Consumers borrowed a lot (and other consumer sundries)

Daily Data: Revolving credit spiked, plus an impromptu health check for the Almighty Consumer

How is the Almighty Consumer, really? Healthy? Stressed? Feeling luxurious? Something in between? This, and other mysteries of the “recovery.”

Everything reads better in your browser or in the app. The footnotes especially, and Random Walk is really leaning into the footnotes. Plus, if you have the app, you can set delivery to “app only” and then my daily barrage will feel less like a barrage. Alternatively, sign up for Weekly Recap only.

If this email was forwarded to you, please click the shiny blue button:Daily Data

Consumers borrowed a lot for their holiday shopping

You know how sometimes when you see water rising kinda quickly and the cool-headed response is something like:

It’s fine. You can see the line where the water rose to before—it’s just the tides coming in, like they usually do.

And that makes a lot of sense. Recapturing old highs isn’t something to lose sleep over.

Blowing past old highs, however . . . well, then maybe you start getting nervous.

It turns out consumers added a lot of revolving credit in November, which is mostly credit card debt. Now, considering that consumers shed a lot of credit card debt early in pandemania—free money will do that—adding a lot is just playing catch up.

. . . well, it’s catch up to a point, and we’re getting close to running past that point.

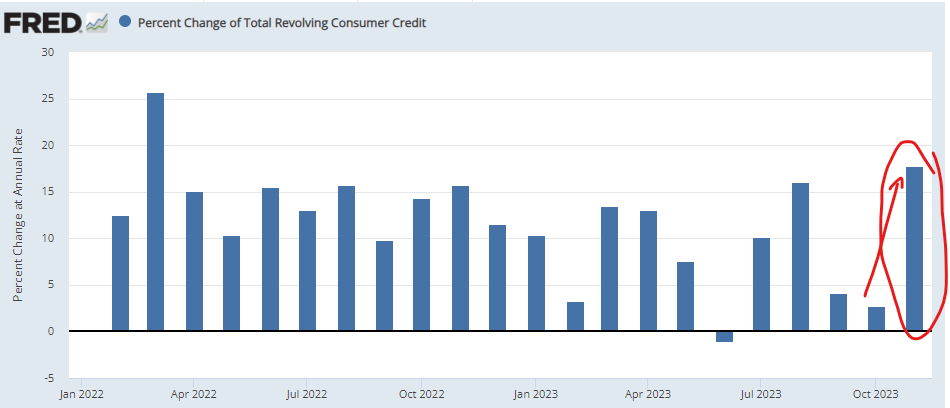

Revolving consumer credit popped in the latest read:

That’s a 17% YoY pop in revolving credit, which is the biggest pop since March 2022.

So much popping.

If you zoom out, it’s not quite as dramatic, but it’s still worth noticing:

Total revolving credit is now above trend (unadjusted for inflation, however).

OK, so lots of credit card debt.1 What does it mean?

Look, we know people did a lot of holiday shopping, and they used a lot of credit and BNPL to get there.

So it probably means that, at the very least.

Are consumers stressed?

Does it mean more than that?

Does it also mean consumers are stressed (because they’ve burned through their savings)?

Maybe.

Interest expenses and delinquency rates haven’t been updated yet, so we shall see.

In terms of other stuff, there is some other stuff that suggests some stress.