Cash flew to safe assets, but where did it fly from?

Daily Data: Another puzzle: a zero-sum game where everyone wins

Another mystery of the immaculate tightening that wasn’t (but also was). The Fed beckoned cash to return to its maker—and return it did—but where did it come from? Not stocks, that’s for sure.

Everything reads better in your browser or in the app. The footnotes especially, and Random Walk is really leaning into the footnotes. Plus, if you have the app, you can set delivery to “app only” and then my daily barrage will feel less like a barrage. Alternatively, sign up for Weekly Recap only.

If this email was forwarded to you, please click the shiny blue button:Daily Data

Money came to, but it didn’t come from

Here’s another puzzle of the past year and a half.1

When the Fed raised interest rates, the goal was to create something of a money magnet. By increasing the returns on the world’s “safest” asset, investors would promptly stop what they were doing anywhere else in the economy, and send all their money back to the source. The effect of sucking money out of the economy—depriving it of oxygen, so to speak—is, of course, deflation.

It’s a zero-sum game. Money goes from stocks, loans, investments, etc., and to treasuries and other safe stuff.

The stock market’s loss, is the debt market’s gain.

Or that’s how it’s supposed to work. And that’s why everyone (Random Walk included) was pretty bearish on the stock market. If money is flying from stocks, that should make prices go down.

But here’s the mystery.

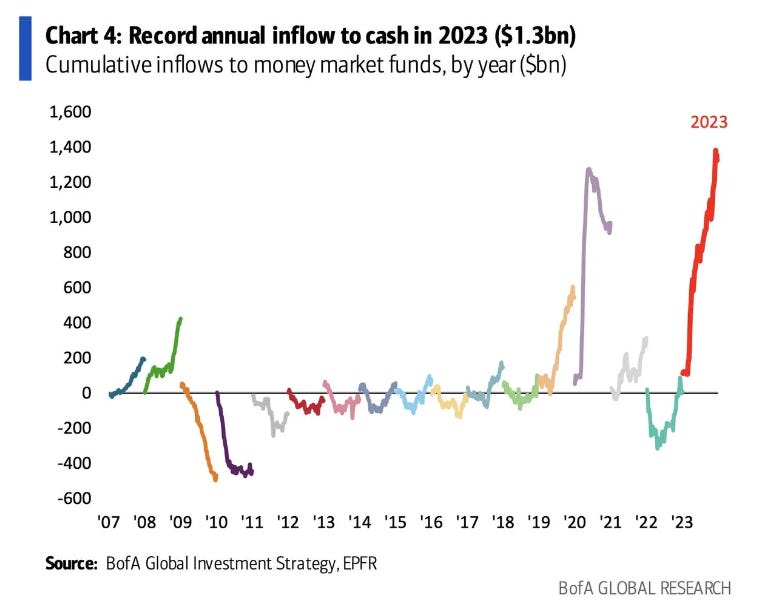

The first part of the plan definitely worked—tons of money piled into safe assets and their next of kin. The money magnet was activated.

The second part, though, did not. There was little or no deflation in asset prices.

Money inflowed, without a corresponding outflow. A zero-sum game, and everyone won.

How does that work?

Charts today, courtesy of the WSJ (and one via Daily Chartbook)

Treasuries, money market funds, and bonds, all saw massive inflows:

But stocks also saw pretty substantial inflows:

In fairness, there were $133B in outflows from the S&P ETF at the outset of tightening, but as everyone knows, the stock market is absolutely ripping of late, and money is piling back in.2

It’s weird right?