Consumer credit, including fintech, still pretty OK

Daily Data: Checking in on loss rates, BNPL, and the like. Only one bad standout, and it's not who you'd expect. Plus some general weirdness going back to 2017.

In today’s dispatch (accidentally going out late because a scheduled send for 6:30pm is not the same as 6:30am):

Credit card delinquencies rising, but rising back to normal, for the most part (except for maybe one outlier)

Fintech consumer lenders still growing revenue, without growing losses in kind

A legacy retailer, on the other hand, is the pits

Weird, unexplained divergence between Big and Small Bank credit cards

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. Daily Data: Consumer credit is still pretty OK

Consumer credit default rates are interesting to Random Walk for two reasons: (1) a general health check on the Almighty Consumer; and (2) a general health check on consumer fintech companies, which have drawn the lion’s share of VC investment and excitement for some time.

Anyways, consider this a small chart dump on relevant consumer credit products, and generally speaking, things look pretty solid.1

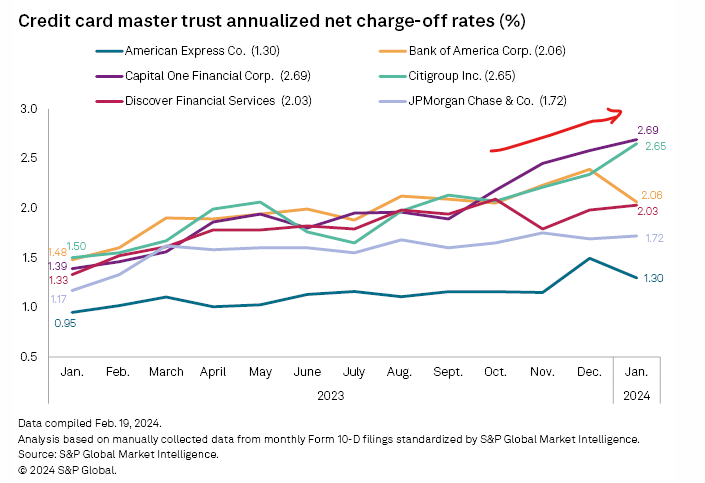

Legacy credit cards solid

For the Old-G fintech companies, i.e. credit card issuers, delinquencies and charge-offs are mostly rising, but in a back-to-normal way.

Delinquencies are rising across the board . . .

. . . but the combined average is now ~1.5%, which is basically what it was before the pandemic.

Charge-offs are also mostly rising across the board, but again off an historically low base:

Citigroup is perhaps a bit troubling?

Capitol One looks like the big offender here, but their bread n’ butter is subprime credits, so they always run a little hot. If you want to be concerned, (again) maybe Citigroup has some explaining to do, but overall, this is a reasonable headline picture.