Catching up on the week that was (in charts)

Daily Data: Tesla, Starbucks, Credit Cards, Netflix, Gaming, GDP, and more

Random Walk is back.

I summarized everything that we both missed, and when you put all the pieces together the picture is clear: it’s a mixed bag.

There is, at least, one signal that’s genuinely troubling, though, if you’re into that kind of thing.

Everything reads better in your browser or in the app. The footnotes especially, and Random Walk is really leaning into the footnotes. Plus, if you have the app, you can set delivery to “app only” and then my daily barrage will feel less like a barrage. Alternatively, sign up for Weekly Recap only.

If this email was forwarded to you, please click the shiny blue button:Daily Data

The state of things, as told by a week of charts

Random Walk tried to unplug for the past week, for the most part.

It’s a good exercise, in general, but especially it’s a reminder that you don’t actually miss that much just because you stop paying attention. I dialed back my information consumption by about 90%, and the world still turns.

Anyways, now that I’m back, I couldn’t help but try to catch up on all the stuff I missed (but didn’t actually), and, of course, present it here for you, my best beloved.

Did the world change? How are things really? Are we landing softly, or on the precipice of disaster? The people demand to know!

Basically, the usual concerns.

But before we get to the charts, first, an anecdote:

The Uber driver who took us to the Fort Lauderdale airport said this was the worst January for business that he could ever remember. And it wasn’t just him, it was all the drivers in the various Miami Uber chats he’s in. September was slow, but it’s always slow. October and November were good, as per usual. New Years was bonkers, but since then . . .

January has turned into crickets.

Maybe I did miss something. Is there bigger game afoot?

Suddenly, the post-vacation catch-up has some urgency to it.

So what does the data show?

The signals are . . . mixed

There are actually was a decent amount of news this past week. Some big companies reported, and some important macro data was released.

The bigger picture is still a bit muddled, and whether it’s good or bad, depends a bit on who you ask. The anecdata is best summarized as “on the one hand [not-so-good], but on the other hand [pretty good.]”

Again, business-as-usual.

But enough with the windup. It’s time we got to the show, which isn’t really a show, per se, so much as Random Walk’s condensed notes of the week that was (in charts).1

Consumer credit

Credit card delinquencies are rising across major issuers:

Delinquencies are finally higher than prepandemic priors.

Is that an alarm bell? Kind of, but still nothing crazy.

Likewise, Discover Card sorta slipped under the radar with an “oops excuse me, charge-offs were kinda high”

Charge-offs did, in fact, increase . . . but, on the other hand, charge-offs were (supposedly) at “the low end of our expected range.”

Some bad, but also not-so-bad.

It’s in-line with what the other big banks reported the week prior, i.e. there were some chargeoffs, etc. but it’s all expected and otherwise “normalization.”

They would say that, however, wouldn’t they.

Cars

Tesla said, hey, demand “may be notably lower” in 2024.

Lower demand is not good.

OK, but cars are pretty sensitive to higher interest rates, so declining sales isn’t necessarily consumer weakness. Plus cars did a little better in the recent GDP print (more on that below).

Basically, there’s some slowing, but it’s the expected and non-crisis sort of slowing. Probably.

Consumer staples, streaming, gaming and other stuff

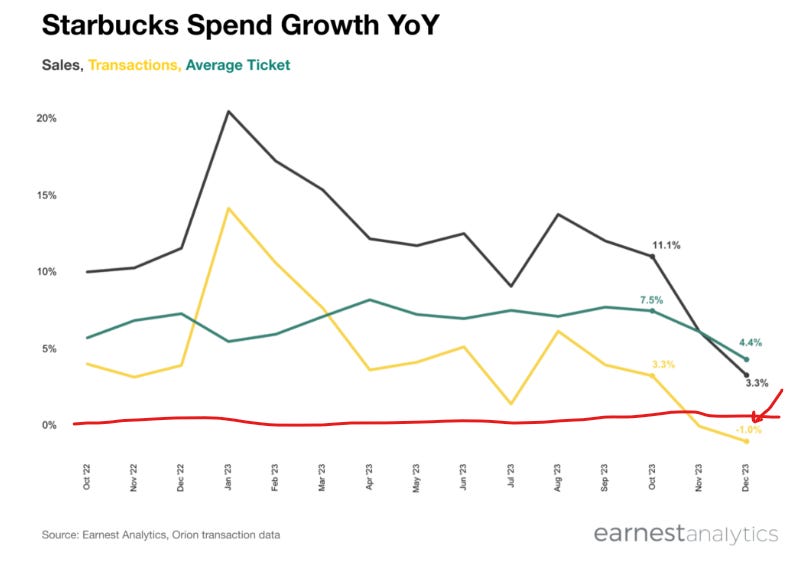

Starbucks felt some pain, with a YoY decline in total transactions:

Starbucks had revenue growth, but it was solely a function of higher prices, and not more/better shoppers.

As a macro “indicator,” if people are buying less coffee, that’s generally not a sign of strength, but y’know, maybe they like Dutch Bro’s instead:

Dutch Bros continues its incremental march on wallet share!

So, coffee is a mixed bag.

Netflix, however, was unalloyed awesomeness:

Netflix added 13.1M paid subscribers (5.4M more than Q4 last year), which was its best Q4 ever.

So much for consumer softness, at least when it comes to the King of Stream.

But, on the other other hand, consumer reticence for streamers not-named Netflix, as well as discretionary items like video games, fancy sneakers, and other stuff, has led to layoffs at Amazon, Google, Microsoft, Paramount, eBay, Unity, Nike, and others.

I mean, the gaming picture (which drove growth at Twitch, Discord, and others), is not looking good (via Matthew Ball):

Less gaming revenue and less time spent gaming.

When they said “netflix and chill” they really meant netflix, and netflix only. No other chilling allowed.

Semis and enterprise

On the enterprise side of things, ASML (semiconductors) was also awesome:

That’s a record breaking quarter for Dutch semiconductors, wherein “record breaking” is beginning to sound repetitive.

IBM and Service Now likewise did pretty well for themselves, suggesting the corporate buyer is alive and well.

But . . . Citi, BlackRock, and Intel are making some cuts, which I suppose could be classified as consumer, but whatever.

Employment

Employment is the first unequivocally worrisome signal.