Discretion is the better part of valor

Five(ish) great datas on dynamism, peak oil, prices n' wages, WFH, and Maps (on maps on maps). Plus some thoughts on what consumers are telling us about the future.

Welcome to a Tuesday Random Walk. That starts with:

Scatterplots or the mosaic of datas on the path to enlightenment:

Space Balls, and other indicia of dynamism (or lack thereof)

Peaked Oil

Inflation we hardly new ye’

Halfway back to the office

Maps on maps on maps (take 2): what mysteries are revealed when you stare at the US map with various different colors and shapes?

Great Wall of Text:

Discretion is the better part of valor. Consumers are signaling that everything is just fine . . . but is it really?

Thanks as always for being here, and please do tell a friend. Also this:

Scatterplots

Space Balls

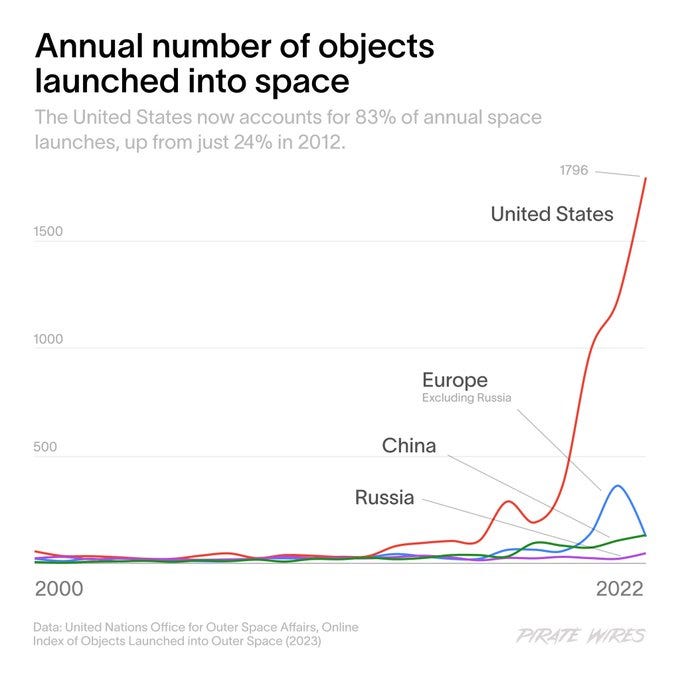

Launching things into space is presumably a byproduct of ambition, dynamism and competence, so in that sense, we’re looking pretty good, or Elon is, but we’ll take credit for that:

The Europeans, by contrast, seemed to be rallying for one last hurrah, and then were like “nah, we’re done . . . too old for this sh*t.” Europe has retired from everything, it seems, other than regulating. That they do.

I’m reminded of another graphic illustration of a national retirement party . . . in this case, Japan:

Perhaps hibernation, rather than retirement. RW plays the long game.

Peaked Oil

Some people at Bloomberg say the end is nigh for oil demand, because EVs are on the march:

Oh my, all the oil we’ll save:

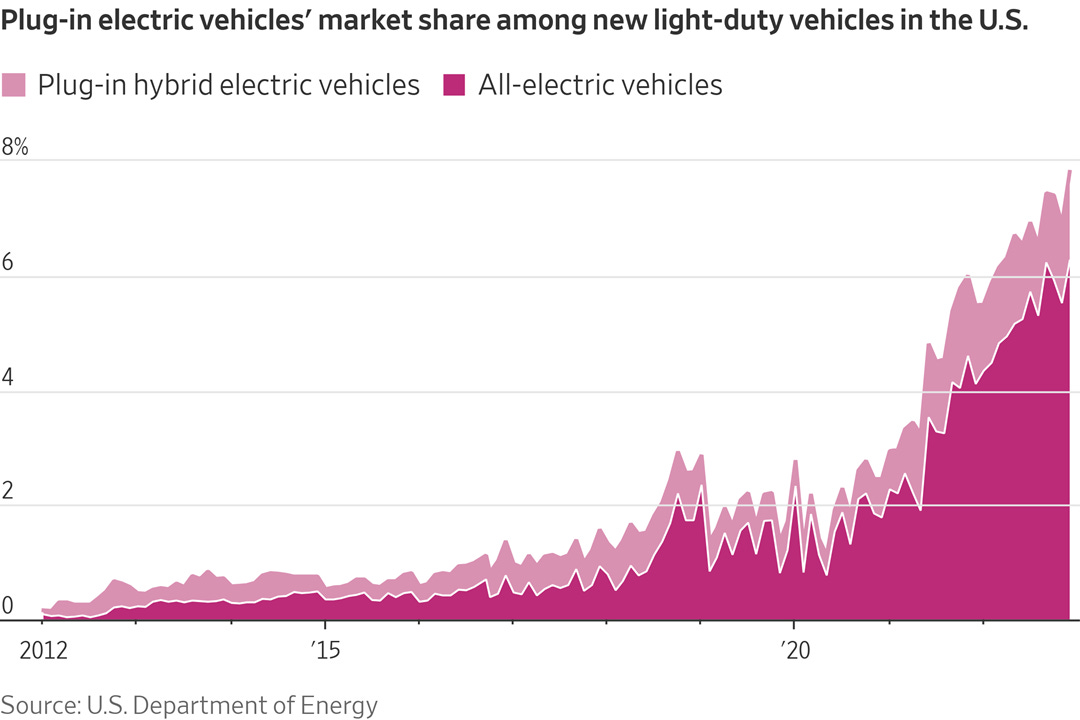

All of this has been contingent upon the rate and pace of EV adoption, and it has, indeed been quite steep:

It seems unlikely that this transition will proceed without substantial unexpected tradeoffs, but you have to tip your cap to the optimists. That’s a pretty remarkable change.

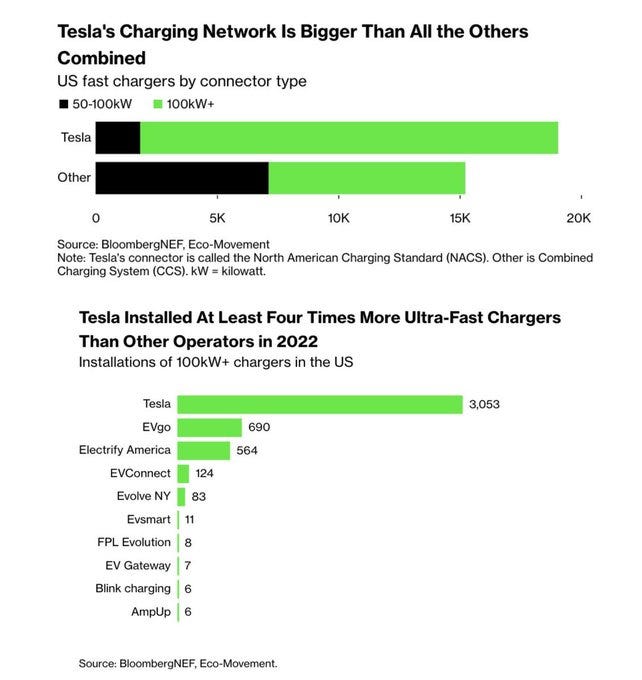

And yes, we can thank Elon for that too, apparently:

Pretty remarkable, indeed.

Inflation, we hardly knew ye’

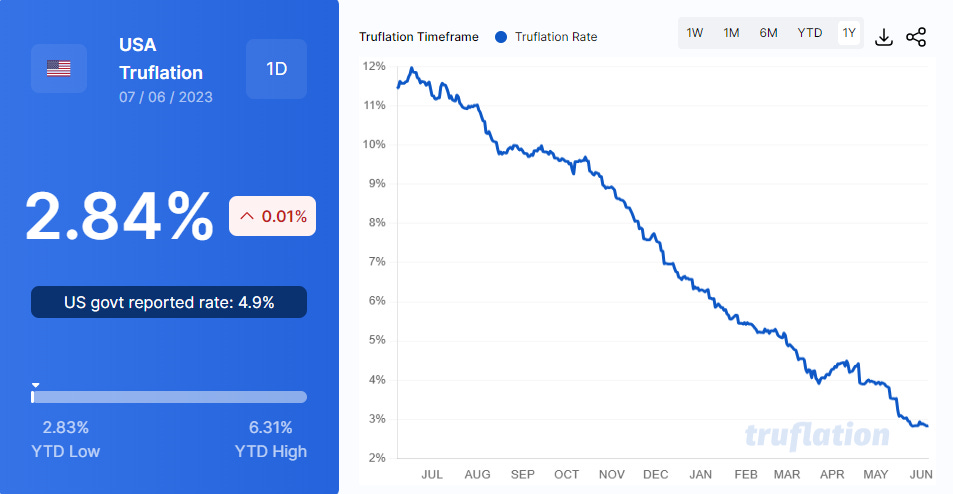

Apparently someone has discovered the “true” CPI, and they’ve called it Truflation:

Looking good!

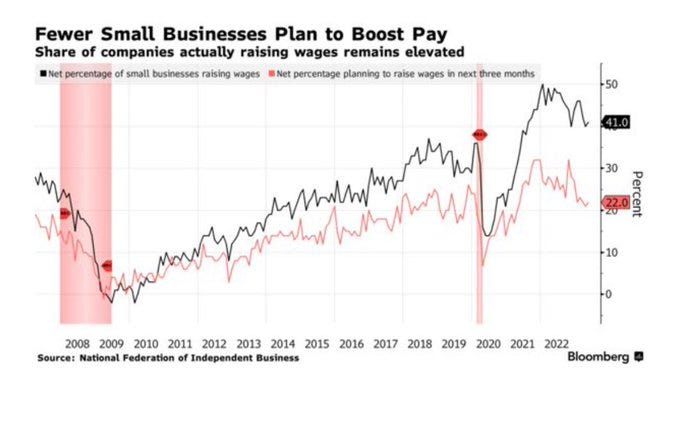

RW isn’t going to interrogate the methodology, but it generally makes sense . . . the most persistent price pressure is coming from wages:

. . . but that too is moderating a bit, for job switchers at least:

And among small businesses:

Long a RW theme, the pay-bump at the lower ends, where the worker-shortage is most acute (and the leverage premium is most absent), is truly a thing to behold.

Of course, now that that inflation is moderating, landlords might decide this is the perfect time to try and pass off the costs of rising rates to their renters.1 Labor shortages (i.e. an aging population) also make me question whether we’re really out of the woods just yet.

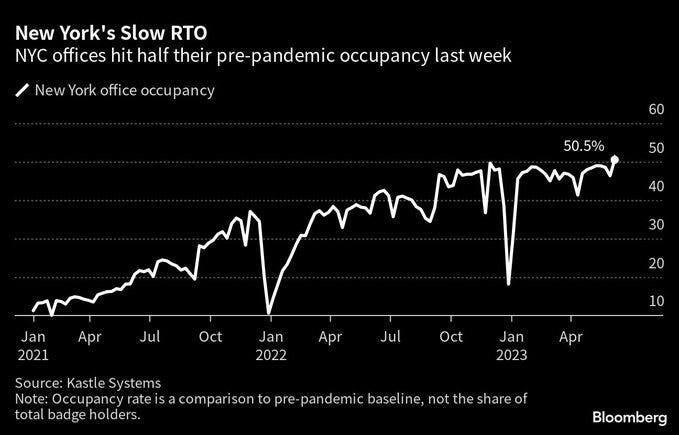

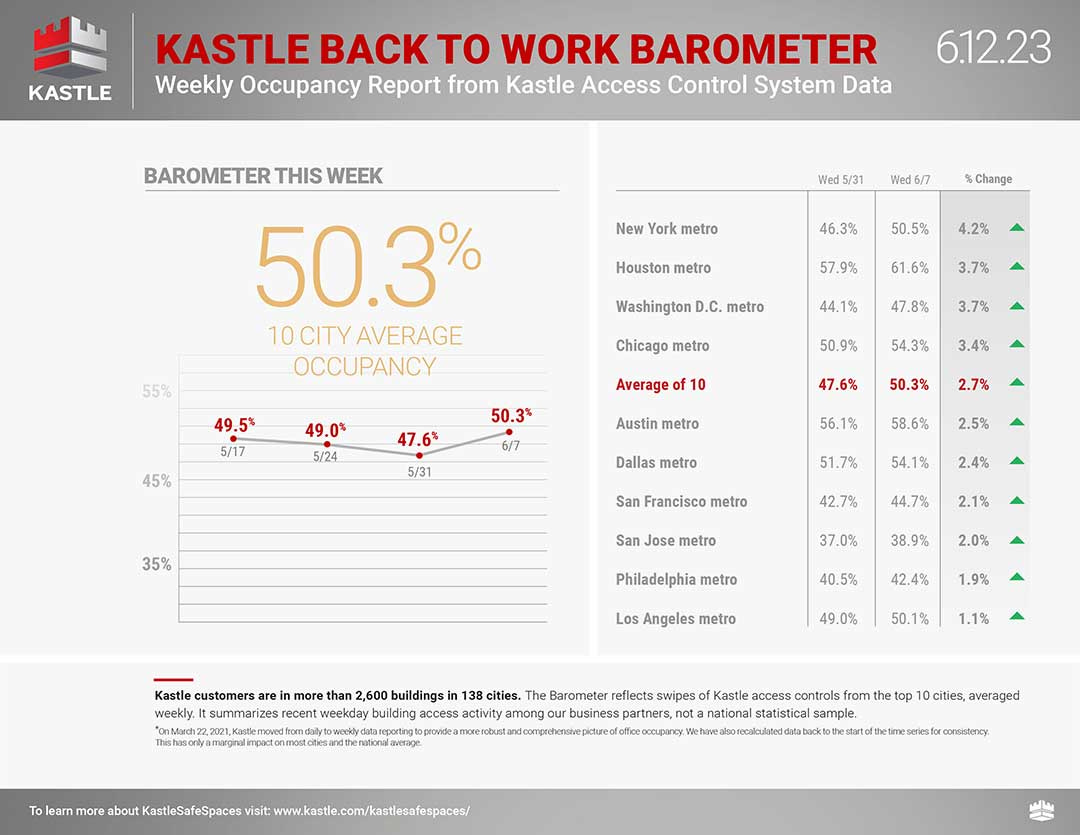

(Halfway) back to the office

It took 3 years, but NYC is (halfway) back, baby!

The cars are back too (but I guess they have been for a while):

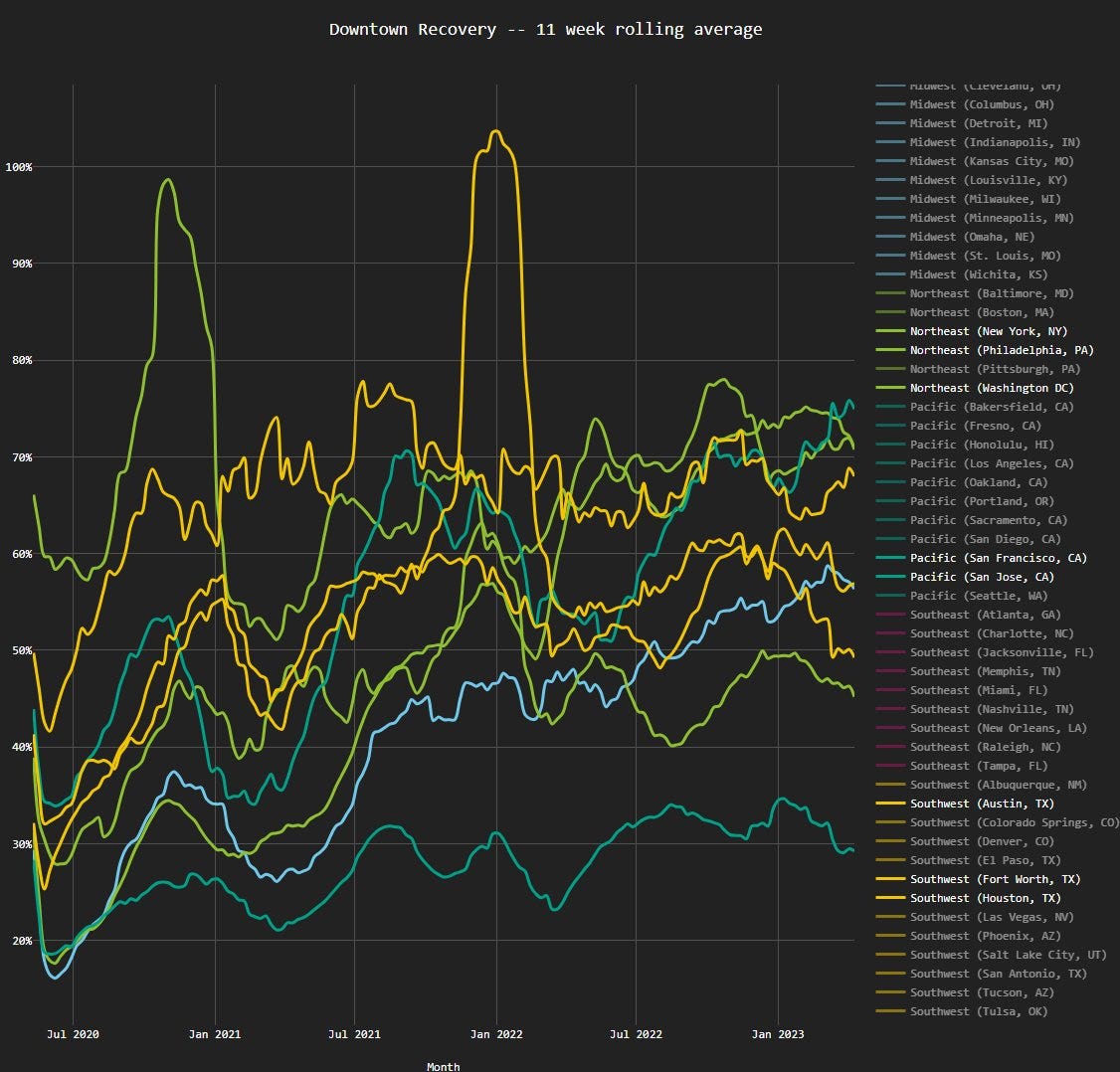

It’s not just NYC, either:

Cellphone data tells an even more optimistic story (although also a substantially noisier story):

RW views this more as indicia of labor market tightening than anything else. People are being called back to work because their bosses have more leverage than before.

Maps on maps on maps (take 2):

The first edition of maps on maps on maps was a big hit, so RW is running with a second: what mysteries are revealed when you stare at the US map with various different colors and shapes?