Congestion?! Is that all I am to you?!

Five datas on the consumer shortage, peak engagement, Threads, What risk?, and Fintech is still big. Plus, I'm more than just a tailpipe--I'm a person!

Random Walk welcomes you to the moment you’ve all been waiting for: more Random Walk!

The five datas that Warren Buffet reads before he goes to bed:1

No juice left to squeeze or the looming consumer shortage

Peak engagement and the 80/20 rule in full effect

Threads on threads

What risk? There’s no risk here

Fintech is still big (reprise)

The one thought piece that keeps Ole’ Warren turning in his sleep:

Who you calling congestion?! Why does everyone have to be so mean all the time.

Apologies for the NYC-centric Great Wall of Text, although I think you’ll enjoy it just the same.

Scatterplots

No juice left to squeeze

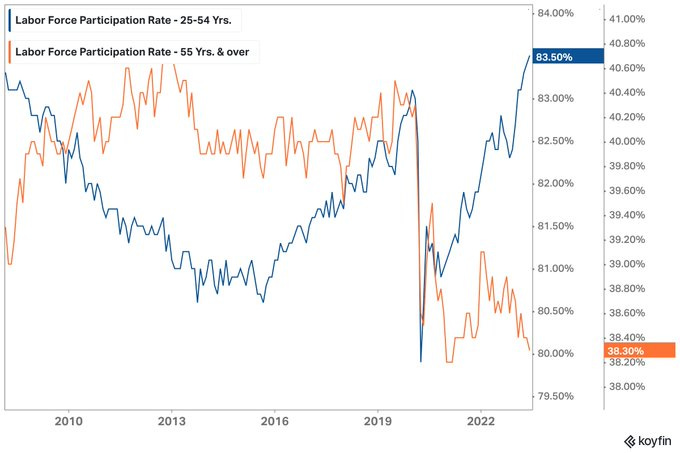

Speaking of looking into the future, prime age workers are participating in the workforce about as often as they ever have. Older folks, on the other hand, continue to say “to hell with it.”

The heart of the order—prime age workers—is doing as much as it possibly can. There is no juice left to squeeze.

As the nation gets older, older folks will have to do more, not less, so the orange line is very much going in the wrong direction. Perhaps once retail day-trading gets less fun for seniors and retirement wealth deflates a bit, they will start punching the clock again.

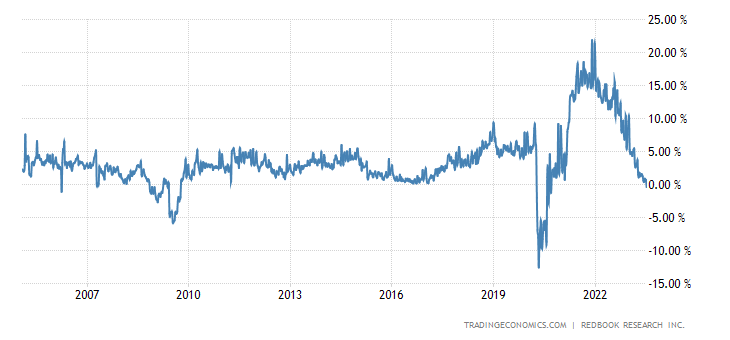

For what it’s worth, the Redbook Index of retail sales took a bit of a header this month (going negative for the first time since the pandemic began):

Do we have a consumer shortage?

Likewise, consumer credit only grew ~$7B this month, which was ~$13B less than expected (and the lowest MoM change since November 2020):

That could mean that consumers are dialing things back (trouble), or it could mean that their balance sheets are just better than ever (not trouble), or it could be both.

I used the full series for perspective in both cases. For the Redbook Index, it’s pretty much been a bad thing every time when the index goes negative. For consumer credit, though, small gains and even rapid(ish) declines in consumer credit are not necessarily evil omens, but sometimes they are (also, the last couple of years are just remarkably spiky).

Anyways, you already know where RW thinks this is heading.

Peak engagement

Workers are as “engaged and thriving” as they’ve ever been:

I take these with a grain of salt, but it’s kind of hilarious that “quiet quitters” comprise a steady ~60% of the workforce (with “loud quitters” taking the remaining 20%). Not only is that a lot of quitters, but it’s also the 80/20 rule hiding in plain sight, i.e. 80% of the value is driven by 20% of the people.

Hanging by Threads

These charts have been everywhere, but RW will nonetheless post it here. The number of users on Threads, Facebook’s twitter clone, has passed 100m:

It’s the fastest ever app to 100m! (h/t App Economy Insights)

Here’s another even more dramatic cut:

Are instagrammers who clicked the Threads icon really “users”? I doubt it, but we’ll see. Twitter’s strength has always been “who” and not “how many” because it’s a relatively small platform, in the big scheme of things:

Truthfully, I haven’t been paying that close attention—I’ll check it out eventually, probably—but the most entertaining review of Threads that I’ve read was overwhelmingly negative.2

No risk here

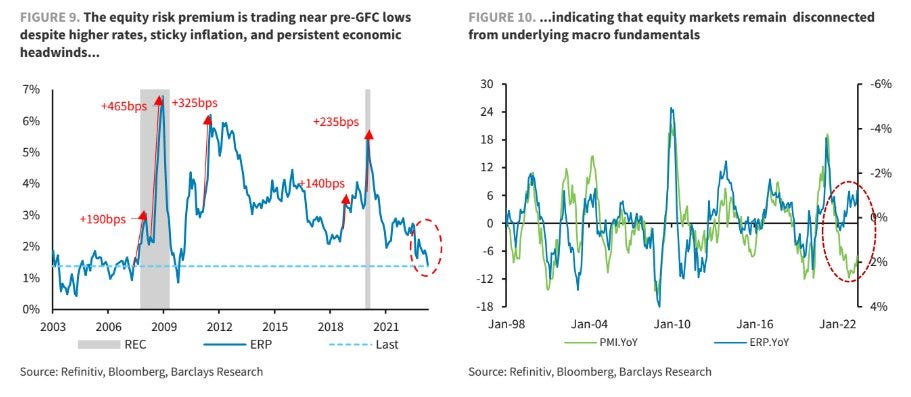

Investors are earning less for their risk than they were during peak pandemania and only slightly more than they were right before the world melted in ‘07-’08 (at least according to Barclays via Daily Chartbook):

The equity risk premium (“ERP”) measures how much more money you’re expected to make by investing in stocks, rather than “risk free” instruments, like government bonds. Currently, the difference is ~1.5%, i.e. you can expect an extra $1.50 on every $100 you put in the riskiest asset class, relative to the safest.

No further comment.

Fintech, still big (reprise)

Last week, RW gave some props to VC for being right about fintech: it’s a really big opportunity with room for multiple winners.