Are we "winning" the trade war

Winning the least-negative in a negative sum game

are we winning the trade war with China (such that anyone wins)?

Chinese manufacturing contracts (supposedly), but experts want stimulus

a substantial drop in imports for US, means a substantial drop in exports for them

‘origin-washing’ the hottest new thing in global trade

of carrots and sticks for the entirety of the global supply chain

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. Are we “winning” the trade war?

Random Walk’s strong opinion, weakly held, vis-a-vis China and the trade war is that the tariffs are very much China tariffs, and because China’s economic policy is to be the world’s manufacturer, China needs the US (and the world) to buy its stuff, more than the US needs its stuff.

Or, as I put it then: we finance consumption to sustain our economy, China finances production to sustain its economy. China needs the world to buy its stuff. We need the world to buy our UST.

The point is that we “win” a trade war with China, in the sense that our flatware shortage is their recession.

We may lose a capital war (and everyone loses in wars, in at least some ways), and query what prize we’re winning anyway (and at what cost), but China’s economic everything is selling us stuff (and selling stuff to other countries, some of which is then sold to us).1

Not saying it won’t hurt (or that it’s a good idea), but a trade war hurts them a whole lot more than it hurts us.2

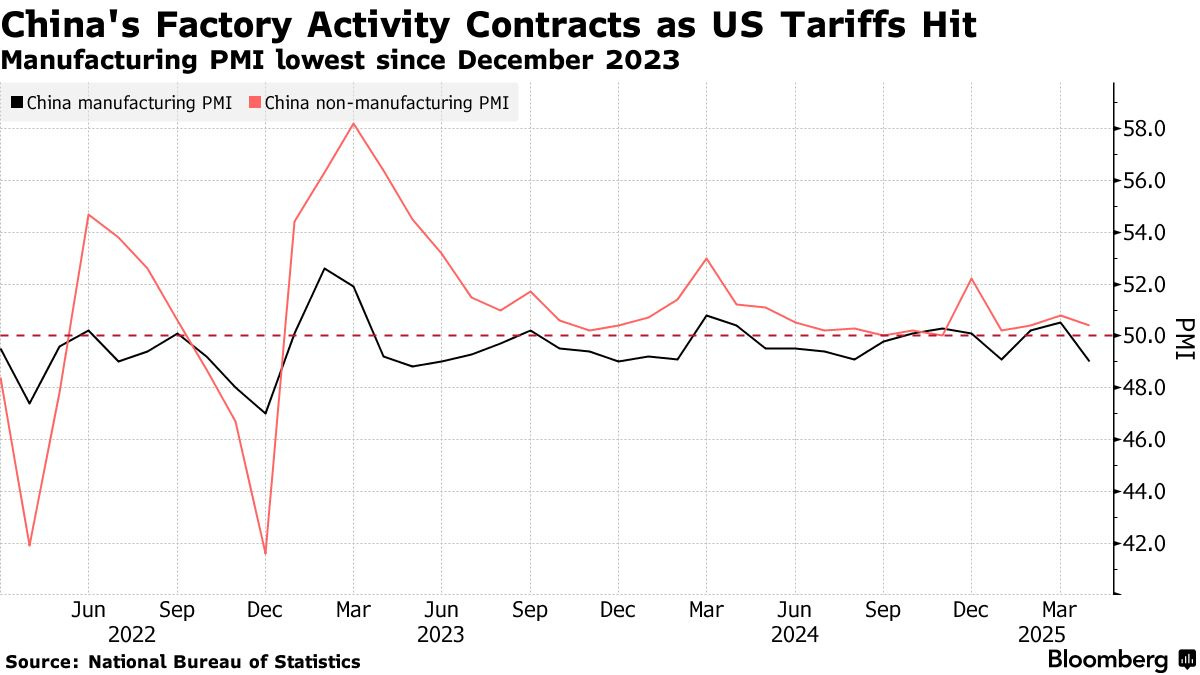

Manufacturing in China is going south

Anyways, apparently China’s equivalent of the PMI is contracting:

The official manufacturing purchasing managers’ index fell more than expected to 49 from 50.5 in March, the National Bureau of Statistics said Wednesday . . . “It’s definitely worse than expected. It shows tariffs started to bite,” Robin Xing, chief China economist at Morgan Stanley, said . . . He forecast a significant economic slowdown this quarter that could trigger more stimulus . . .

To help ease the pressure on exporters, Beijing this week laid out plans to help struggling firms access loans and to boost domestic consumption, but stopped short of announcing more aggressive economic stimulus.

So, China is seeing some pretty severe contraction in their manufacturing sector, maybe.

And experts are calling for stimulus. Again. But more of it this time.

Chinese exports collapsing

None of this should be surprising, of course.

You can’t simultaneously freak out about the total lack of inbound from China (which is definitely alarming), without also considering that China now has a total lack of outbound.

I mean, this has to hurt: