Higher rates have made firms stronger, and more improvements are on the way

Doing more with less is the name of the game, and the good news, is that there are more rabbits yet to de-hat

raising rates worked, insofar as it made companies stronger and leaner

one simple trick to find more money in the couch cushions

the corporate maneuver that’s going to be all the rage in 2025

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. Higher rates have made firms stronger, and more improvements are on the way

One of the underappreciated successes of the Fed’s tightening has been a general tightening of ships.

Instead of blowing up with the higher cost of capital, companies (big and small) just learned how to live without it. Companies got more disciplined, they trimmed the fat, and learned how to operate sustainably.

Companies began to do more with less.

I mean, I quibble with the estimable Mr. Torsten Slok of Apollo at my peril, but he recently made the argument that the Fed’s ability to influence the economy was “weak.”1

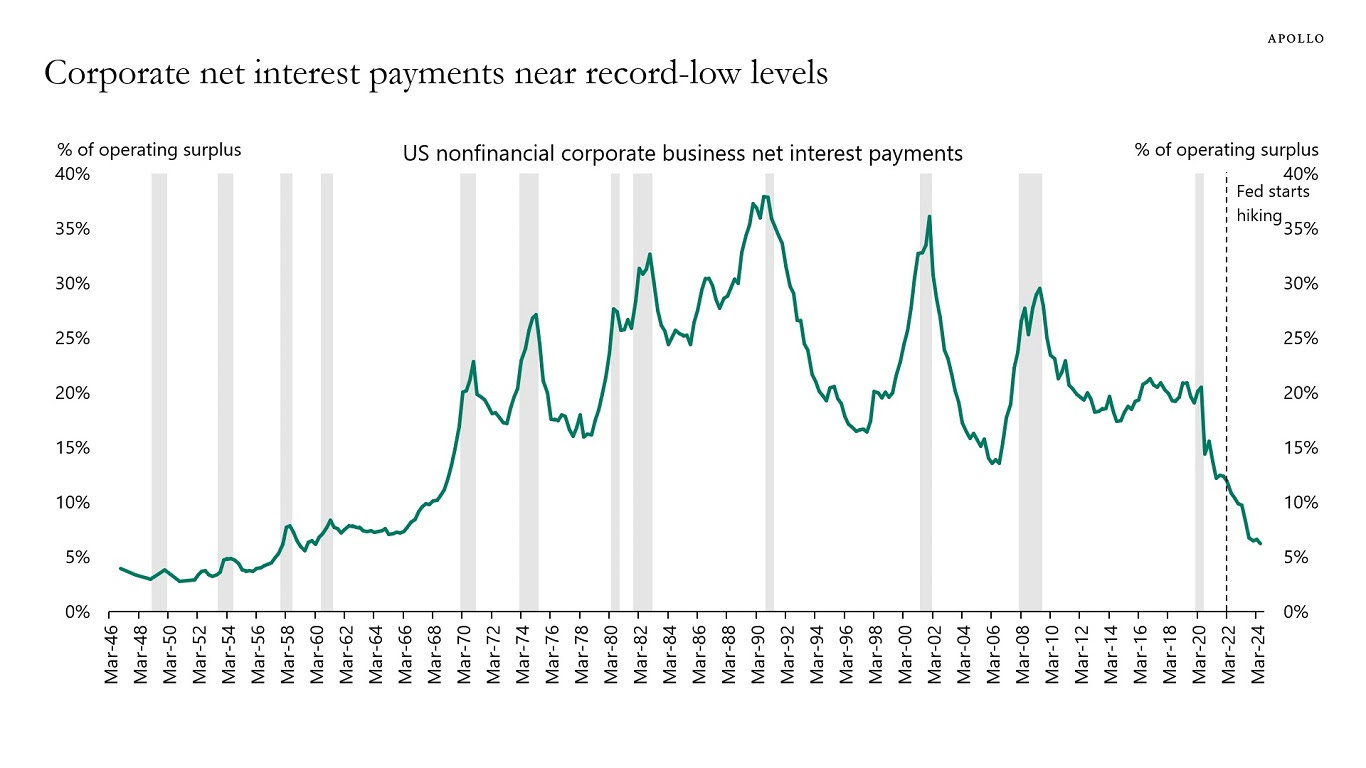

Among other things, Slok cites the decline in corporate net interest payments as evidence:

Rates went up and corporate interest payments went down. Very curious.

According to Mr. Slok, this implies an impotent Fed:

the bottom line is that Fed hikes have . . . had a very small impact on corporates because of locked-in low interest rates and rising earnings.

But I don’t think that’s right.

As Random Walk covered last week, what happened when rates went up is that the private sector stopped borrowing as much. That’s why interest payments have come down—not because of “locked-in low rates”—but because credit-creation has slowed to a relative crawl.2

To my mind, “stop borrowing so much, and go make money the hard way” is the Fed’s policy working precisely, as planned. Nothing impotent about it. That firms have adjusted so ably is to their credit, and a very good thing.

You see, tighter money has a way of focusing the corporate mind. Easy money (while it tastes delicious in the short-term), by contrast, encourages bloat and inefficiency—and since we don’t really have the luxury of bloat and inefficiency anymore, then signs of “getting lean” are precisely what we need.

Bloat hiding in plain sight

All of this is somewhat longish table-setting for another way that tighter money can force firms to “find money in the couch cushions.”

And, again, since ‘doing more with less’ is pretty much the name of the game for the foreseeable future, these are key things to highlight.

Plus, given the importance of growing earnings to share prices, once all the low-hanging fruit of “getting lean” has been picked, firms need other ways to unlock sequestered value, so I’d expect to see more it going forward.

So what is it?