Excess Liquidity

Daily Data: Is the Fed's job done or is there still too much cash flying around?

Money got loose, so the Fed raised a posse to bring it on home. Some people think the Fed’s job is done.

What does the data show?

Everything reads better in your browser or in the app. The footnotes especially, and Random Walk is really leaning into the footnotes. Plus, if you have the app, you can set delivery to “app only” and then my daily barrage will feel less like a barrage. Unfortunately, substack does not yet have a “Weekly Digest” option, but I’m hectoring them aplenty.

If this email was forwarded to you, please click the shiny blue button:Daily Data

Are you feeling liquid (still)?

With more evidence that people are buying less stuff (leading to slower price increases), investors are starting to get frisky for rate cuts.

The idea, of course, is that the Fed should declare “Mission Accomplished” before it’s too late.

Inflation is cooled, and now that there’s some moderate stress in the fundamental economy, it no longer makes sense to “kill demand.”

To the contrary, the Fed should start loosening things up (so the argument goes).

The bet is that we can return to something like what we had before, i.e. soaring asset prices, but tepid everything-else prices.

Goodbye Treasuries, and hello Stocks! Just like the old times.

Perhaps.

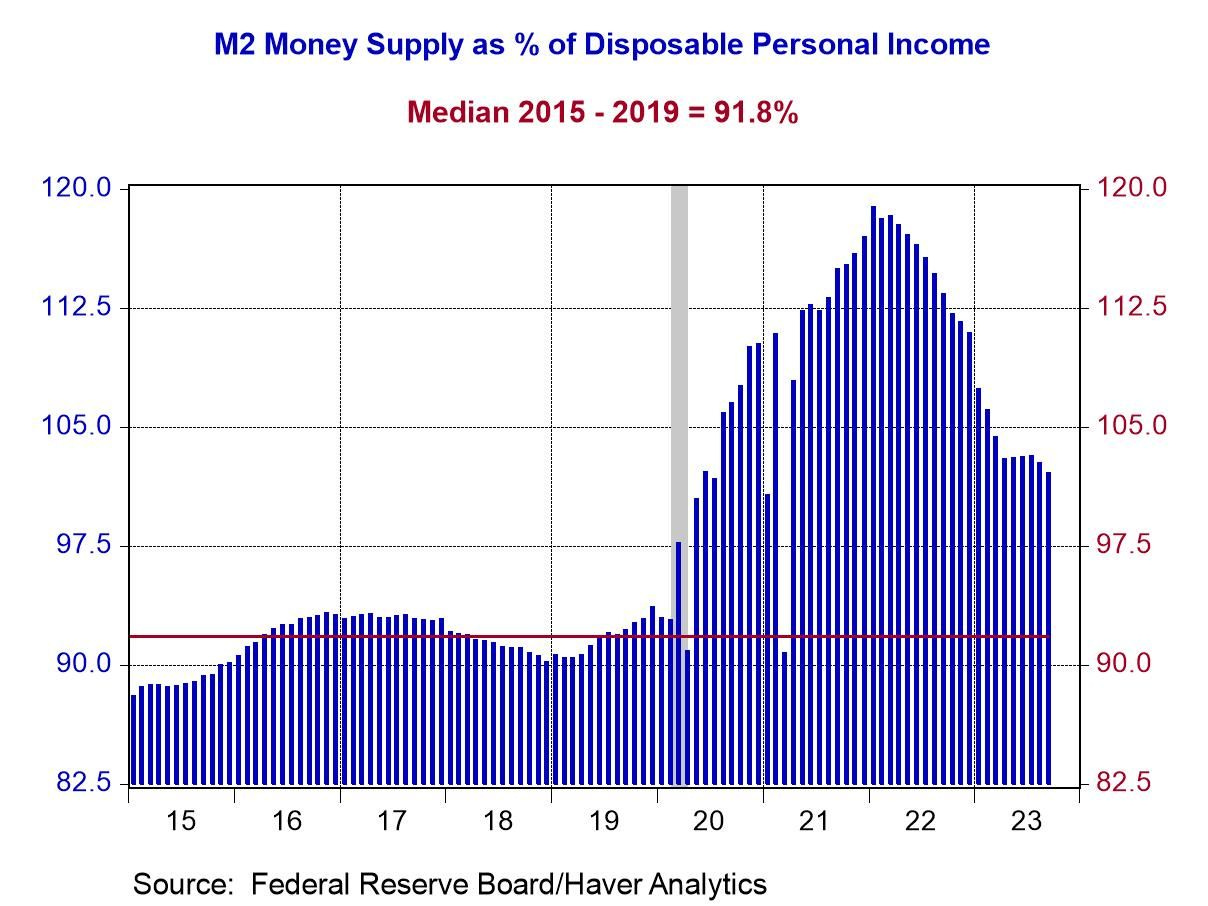

Anyways, a key premise of “cuts around the corner” is that “excess liquidity” has been washed out of the system.1 In other words, before you can “loosen up” again, you need to make sure that there’s nothing leftover from the last loosening that helped make the mess in the first place.

So, how is “excess liquidity” doing?

Excess liquidity is still a little excessive

Well, liquidity appears to be hanging in there by the hair on its chinny chin chin.

As a share of Disposable Personal Income, the money supply is still well above prepandemic levels:

M2 is burning off, but it’s not all burned off.

And who holds the “excess” liquidity?

Mostly the Top 20% hold the excess liquidity (via Daily Chartbook)

Interestingly, it’s the second-highest decile that holds the biggest stockpile of new “liquid assets.” 2

Relatedly, JPM took at look at Regions Financial (which skews lower-income), and confirms that while nominal savings are still high, as a share of spend, savings are much closer to what they used to be:

That’s more evidence that the (inflation adjusted) cushion for lower-income households is nearly gone.

So, liquidity is not all washed-out just yet, but it’s getting awfully close.

But perhaps not for everyone

Keep reading with a 7-day free trial

Subscribe to Random Walk to keep reading this post and get 7 days of free access to the full post archives.