Builders did what now?

A puzzle in Florida, but also elsewhere

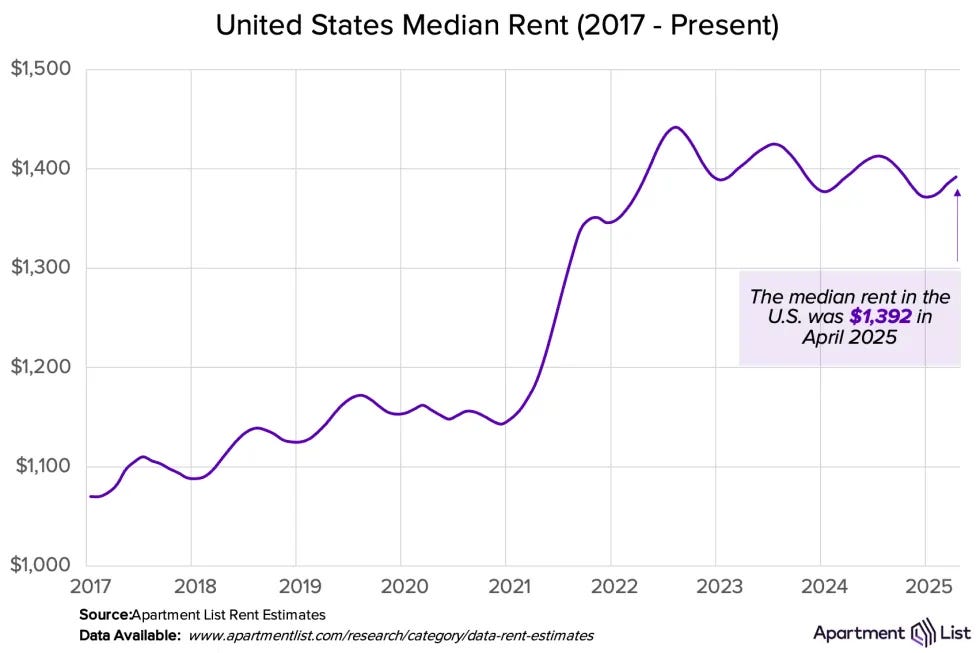

rents continue to fall, as ample supply comes online, relative to demand

mostly, builders have slowed new dev, but not everywhere . . . and the places they chose are odd choices

this has to end badly, right? Or maybe not

Florida is different this time aorund

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. Sohn Investment Conference

Random Walk will once again be at the NY Sohn Investment Conference, May 14. It’s great. You should come, and if you do, make sure to say “hi.”Also, get 20% off with the code RandomWalk20

Recaps from last year (one and two).

It’s worth it, and it’s for a good cause. Plus, 20% off with the code RandomWalk20. See you there!

The builders did what now?

There’s something underway that seems so likely to end badly, that it’s kind of hard to figure how it’s still underway.

Random Walk has written variously about how new residential development has slowed, for the most part. It’s got nothing to do with zoning or a housing shortage, and everything to do with the opposite of that: there is ample supply to meet demand, such that rent growth has slowed, and at prevailing rates, new dev just doesn’t pencil.

Nationally, rents have been slowly declining since interest rates started to rise ~3 years ago.1

If your costs go up (for labor and capital), then you better be able to charge more to cover the difference, and you can’t do that, if rents are flat.2

Builders are pretty smart, though, and they know this better than anyone, and so for the most part, new permitting has slowed.

The places where builders are building

But not everywhere.

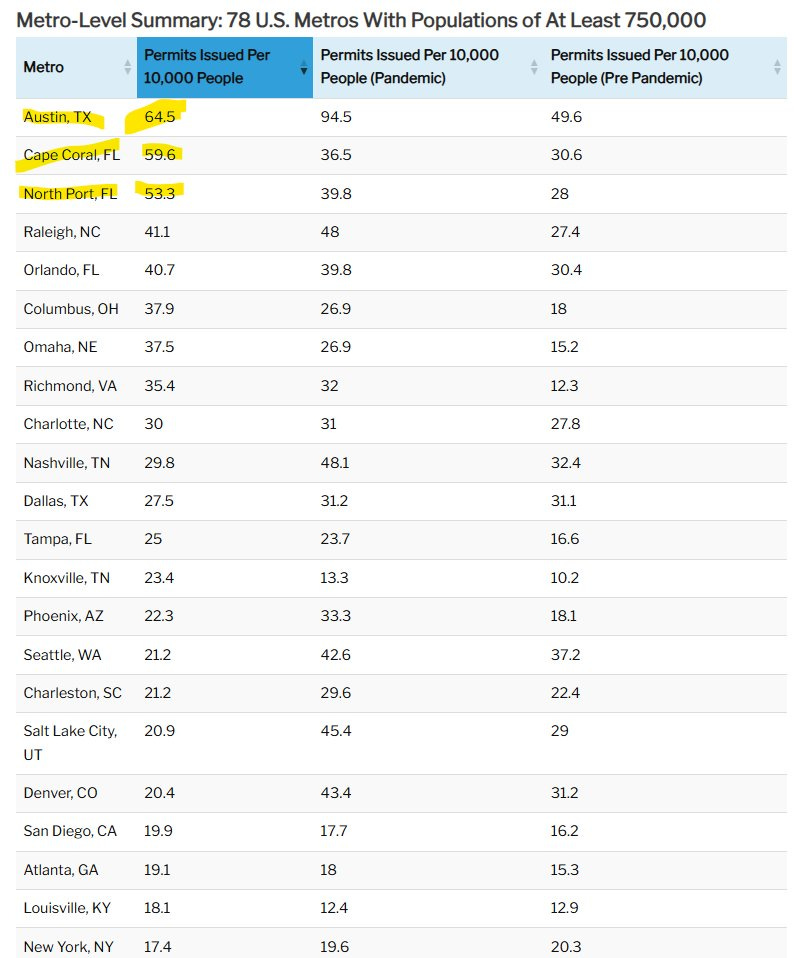

There are some places where new permits are going like gangbusters:

Austin is atop the leaderboard, well-above its pre-pandemic pace, but below its peak pandemic highs

Two Gulf-side Florida metros are second and third: Cape Coral and North Port, both running well-above pre-pandemic and pandemic levels.

So, if you trust the permitting data, then it would seem like Austin, Cape Coral and North Port are the places with the most new inventory on the way.

The places where supply is already piling up

That, by itself, is not all that remarkable.

The remarkable thing is that they also happen to be among the “worst performing” and well-supplied real estate markets in the country.