‘It’s a buyer’s market out there’ and other missives from the world of real estate

18(!) real estate charts on how affordable everything is getting (plus much more)

🚨🚨I’ll be doing a live session with Arnold Kling tonight at 6pm 🚨🚨We’ll be streaming on substack. Details to follow.

It’s a buyer’s market out there

price cuts galore!

discounts to listing prices!

seller concessions to the moon (in some pretty surprising cities, as well)

number of metros where prices are declining is the highest it’s been since rates first jumped

Other missives:

a massive reset in homeownership rates

2021 was a mad, mad, mad world (for CRE)

a tale of two office types

real estate, an early AI adopter?

👉👉👉Reminder to sign up for the Weekly Recap only, if daily emails is too much. Find me on twitter, for more fun. ‘It’s a buyer’s market out there’ and other missives from the world of real estate

Random Walk has long maintained that home values are, for the most part, either flat or down (and definitely not up).

For the uninitiated, just quickly: I know what the indexes say, but the biggest issue with the indexes is that they do not capture the prices of trades that do not clear. In other words, homes have not be selling, and it’s not because demand has changed, but it’s because owners have little inclination to lower prices to what the market can actually bear.

That homeowners themselves could not afford their own homes at the values they list them for should tell you something about the “real” value of homes, but if there’s no sale, then the index does not capture the decline.

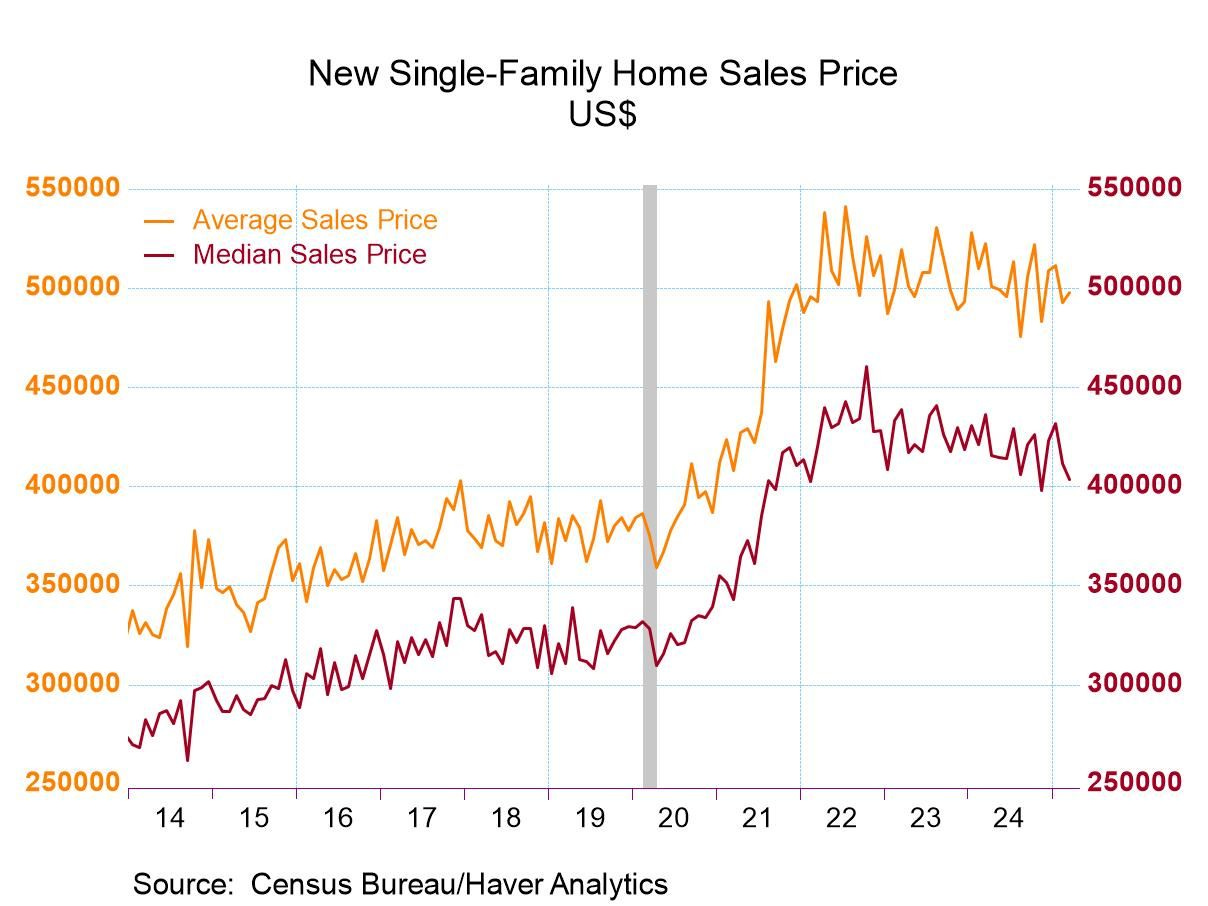

Where homes do actually sell, i.e. the new homes market, prices look like this:

Median (and average) new home sales prices have been in steady decline since their pandemic highs.

The reason that home values are declining is not because of some looming disaster (provided people do not lose their jobs). It’s because (a) while there is obviously no housing shortage;1 there is (b) a money shortage, i.e. purchasing power has been eroded by higher mortgage rates.

“Fixing” the housing market is actually easy—just do away with the 30-year mortgage, and free the banks from their interest rate lock-ins.

Short of that, the prediction has been that as time moves on, homeowners will gradually capitulate to the new normal, and shift conditions in favor of buyers.

How’s that prediction looking?

Pretty good. Behold the charts:

Share of inventory with price cuts hits a post-GFC high

Naturally, one sign of seller capitulation is price cuts.

Well, we got even more of those: