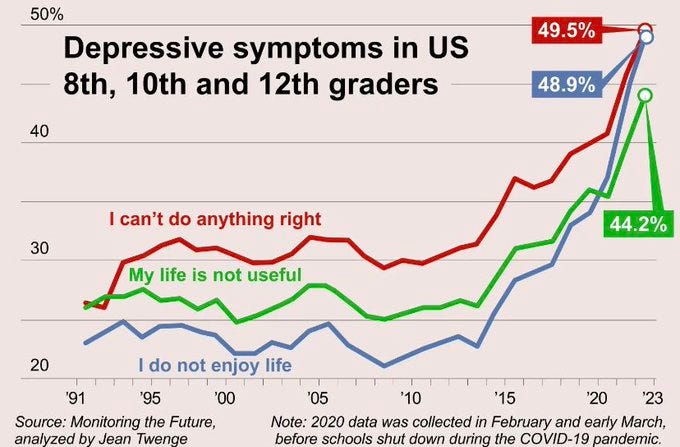

This is another one that was making the rounds:

I’m not really sure what to make of these. Self-reported conditionals are pretty suspect to begin with. If one were take the data at face-value, the easy (and at least somewhat “right”) answer is to blame social media, iphones, etc.

I continue to think, however, that those tools give us what we want (although what we want isn’t always good for us) . . . so what exactly do we want?

Is it really ‘Game On’ for homebuilders?

Housing starts jumped to an extraordinary 22% in May (according to census data released this week):

Multifamily, in particular, added the most starts since 1986 (supposedly):

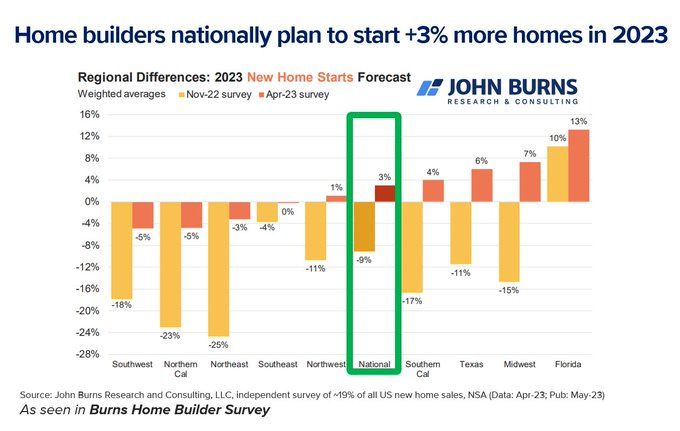

It’s corroborated somewhat by other evidence of builder optimism:1

Personally, I find it extremely hard to believe.